Tim Cook promised a record quarter and actually delivered one

iPhone 17 demand was 'simply staggering' and China went from problem child to star student

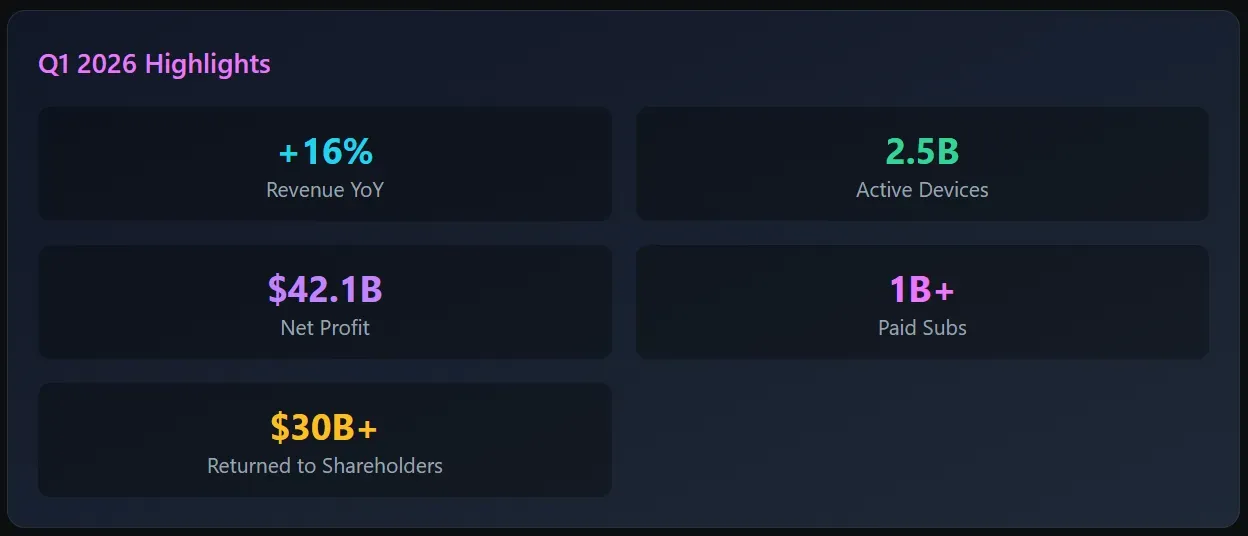

Remember last quarter when Tim Cook casually mentioned they were expecting a 'record-breaking quarter'? Most CEOs say that and deliver something mediocre. Tim Cook said it and then proceeded to drop $143.8 billion in revenue - the largest single quarter in Apple's entire 48-year history. Revenue grew 16% year-over-year, the biggest jump in four years. Sometimes you just have to respect the man.

EPS came in at $2.84 vs $2.67 expected - another all-time record. Net profit hit $42.1 billion in a single quarter. That's more profit than most S&P 500 companies generate in an entire year.

The numbers that made analysts look silly

Metric -- Expected -- Actual

Revenue: $138.4B -- $143.8B (+3.9%)

EPS: $2.67 -- $2.84 (+6.4%)

Gross Margin: 47.5% -- 48.2%

iPhone 17: 'the demand was simply staggering'

