Palantir (PLTR): 70% revenue growth, 137% commercial growth - Palantir's Q4 earnings report

Palantir's guidance just blew up consensus by 15% and nobody's talking about the real story here

PLTR just dropped Q4 2025 results and honestly, Alex Karp wasn't lying when he called these:

"the best results in tech in the last decade."

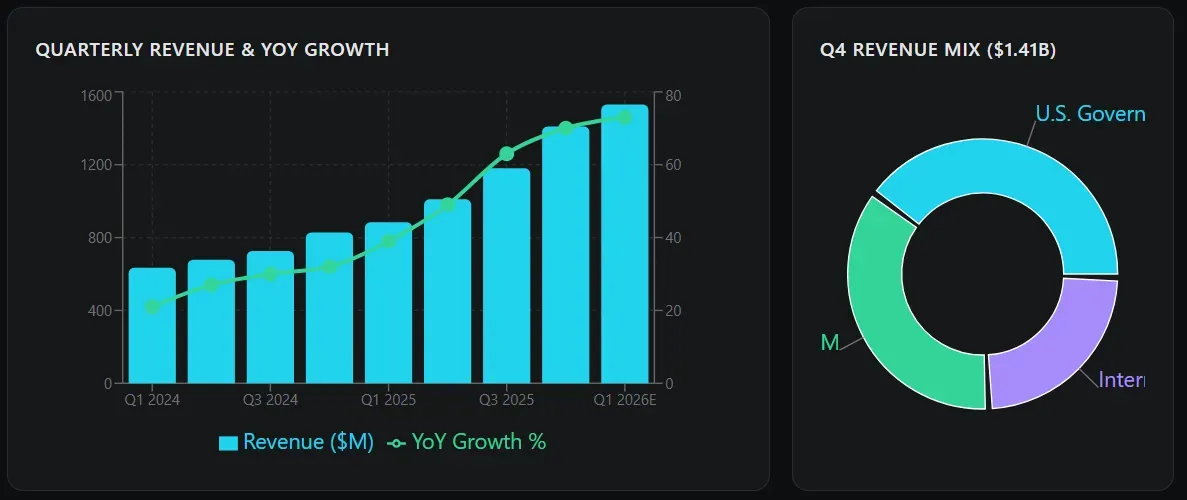

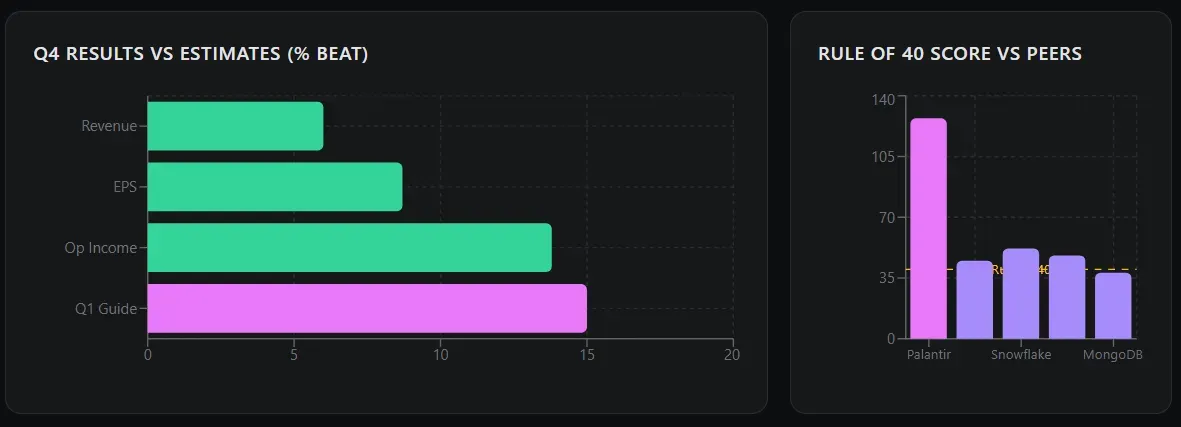

Revenue grew 70% year-over-year to $1.41 billion, crushing the $1.33 billion estimate. EPS came in at $0.25 adjusted vs $0.23 expected. Shares popped 5% after hours - but the real story here isn't just one quarter. It's about what this company is becoming over the next 3-5 years.

