Precious metals just had their worst day in 13 years and I think this is only the beginning

Gold crashed 10%, silver plunged 25%, and the great rotation trade is finally here

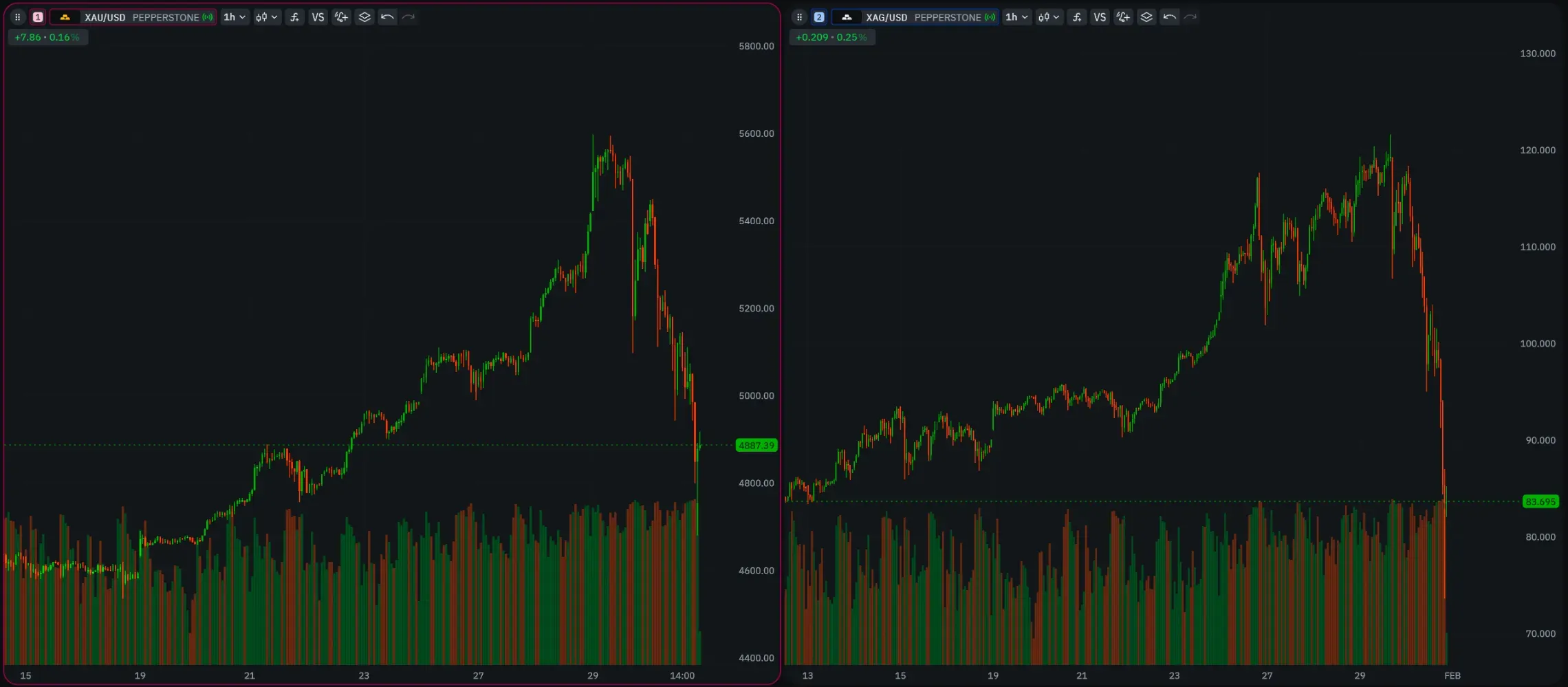

Well, that escalated quickly. After watching gold and silver rip to all-time highs for months, I woke up Friday morning to see precious metals getting absolutely demolished. Gold crashed 10% to $4,800, silver plunged a staggering 25% to $80, and my Twitter feed was filled with people asking what the hell just happened. The worst single-day selloff in 13 years.

What actually happened

Gold touched $5,595 on Thursday, January 30th, marking yet another all-time high. Silver hit $120.45. Then, within hours, both metals completely collapsed. Gold dropped to $4,941 (down 8%), while silver cratered to $95 (down 17%). This wasn't some normal pullback. This was a full-blown capitulation event that traders described as the most severe single-day decline in over a decade.