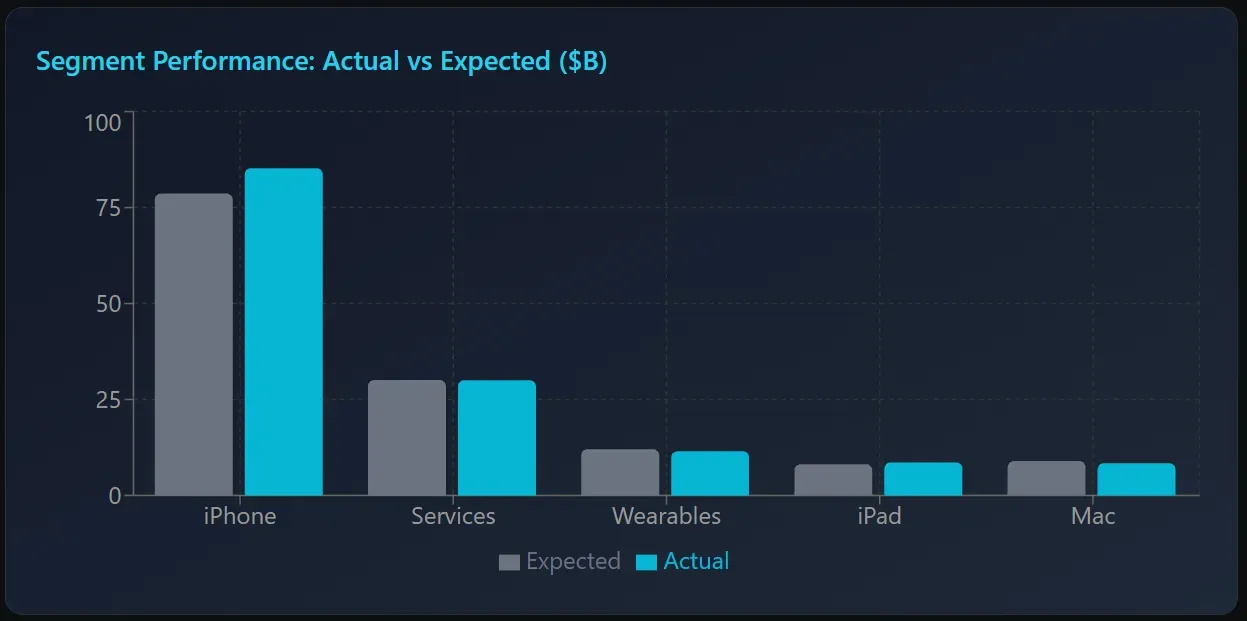

Those are Tim Cook's actual words, not mine. iPhone revenue hit $85.27 billion - an all-time record - versus the $78.65 billion analysts expected. That's 23% growth year-over-year. In a supposedly 'mature' smartphone market. For a product that's been around for 18 years.

For context, Apple missed iPhone estimates last year by the widest margin in 2 years. Everyone was writing 'peak iPhone' obituaries. The iPhone 17 just responded with the biggest iPhone quarter ever recorded. The turnaround is remarkable - this is the same company that saw iPhone sales decline slightly in Q1 2025.

