Reddit (RDDT) found the moat AI cannot replicate

and the stock just went on fire sale

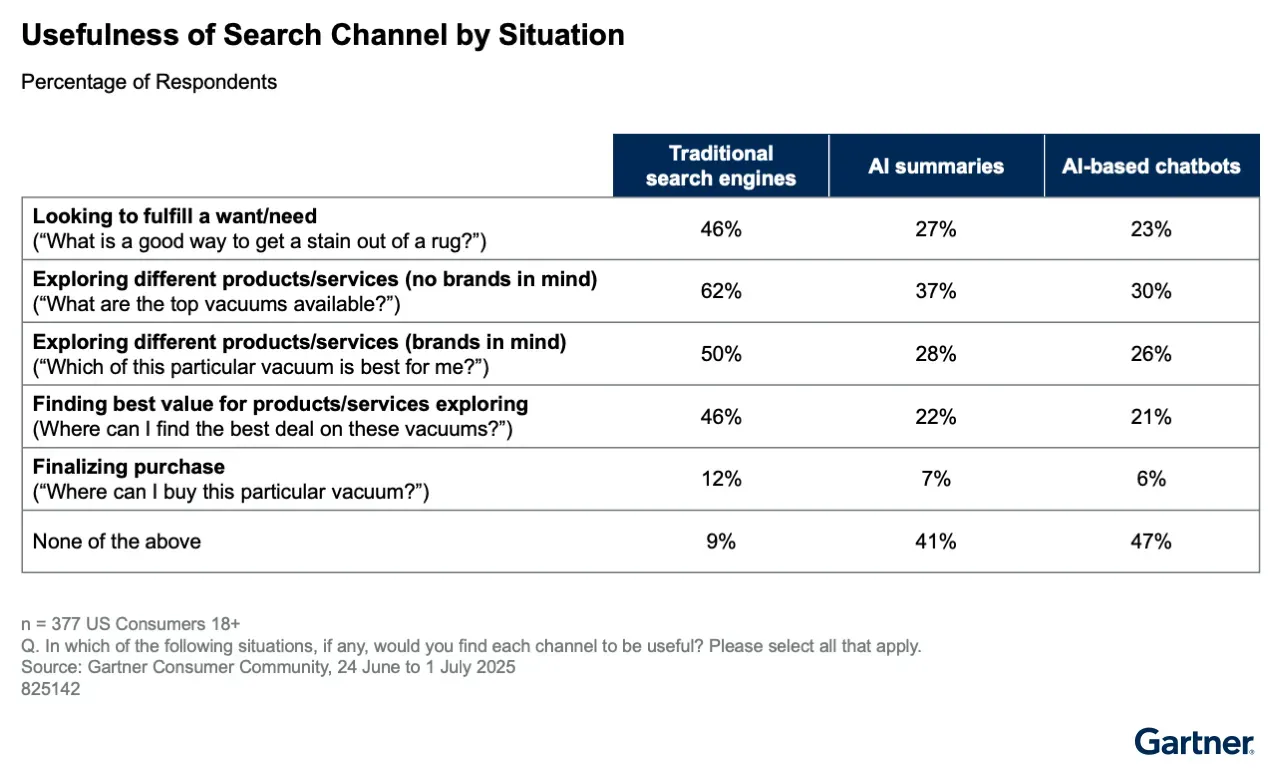

The internet is drowning in AI-generated content, and consumers are losing trust in what they read online. According to Gartner, 53% of consumers distrust AI search results, and 88% of Americans say it is harder than ever to distinguish real information from fabricated content.

In this environment, Reddit has quietly built something that no AI model can replicate: a platform of authentic, human-curated conversations that has become the single most cited source across all major AI platforms. That is the thesis. And yet, the stock dropped 45% in a single month leading into earnings, endured a 19-day losing streak, and then when the company delivered a decisive Q4 beat across every metric - revenue up 70%, EPS beating estimates by 32% - it still sold off another 7% in after-hours trading.

The disconnect between what Reddit has built and where RDDT is trading right now is one of the most compelling setups I have seen in social media names all year.

