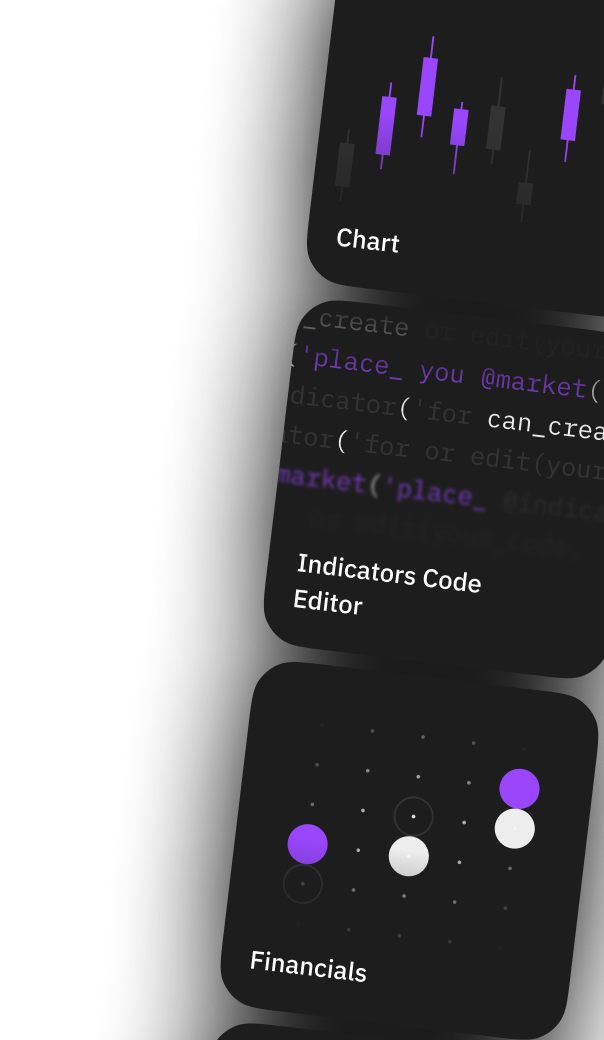

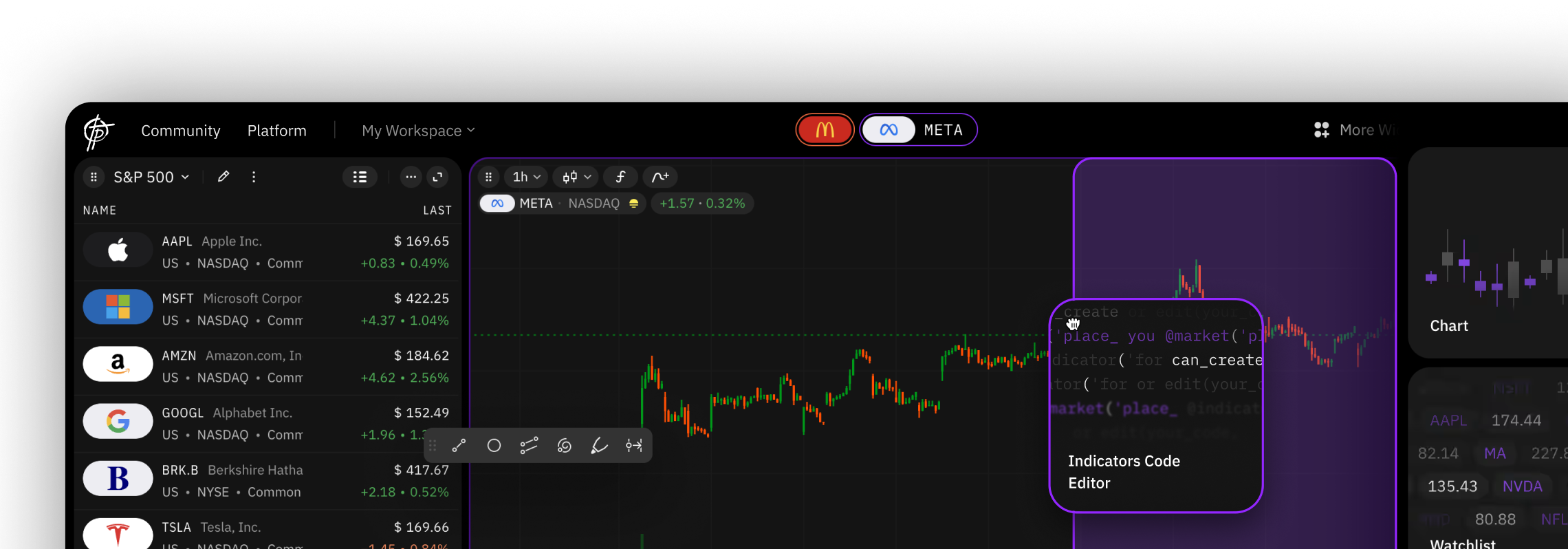

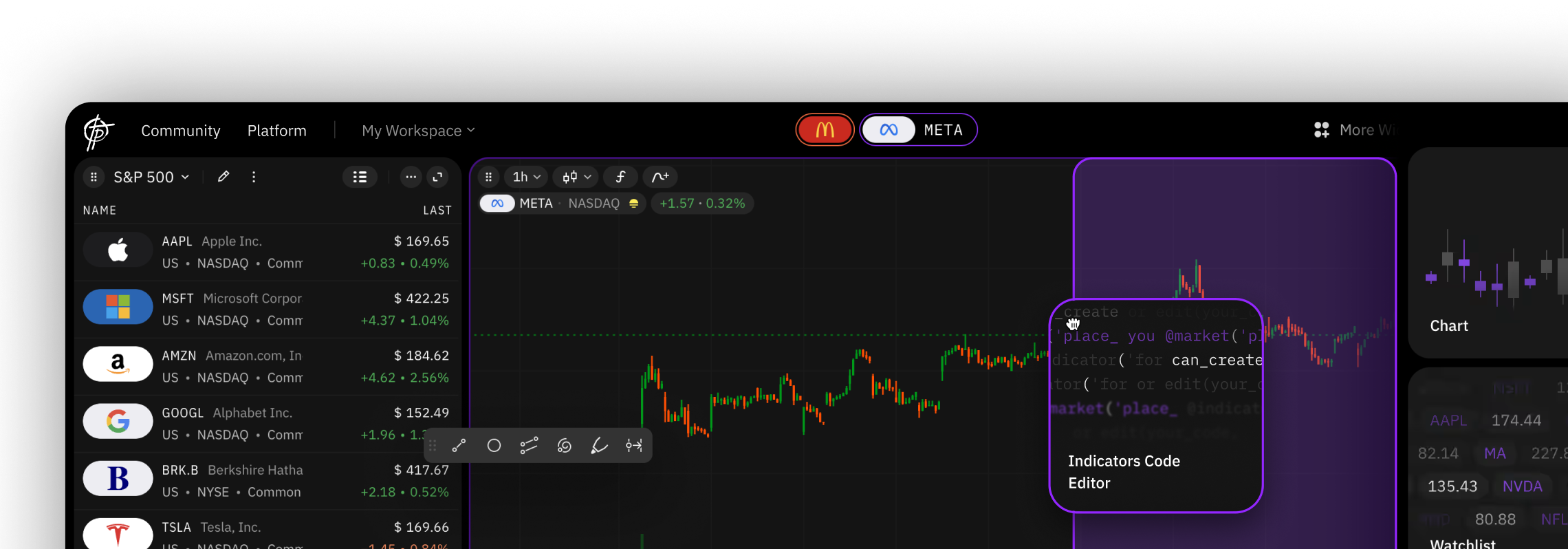

Community-Driven Trading Platform

TakeProfit

![MTC Education - Elliott Impulses [English] big image](https://media-files.takeprofit.com/QMhKa-U8-rkey80Dtgx3g.webp?height=472&width=944&quality=80)

MTC Education - Elliott Impulses [English]

AMD Update

Der AMD Kurs hat an dem 0.13 Fib vom grünen ABCD gedreht. Fürs Erste sieht alles nach Plan aus.

Why not Indian Markets?

One of the largest retail participation

Boyd Gaming Corporation Update

Some time ago, I published an idea about BYD Gaming having upside potential, although I didn't like the indices at the time. I still don't like them, but the idea performed quite well :)

S&P 500, Nasdaq100 and Russell 2000: Focus on changing favorites 📊🔄

- S&P500: Critical zone 5,300 - 5,200 points in view- Nasdaq100: No longer relatively stronger than S&P500 for the first time since May 2023- Russell2000: Shows strength against S&P500 againMy strategy:- S&P500 hedge since last week, planned unwind in the next few weeks- Focus on single stock setups instead of strong sector focus- Technology sector currently “only” one of manyInteresting developments:- Defensive sectors (consumer goods, pharma, utilities, real estate) rotate into the foreground- Bullish divergence in market breadth argues against a significant break below 5,200 points in the S&P500Outlook:- Expected positive market development in the hot phase of the U.S. election campaign- Stronger sector focus in sight for the first half of 2025How do you see the current market situation? Share your thoughts in the comments! 💬#TechnicalAnalysis #WealthManagement #MarketRotation #SP500 #Nasdaq100 #Coaching

Bitcoin

Euphoria and extreme fear alternate weekly with Bitcoin. However, my main scenario remains that the short-term uptrend will still be reached at around 47,000 U.S. dollars. At this level, I will build a position, possibly also in particularly heavily sold Bitcoin alternatives. After that, I expect another breakout attempt in the region of 73,000 U.S. dollars. Will it happen like this? I don't know, but in such volatile markets, I need a clear scenario that I derive from chart analysis and existing trends. This way, I can enter the next trading week relaxed, because I have a roadmap in this wild "crypto world".