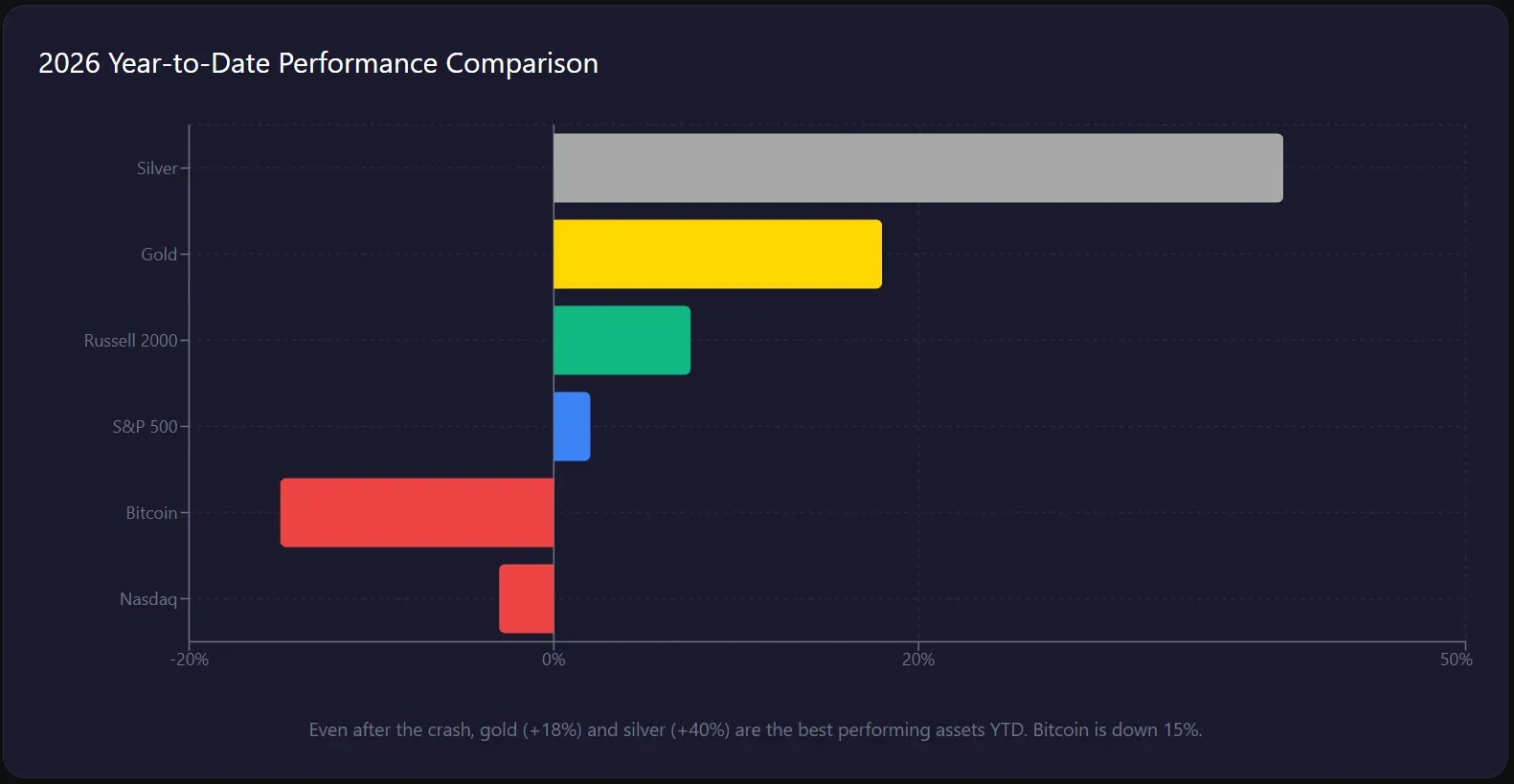

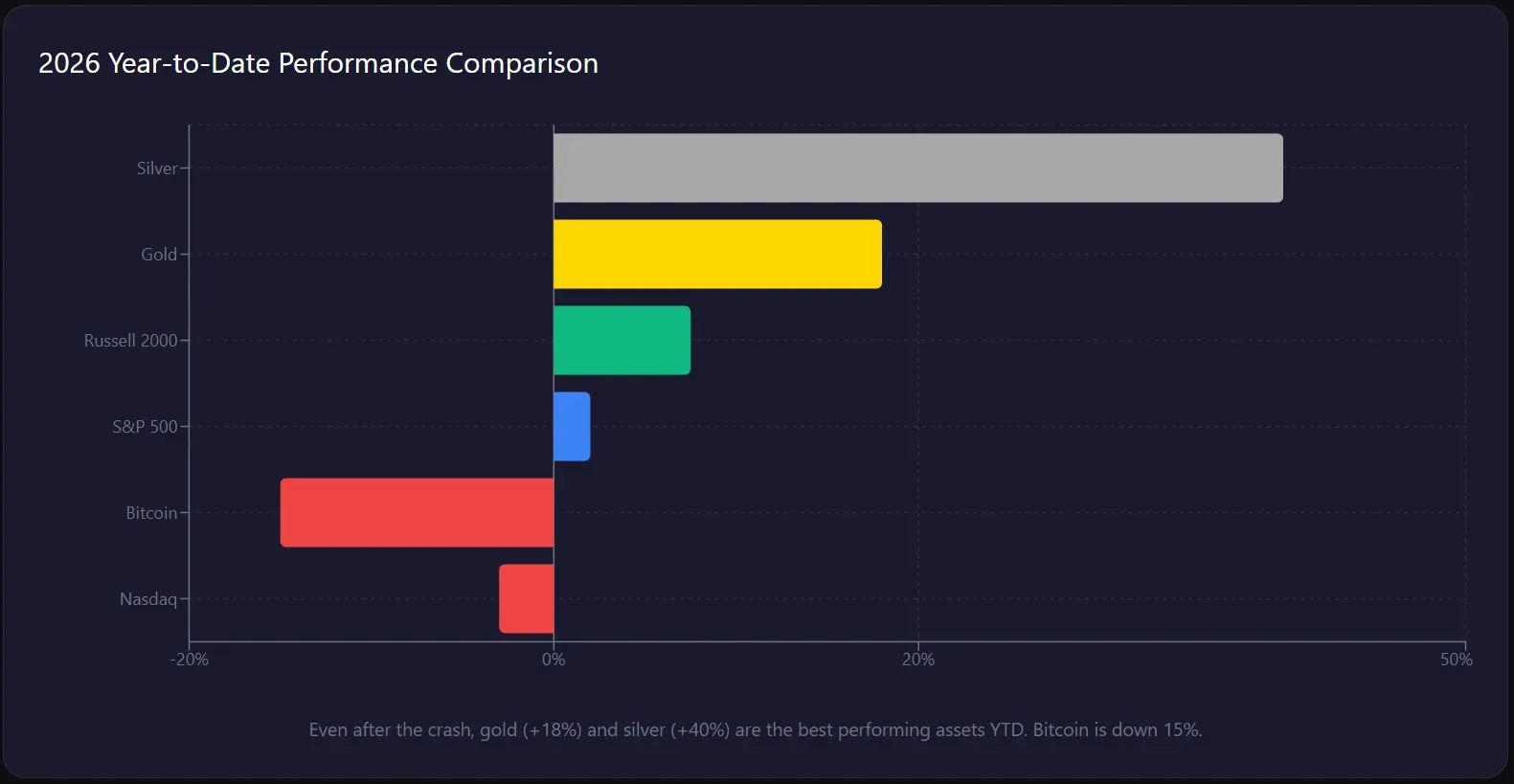

But here's the thing that matters: even after this brutal selloff, gold is still up 18% in 2026 and silver is up 40% year-to-date. The underlying fundamentals haven't changed. What changed was positioning, sentiment, and one very important announcement from the White House.

The five reasons for the crash

1. Classic profit-taking at extreme levels. Gold had seven consecutive up sessions and was up over 20% for the month alone. That's the strongest monthly performance since the 1980s. When you see moves of this magnitude, profit-taking becomes inevitable. Ahmad Assiri at Pepperstone nailed it when he said moves like this are rare and represent a genuine reallocation of capital, not just short-term speculation.

2. Kevin Warsh nominated as Fed Chair. This is the big one. Trump announced former Fed Governor Kevin Warsh as his nominee to replace Jerome Powell. The market immediately priced Warsh as hawkish. Evercore's Krishna Guha put it perfectly: the Warsh pick should stabilize the dollar and reduce the asymmetric risk of deep dollar weakness, which is exactly why gold and silver sold off so sharply. The debasement trade just got challenged.

3. Government shutdown fears fading. One of gold's key tailwinds was uncertainty around the potential government shutdown. As those fears receded (at least partially), one of the safe-haven catalysts disappeared. Remove a tailwind and gravity does its work.

4. Margin-driven liquidation cascade. Silver futures are often traded with much higher leverage than gold. When prices drop, margin calls hit silver harder and faster, triggering forced liquidation. This explains why silver fell twice as much as gold. It's the same pattern we saw in late December when CME raised margin requirements and sparked an earlier selloff.

5. Broader risk-off sentiment hitting everything. Microsoft earnings disappointed with slowing cloud growth, sending tech stocks lower. The Nasdaq dropped, gold dropped, silver dropped, Bitcoin dropped. This was a synchronized derisking event across asset classes. As FalconX's Joshua Lim noted, it triggered a bigger unwind across consensus hedge fund and CTA positions in metals and equities.