The numbers that matter

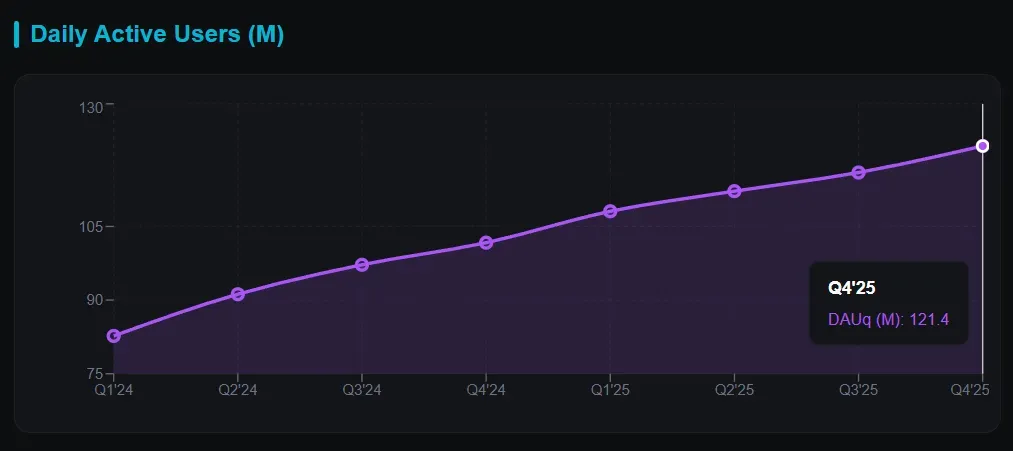

Q4 2025 was not merely a beat. It was a comprehensive outperformance. Revenue came in at $726M, up 70% year-over-year and surpassing the $667M consensus by nearly 9%.

EPS reached $1.24 versus the $0.94 estimate, a 32% beat. That marks the ninth consecutive earnings surprise from Reddit.

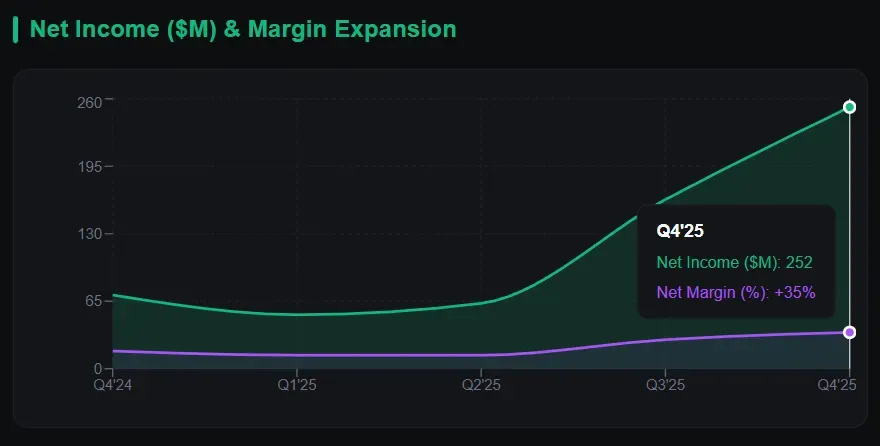

Full-year revenue hit $2.2B with 69% growth, net income reached $530M, and free cash flow tripled to $684M. These are not the numbers of a company in decline.

The authenticity moat

What makes Reddit particularly interesting right now is a structural shift in how consumers engage with information online. The internet is saturated with AI-generated content. Google AI summaries are increasingly scrutinized for inaccuracies, 53% of consumers actively distrust AI search results according to a recent Gartner survey, and 88% of Americans report that it is harder to tell what is real online than it was a year ago. In this environment, Reddit’s human-generated, community-curated content is not simply a differentiator - it is becoming one of the last reliable sources of authentic information on the internet.