Q4 2025 results breakdown

Revenue: $1.41B vs $1.33B est (+70% YoY)

EPS (adjusted) $0.25 vs $0.23 est

$0.25 vs $0.23 est

U.S. Revenue: $1.076B (+93% YoY, +22% QoQ)

U.S. Commercial: $507M (+137% YoY)

Rule of 40 Score: 127% (insane)

FY2025 Total Revenue: $4.48B

The guidance that made my jaw drop

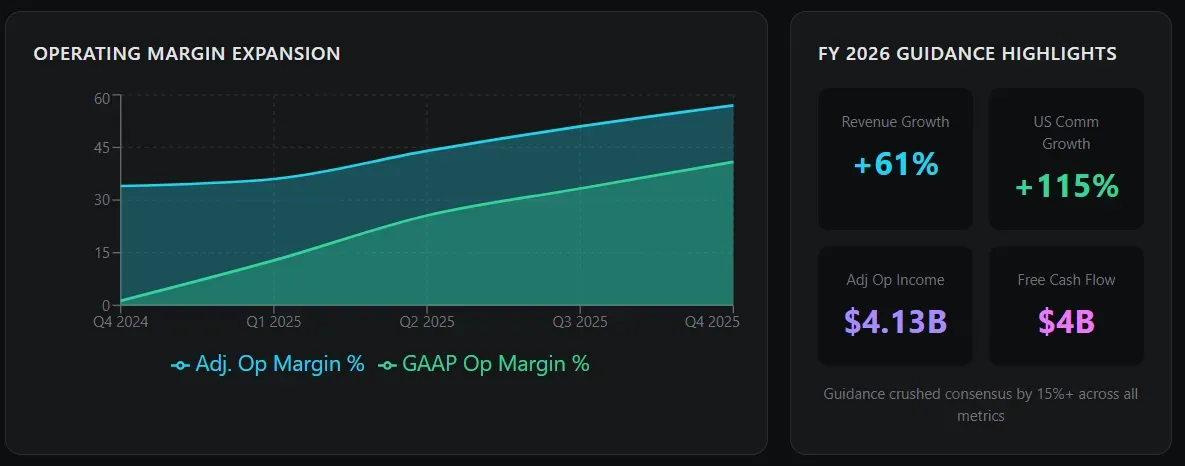

This is where things get really interesting for long-term investors. Palantir issued FY 2026 guidance that absolutely demolished expectations:

Full-year 2026 revenue growth: 61% YoY (analysts expected maybe 40%)

U.S. commercial revenue: 115%+ growth to over $3.144 billion

Q1 2026 revenue guidance: $1.53B midpoint (15.3% above consensus)

Adjusted operating income: $4.126-4.142 billion

Free cash flow: $3.925-4.125 billion

Let me repeat that - they're guiding for 61% revenue growth in 2026 while maintaining operating margins above 50%. That's a Rule of 40 score that most SaaS companies can only dream about.