Technical analysis: key levels to watch

For gold, the $5,000 psychological level is now the critical support zone. We bounced right there on Friday, which is encouraging for bulls. If that level fails, the next major support sits at $4,550-$4,360, which coincides with the 50-day EMA and late 2025 highs. Resistance is now clearly established at $5,400-$5,450, the area where Thursday's all-time high was rejected.

For silver, the $100 psychological level is the line in the sand. If that breaks convincingly, we're looking at $93 as the next support, with a potential drop to $70-$80 (the 50 EMA zone and late 2025 highs) if selling accelerates. A 10-15% correction from current prices would be painful but historically normal after a 20%+ monthly rally.

Where the money flows next: my assumptions

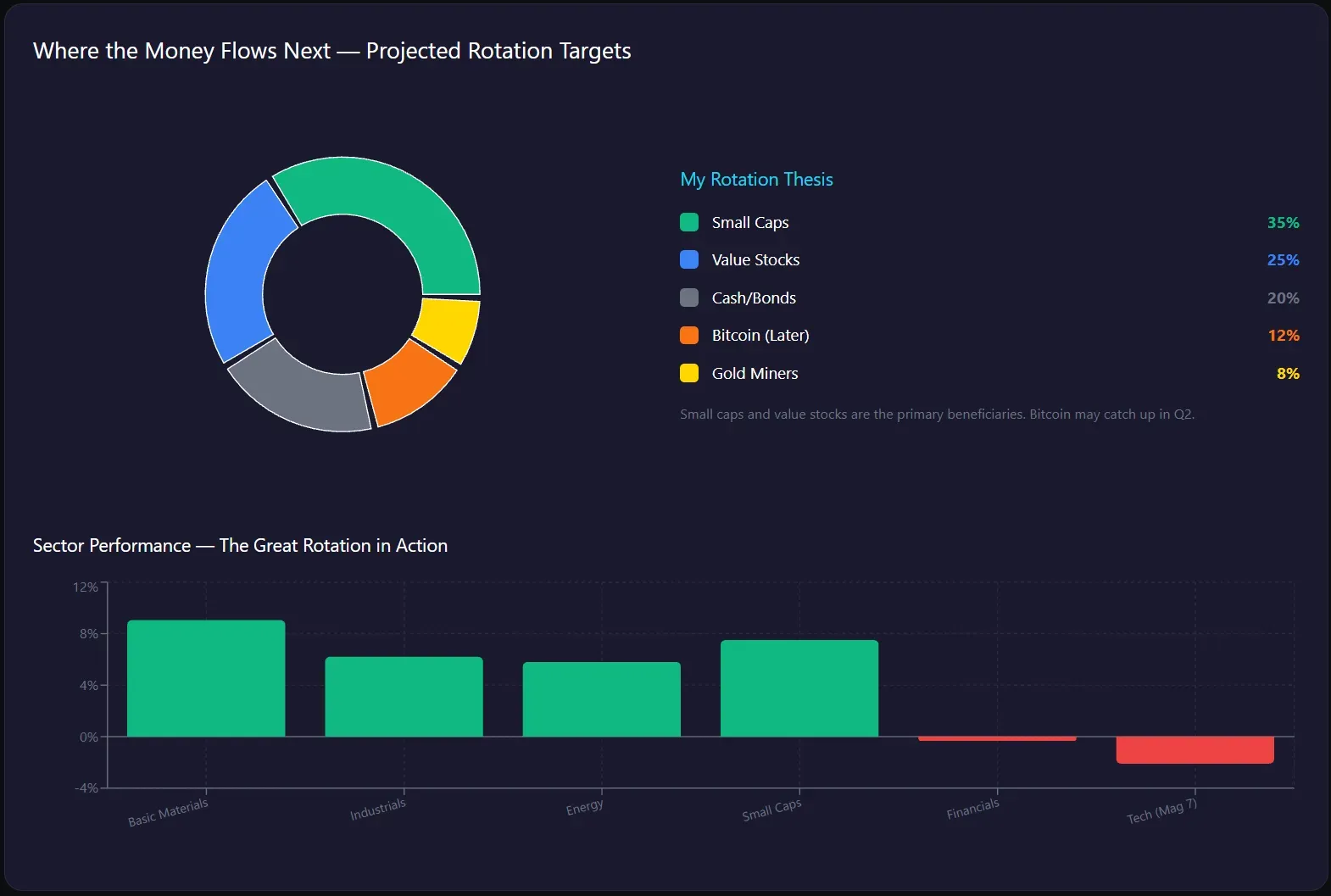

Here's where it gets interesting. When capital rotates out of precious metals after a parabolic run, it doesn't just disappear. It goes somewhere. Based on the current macro setup, analyst commentary, and historical patterns, here's my thesis on where the outflows from gold and silver are likely headed:

1. Small-cap stocks (Russell 2000).

This is the big rotation trade of 2026. The Russell 2000 is trading at a price-to-book ratio of just 2.1x versus 5.0x for the S&P 500. Small-cap earnings are projected to grow 30-35% this year versus 22% for the Magnificent Seven. Bank of America forecasts small-cap earnings will grow 17% in 2026 versus 14% for large caps. The One Big Beautiful Bill Act reinstated 100% bonus depreciation and expanded interest deductibility, which directly benefits capital-intensive small and mid-cap firms. I'm watching IWM and IJR closely here.

2. Value and old economy sectors. Financials, energy, and industrials are the natural beneficiaries of the rotation away from overvalued tech and frothy precious metals. Tom Lee at Fundstrat called 2026 a year for fertile alpha generation in stock-picking, particularly in domestically-focused value names. Companies like Caterpillar and Rockwell Automation are benefiting from domestic manufacturing and infrastructure spending. Regional banks are recovering. This is the earnings handoff in action.

3. Bitcoin (eventually, but not yet). Here's the counterintuitive take: Bitcoin got hammered alongside precious metals on Friday, falling to $81,000 and setting a new 2026 low.

The digital gold narrative isn't playing out the way bulls expected. Bitcoin is still trading as a risk asset, not a safe haven. However, VanEck's David Schassler believes BTC is positioned for a rebound as monetary debasement intensifies. Historical patterns suggest gold leads Bitcoin by about three months. If that relationship holds, the massive gold rally we just saw should translate to Bitcoin strength in Q2 2026. I'm not backing up the truck yet, but I'm watching for confirmation.

4. Gold miners (for the contrarians). Here's a wild stat: American stock investors' implied portfolio gold allocation is still near 0.4%, basically rounding to zero. Even after gold's 65% gain in 2025 and another 18% in January 2026. For centuries, minimum gold portfolio allocations of 5-10% were universally recommended. If this selloff shakes out weak hands but the fundamental drivers remain intact (dollar weakness, geopolitical uncertainty, central bank buying), gold miners could be the highest-beta play on a resumption of the bull market. The sector has historically lagged the underlying metal price, creating potential catch-up opportunity.

5. Cash and short-duration bonds (for the cautious). If Warsh brings a more hawkish Fed stance, higher yields could make short-term treasuries and money market funds more attractive. High-yield savings accounts are still offering 5% APY. For investors who got lucky riding the metals rally and want to lock in gains, cash isn't trash in this environment.

The long-term view: correction or trend reversal?

I think this is a correction within a secular bull market, not a trend reversal. The fundamental drivers for gold and silver haven't changed. Dollar weakness at multi-year lows. Geopolitical fragmentation accelerating. Central bank buying continues unabated. Fed independence concerns remain. The Trump administration's fiscal policies still favor stimulus over austerity.

J.P. Morgan still targets $5,000/oz for gold by Q4 2026, with $6,000/oz as a possibility longer term. Goldman Sachs raised their forecast. Major banks aren't backing away from bullish targets despite Friday's carnage. What we're seeing is the market taking a breather after an unsustainably fast move.

That said, JPMorgan's Kolanovic has warned that silver could crash back to $50, arguing it behaves more like a leveraged macro instrument than a store of value.

He sees meme traders attempting to take over the market and a speculative mania destined to unwind violently. A 50% drop would be historically normal for a commodity that's rallied this hard, this fast. Worth keeping in mind.

My take

For gold: Watching the $5,000 level carefully. If it holds on a weekly close, I'm looking to add to positions on weakness toward $5,100-$5,200. If $5,000 breaks, I'll wait for the 50 EMA around $4,550 before getting aggressive. Stop loss would be a weekly close below $4,300. Target remains $5,500+ by year end.

For silver: More cautious here given the leverage dynamics and Kolanovic's warning. The $100 level is critical. If it holds, accumulation zone is $95-$105. If it fails, I'm looking at $70-$80 as the next major support. Position sizing should be smaller than gold given silver's higher volatility.

For the rotation trade: Scaling into small-cap exposure via IWM or IJR on any weakness. Looking at beaten-down regional banks and domestic industrials. Keeping some dry powder for Bitcoin if we see a confirmed breakout above $95,000.

Stay nimble out there.