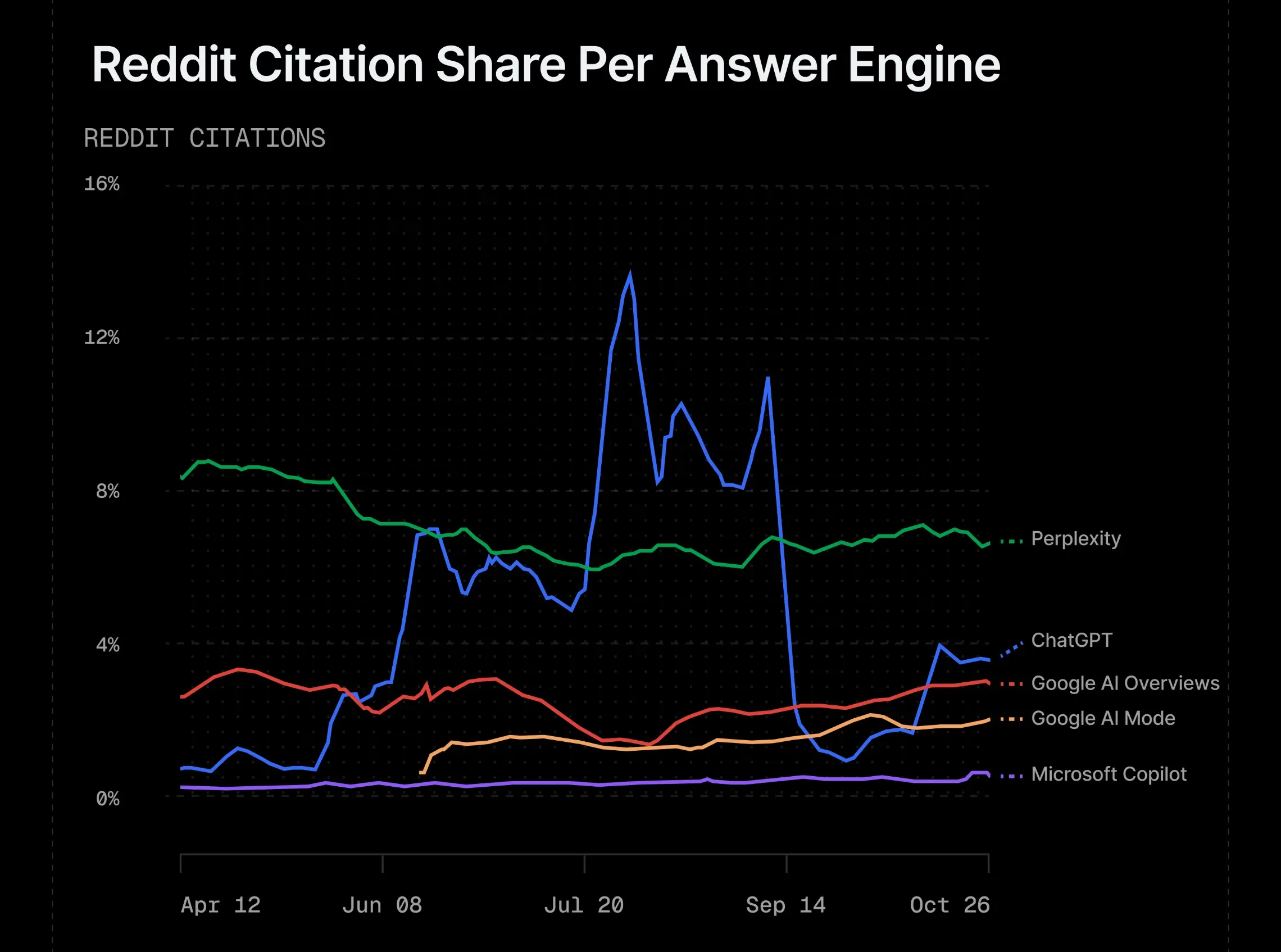

CEO Steve Huffman addressed this directly on the earnings call, noting that the candor of Reddit’s conversations is “rare” and what makes the platform “uniquely helpful and influential.” According to Profound’s analysis, Reddit is the number one cited source across all major AI platforms.

The AI companies themselves cannot function without Reddit’s content. That is not merely a competitive advantage - it is a structural toll bridge on the information economy.

Growth engine firing on all cylinders

The advertising platform remains in its early stages of maturation. Shopping ads enhanced with machine learning improved advertiser ROAS by over 75%. SMB revenue doubled year-over-year.