The long-term bull case: why PLTR could be a generational compounder

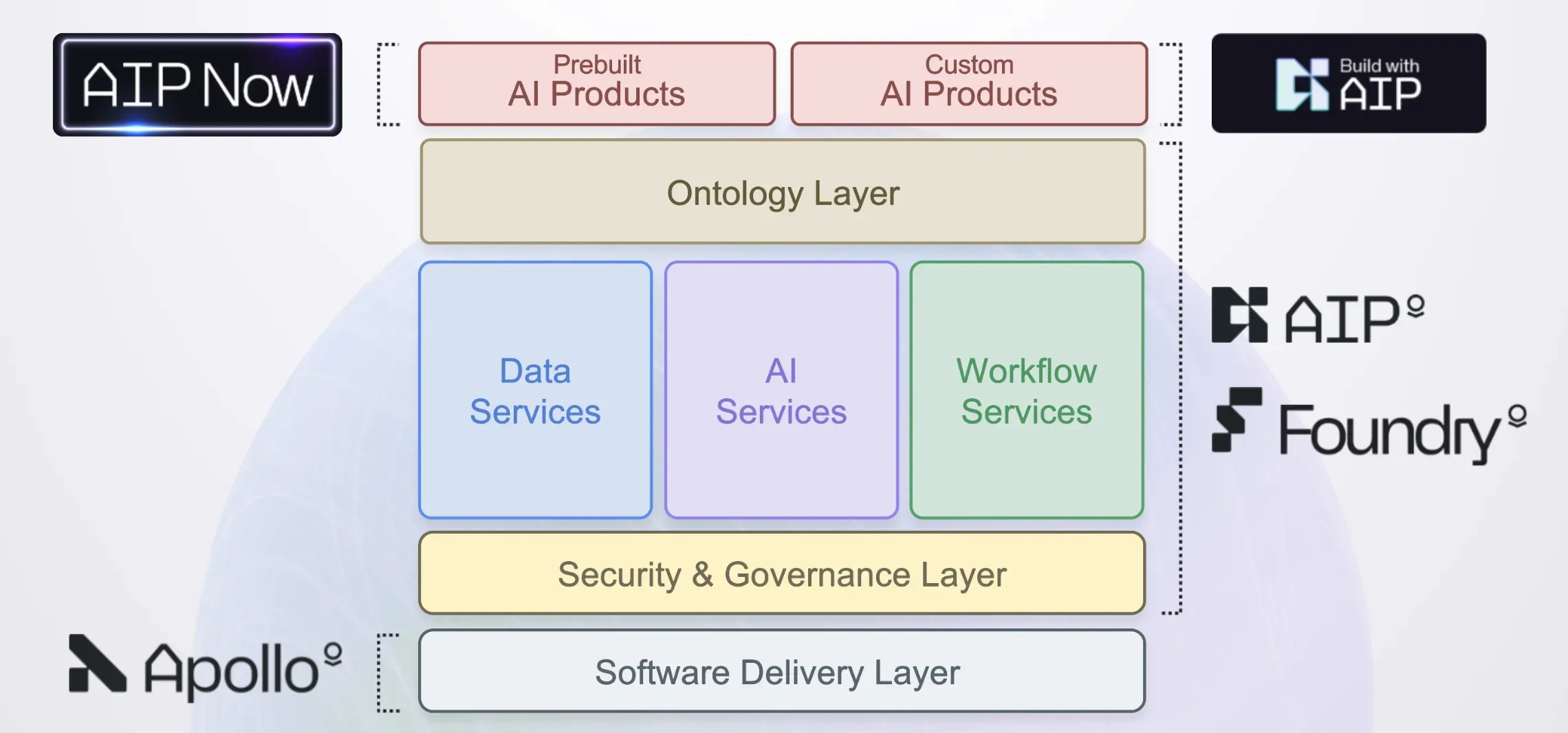

1. AIP is the real deal.

The Artificial Intelligence Platform isn't just hype - it's driving 137% growth in U.S. commercial. Companies like Wendy's are using it to solve supply chain problems in 5 minutes that used to take 15 people a full day. That's real productivity, real ROI, real stickiness. When you embed that deeply into enterprise operations, you don't get replaced.

2. Government is the foundation, commercial is the rocket fuel. The $10B Army contract and $448M Navy shipbuilding deal provide stable, long-duration revenue. But U.S. commercial growing 137% YoY is where the optionality lies. Citi sees government revenue growing 51-70% in 2026, while commercial could keep accelerating.

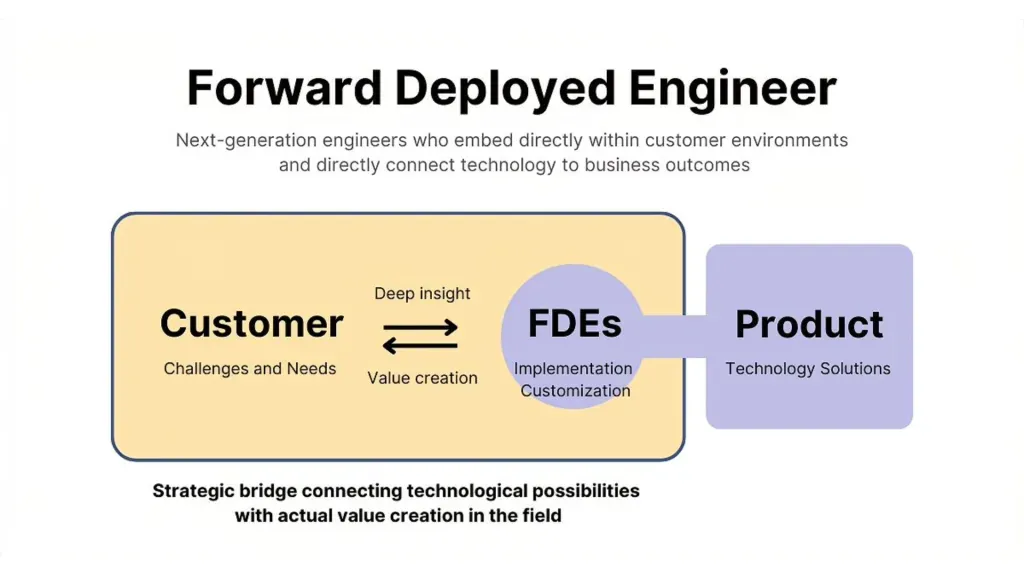

3. Operating leverage is exceptional. Q4 operating margin hit 40.9% vs 1.3% a year ago. Revenue grew 63% in Q3 while headcount only increased 10%. Their AI-powered Forward Deployed Engineer (AI-FDE) tool means they can scale without proportional hiring. That's a structural margin advantage.

