My Script

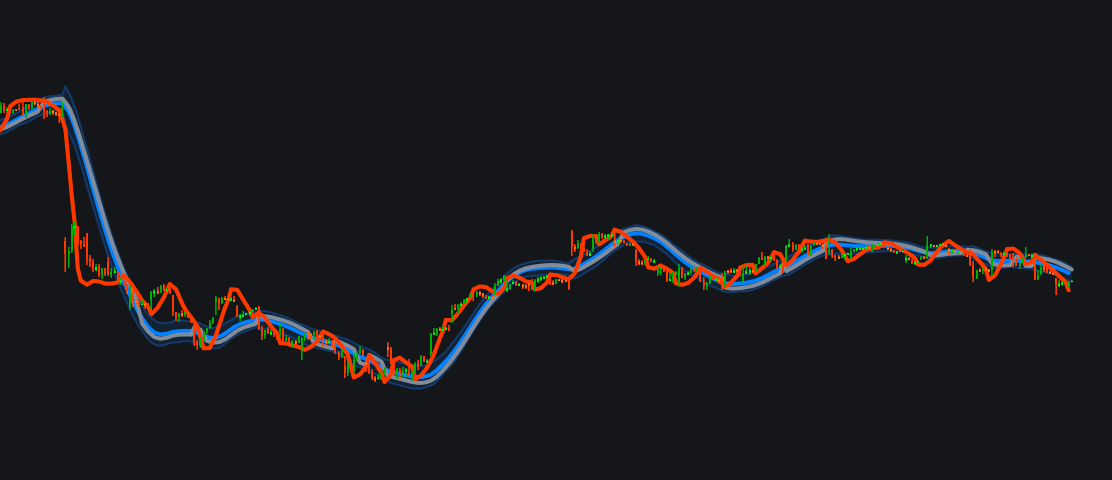

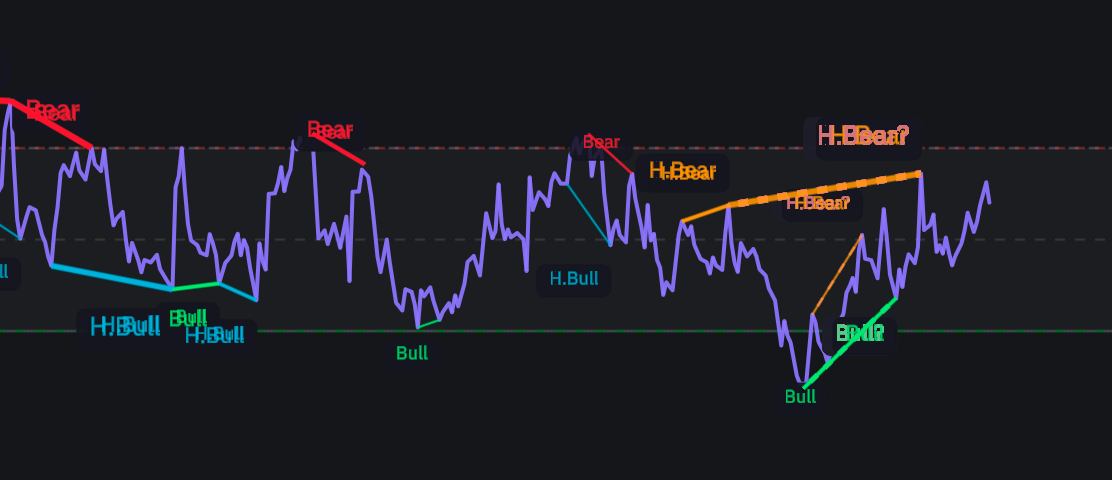

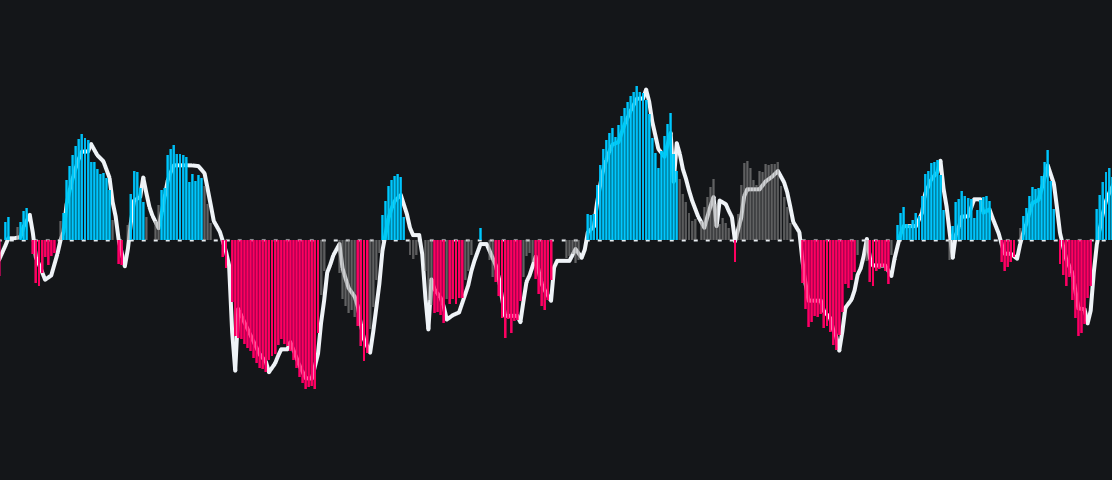

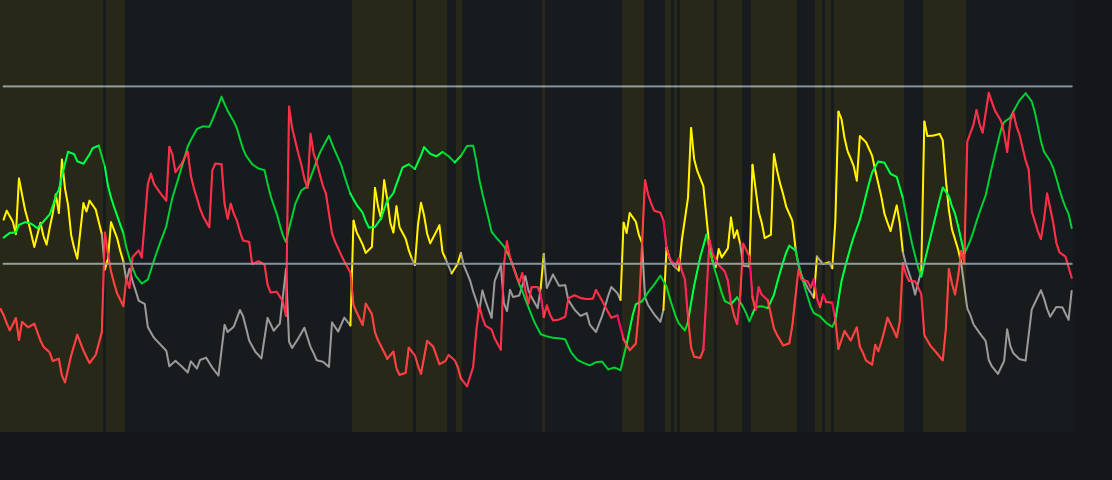

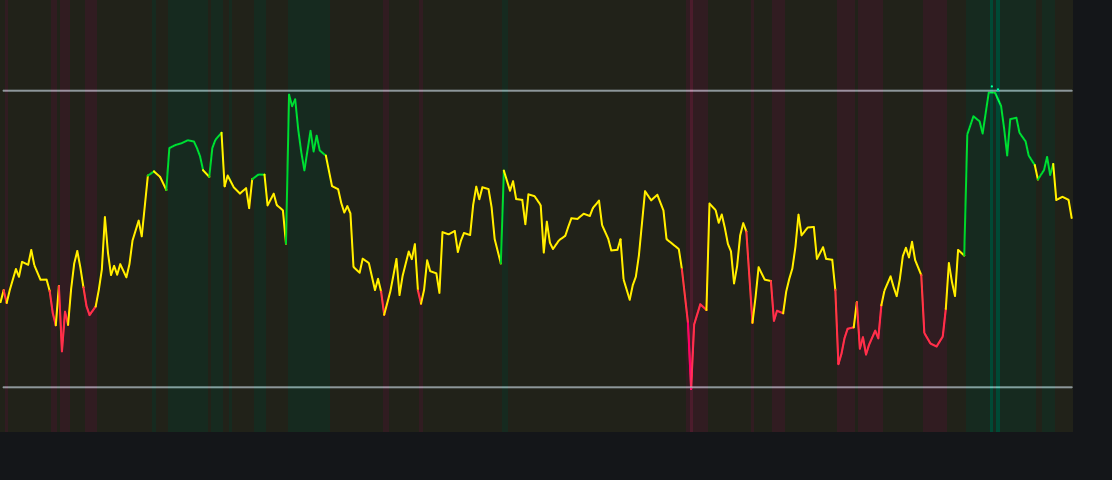

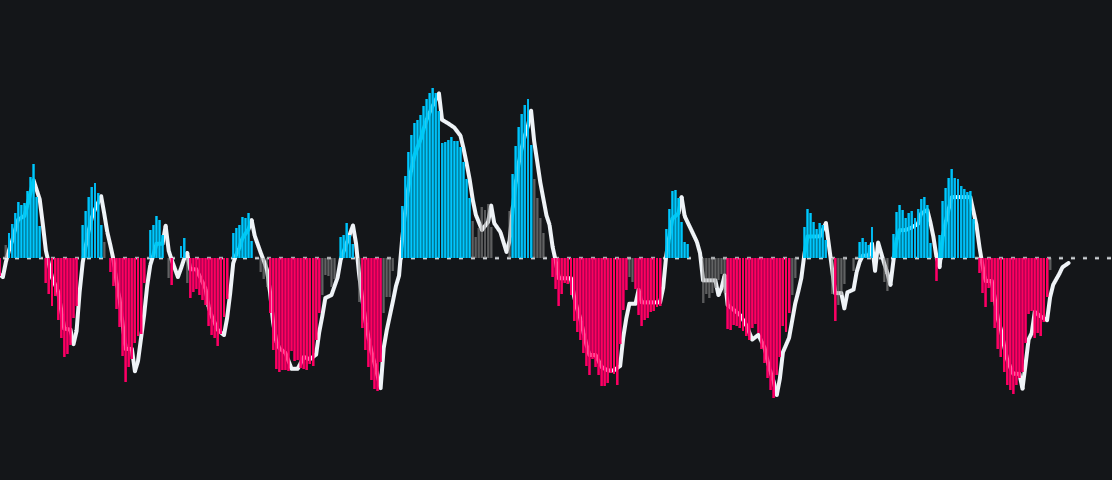

QQE MOD Indicator is a trading indicator based on the well known QQE MOD indicator concept originally developed by Mihkel00 and widely used as an indicator in TradingView. This version is an Indie port adapted for the TakeProfit platform, preserving the…

QQE MOD Indicator is a trading indicator based on the well known QQE MOD indicator concept originally developed by Mihkel00 and widely used as an indicator in TradingView. This version is an Indie port adapted for the TakeProfit platform, preserving the…