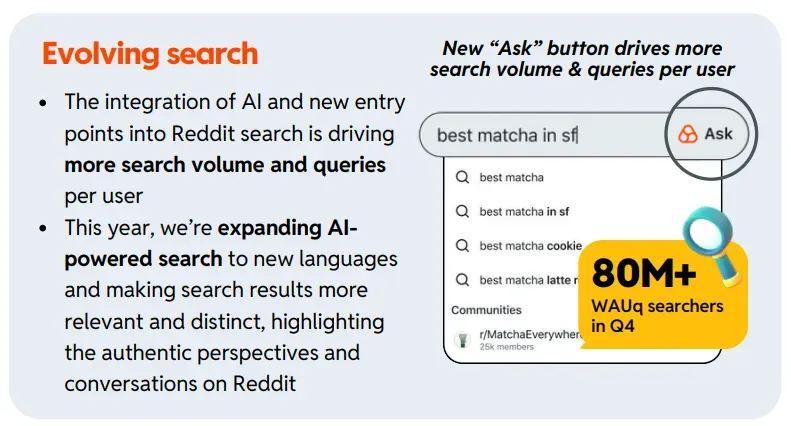

Reddit Answers now processes more than 80 million weekly searches, keeping users on-platform rather than redirecting to Google.

International DAU growth reached 28% year-over-year, significantly outpacing domestic expansion.

The $1B buyback authorization signals management conviction, supported by $2.5B in cash on the balance sheet.

Q1 2026 guidance of $595-605M in revenue implies 52–54% growth, once again exceeding consensus expectations.

Why it is selling off

The bear case deserves a thorough examination.

First, insider selling has been aggressive - 411 sales and zero purchases over the last six months. The CEO disposed of approximately $46M in shares, and the COO sold roughly $80M. That level of insider distribution raises valid concerns about management confidence.

Second, the FTC is investigating Reddit’s data licensing practices, and the EU AI Act is introducing regulatory uncertainty around how user-generated content is monetized.

Third, there is what analysts have termed the “Data Paradox”: the very content that makes Reddit valuable to AI companies is also the source of its greatest regulatory and competitive exposure. YouTube has reportedly begun overtaking Reddit as the top social citation source for large language models. Finally, the broader software sector experienced significant pressure following Anthropic’s enterprise AI upgrade announcement, which triggered fears of AI-driven displacement across the sector.

Technical setup

Price structure - RDDT hit its ATH at $283.09 in late August 2025, spent four months distributing in the $225–$263 range, then broke down hard through January-February. The former support at $182.09 is now overhead resistance. Price is sitting directly on local support at $139.37, which lines up with the June-July 2025 consolidation zone. Below that, major support at $104.26 is the next structural floor.

RSI & momentum - RSI reads 28.18, deep in oversold territory. More notably, the chart shows a bullish divergence: price is making lower lows while RSI is forming higher lows, a classic signal that selling momentum is exhausting. It does not guarantee a reversal, but it indicates the downside pressure is fading.

Overall read - technically damaged in the intermediate term, trading below all major moving averages with broken support levels overhead. However, deep oversold RSI, bullish divergence, and a test of historically significant support at $139 create conditions for a relief bounce toward $165–$182. A sustained reclaim of $182 would be the first structural reversal signal. Failure to hold $139 opens the path to $104.

Valuation check

At $139, Reddit carries a $28B market capitalization against $2.2B in 2025 revenue and $530M in net income. That equates to roughly 12.7x revenue and 53x earnings. This is not inexpensive by any conventional metric, but it represents a meaningful compression from where the stock traded a month ago at $250+ (22x revenue). For a company delivering 70% revenue growth with 35% net margins and tripling free cash flow, the current multiple begins to appear considerably more reasonable on a growth-adjusted basis.

The consensus analyst target sits at $228–240, implying 60–70% upside from current levels. Even the most bearish target of $135 is approximately where the stock trades today.

The bottom line is this: Reddit just delivered one of the strongest quarters in social media history, and the stock is trading as though it missed. The authenticity moat is real, the growth trajectory is difficult to dispute, and the valuation has compressed to a level where the risk-reward profile favors the upside for investors with a longer time horizon. The insider selling and regulatory overhang are legitimate concerns, but at current levels, the market appears to have more than accounted for them. I am scaling into this name on weakness with a 12-month horizon.

The AI revolution depends on Reddit’s data, consumers trust Reddit’s communities, and the advertising platform is still in its formative stages. In my experience, the best opportunities tend to emerge when the setup feels the most uncomfortable.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.