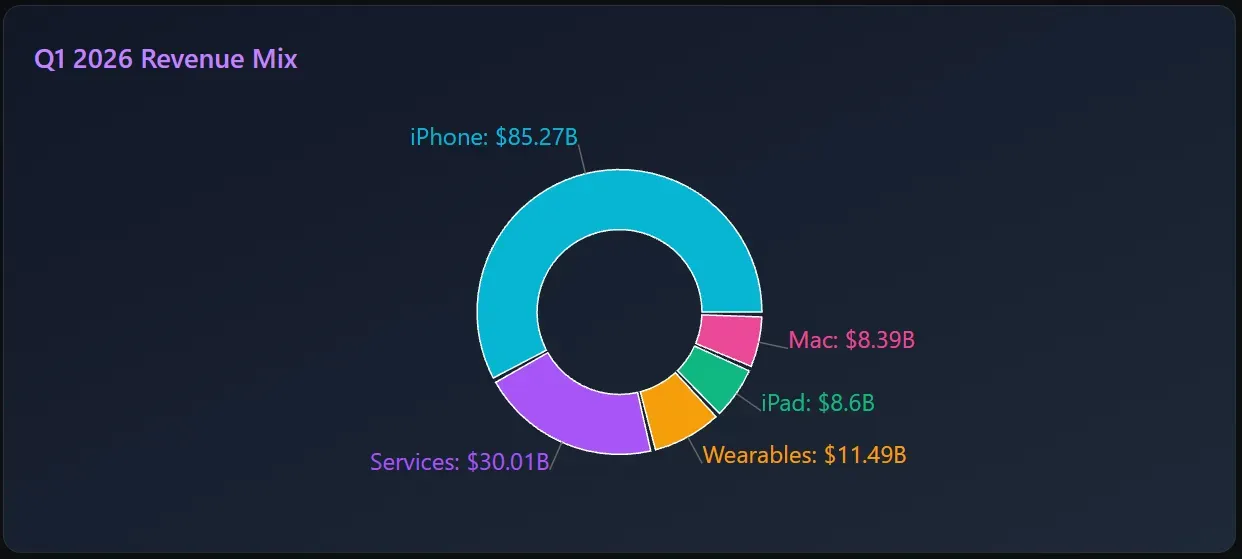

Segment breakdown

Segment -- Revenue -- Expected -- YoY

- iPhone: $85.27B -- $78.65B -- +23%

- Services: $30.01B -- $30.07B -- +14%

- iPad: $8.60B -- $8.13B -- +6%

- Mac: $8.39B -- $8.95B -- -7%

- Wearables/Home/Acc: $11.49B -- $12.04B -- -2%

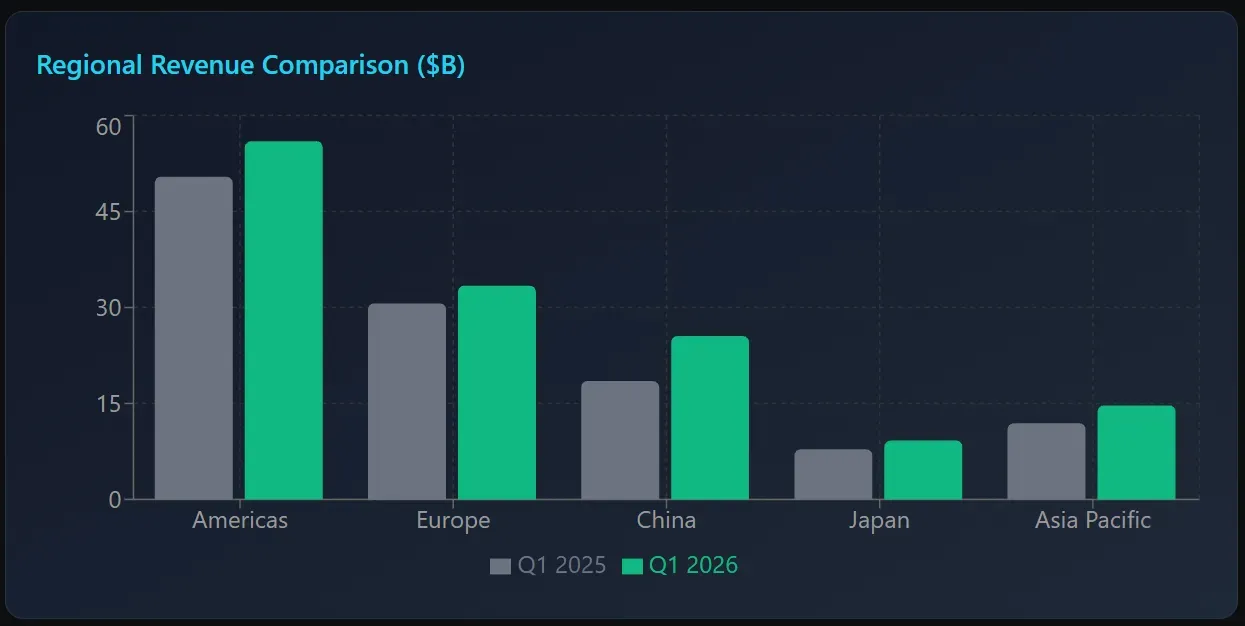

China: from dumpster fire to growth engine

This is the headline nobody expected. Last year, China sales dropped 11% and everyone (myself included) was writing doom articles about Apple losing the world's largest smartphone market to Huawei. This quarter? +38% year-over-year growth to $25.53 billion. That's not a typo. Thirty-eight percent.

What changed? Three things:

- iPhone 17 is genuinely compelling – the 'Air' model created real buzz,

- government stimulus programs kicked in, and

- the Apple ecosystem lock-in is proving sticky even against domestic competitors. When Chinese consumers have spent years building photo libraries, buying apps, and using Apple Pay, switching costs add up.

Americas grew 11% too, so this isn't just a China story. But the China turnaround removes one of the biggest bear arguments against the stock.