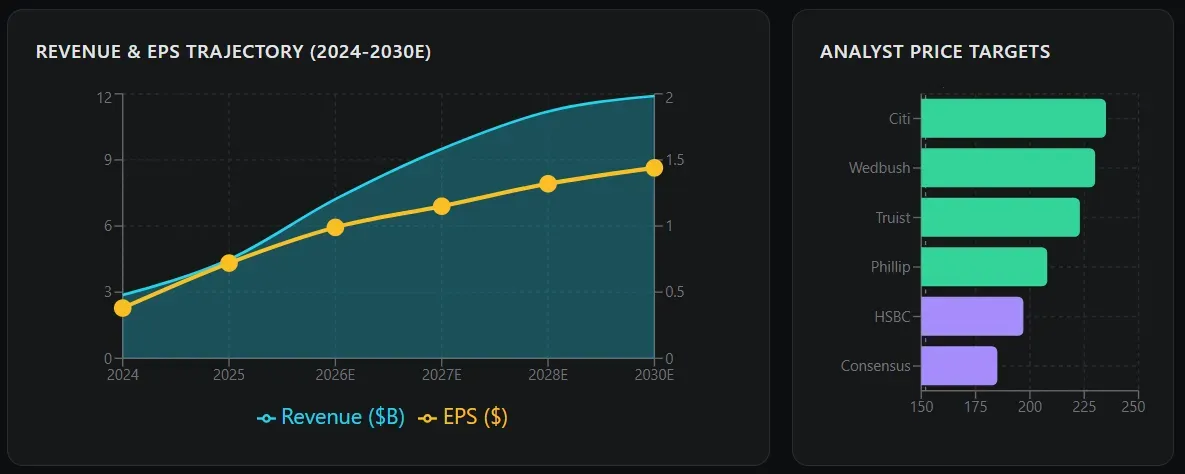

4. The $1 trillion path exists. Wedbush's Dan Ives sees a $1T valuation in 2-3 years. Current market cap is ~$450B. If they execute on guidance and commercial momentum continues, it's not crazy math. Revenue could hit $11.9B by 2030 with normalized EPS around $1.44.

The risks you can't ignore

Valuation is stretched. P/E around 350x. Price-to-sales near 86x. This isn't a stock for the faint of heart. Multiple years of growth are already priced in. Any slip in execution could trigger 20-30% corrections.

International weakness. International revenue dropped to 25% of total from 31% YoY. They're winning in the U.S. but struggling to replicate that globally. Europe in particular has been tough.

Political risk. Government business has surged under the current administration. A future change could impact contracts. The work with DHS and ICE has drawn criticism.

Competition emerging. AI is lowering barriers. Large tech (Microsoft, Google) and smaller players could eat into the market. Palantir's moat is real but not impenetrable.

Technical setup & key levels

Stock down ~15% from November all-time high of $207.52 heading into this print. RSI was cooling around 47, MACD histogram negative. After-hours action suggests we break out of this consolidation.

Resistance 1: $186-188 (recent consolidation high)

$175-180 (recent consolidation high)

Resistance 2: $200-210 (ATH zone)

Support 1: $140-145 (recent lows)

Support 2: $120-125 (200 DMA zone)

My long-term positioning strategy

This isn't a trade - it's an investment thesis. For long-term positions:

Accumulation zone: $140-165 on any pullbacks

12-month target: $200-235 (aligns with Citi's $235 PT)

3-year target: $300+ if commercial thesis plays out

Position sizing: 2-5% of portfolio max - this is high beta, high conviction

Stop loss guidance: Below $120 would invalidate the thesis. If they start missing on commercial growth rates or margins compress, reassess immediately.

Last take

Palantir is expensive. Everyone knows it. But it's also one of the only pure-play AI software companies executing at this level. A 127% Rule of 40 score, 137% U.S. commercial growth, and guidance that demolished expectations - these are generational numbers.

The long-term question isn't whether PLTR is worth $150 today. It's whether it's worth $300-400 in 2028-2030 if they keep compounding. Given AIP adoption, government tailwinds, and operating leverage, I think the probability is higher than the market implies.

That said, position size appropriately. This stock can drop 20-30% on a single bad quarter. But for those with a 3-5 year horizon and stomach for volatility, PLTR remains one of the most compelling AI infrastructure plays in the market.