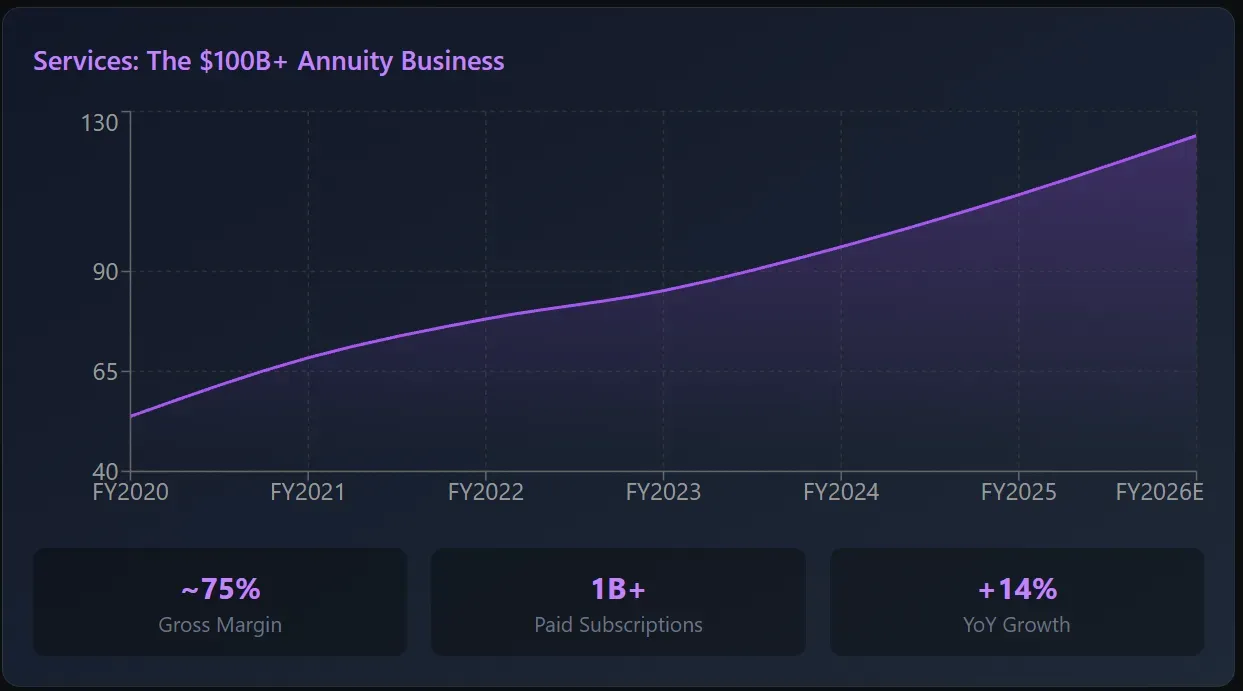

Services: the $100 billion annuity business

Services revenue hit $30 billion for the quarter - that's 14% growth and tracking to over $120 billion annually. Apple now has more than 1 billion paid subscriptions across its ecosystem. The best part? Services margins are roughly 75% - more than double hardware margins.

Think about what this means: Apple has 2.5 billion active devices worldwide, each one a potential subscription revenue stream. App Store, iCloud, Apple Music, Apple TV+, AppleCare, the Google licensing deal - it all adds up. And it's recurring. Every quarter. Like clockwork.

Apple TV+ viewership jumped 36% in December alone. They also just acquired Q.AI for $2 billion to beef up AI capabilities, and partnered with Google to bring Gemini to Apple Intelligence. The ecosystem keeps getting stickier.

Technical setup

The chart is showing a textbook Fibonacci retracement setup after the pullback from December highs. Here's what I'm seeing:

Fib Level -- Price Level

1.0 (Swing High) -- $289.01

0.786 Retracement -- $279.60

0.618 Retracement -- $272.19

0.5 Retracement -- $266.99

0.382 Retracement -- $261.79

0.236 Retracement (Current Zone) 00 $255.36

0 (Swing Low) -- $244.96

The stock pulled back from the $289 high and is now sitting near the 0.236 Fibonacci retracement level around $255-258. This is a relatively shallow retracement in the grand scheme - typically a sign of strength. The 0.236 level often acts as first support in strong uptrends.

Key technicals

Current price: ~$258

200-day SMA: $236.37 - price is holding above, which is bullish

RSI: 30.86 - flashing oversold. Classic setup for a bounce.

MACD: -4.11 - negative momentum, but watch for a crossover signal as price stabilizes at support

The setup here is interesting: stock got hammered alongside tech broadly (down 9% YTD before earnings), now sitting at Fib support with oversold RSI. A strong earnings beat just dropped, and the stock is still holding well above the 200 SMA. If this Fib level holds, the next targets on a bounce would be the 0.382 at $261.79, then the 0.5 at $267, and the 0.618 'golden ratio' at $272.

If price loses the 0.236 level convincingly, the swing low at $244.96 and the 200 SMA around $236 become the next areas of interest. That said, after a beat like this, I'd expect buyers to step in before that happens.

The bottom line

Tim Cook told us to expect a record quarter and delivered one of the most impressive prints in Apple's history. iPhone 17 is a hit. China turned from headwind to tailwind. Services keeps compounding. The install base is now 2.5 billion devices.

Yes, Wearables missed. Yes, Mac was soft. Yes, memory costs might pressure margins going forward (Q2 guidance is 48-49%). And yes, Apple's Siri/AI story is still playing catch-up to the competition. But those feel like footnotes on an otherwise stellar report.

Technically, we've got an oversold RSI at Fibonacci support after a broad tech selloff. Fundamentally, we just got $143.8 billion reasons to believe the Apple story is far from over.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.