Could BYD and Geely Take Over Porsche?

As BYD dominates the Chinese market and competes globally with Tesla, there is growing speculation about its expansion plans. One intriguing question is whether BYD could one day acquire the iconic German automaker Porsche, possibly alongside another Chinese automotive giant, Geely Holding Group.

I Shares China Large Cap ETF

The I Shares China Large Cap ETF (FXI) is an exchange-traded fund focused on the largest and most liquid companies in the Chinese market, primarily listed on the Hong Kong Stock Exchange. These companies mainly come from the finance, energy, telecommunications, and consumer goods sectors. Some of the most prominent holdings include:

TSLA: Doomed To Succeed Or Fail

Tesla's always an interesting ticker for many stock traders because of its liquidity and volatility, but what do the technicals say right now?

S&P 500, Nasdaq100 and Russell 2000

There is either an express scenario for the S&P500, which is currently my primary scenario. In this scenario, we still see a slight correction to the short-term uptrend and then a push to new highs above 5,670 points. A flat “cup with handle” formation is forming on the daily chart. This very strong formation has a cap at 5,670 points; if it is overtraded on a daily closing basis, I will take a long position with a target of 6,025 points.The Nasdaq100 has not yet admitted defeat and has regained strength against the S&P500 this week and is now in neutral territory. In the U.S. sectors, the defensive sectors “Real Estate” and “Utilities” are still in the lead, but this week “Technology” is ahead with a performance of 7.66 %. As this is a U.S. election year, there is a high probability that technology stocks will make a comeback, as the high weighting in the indices means that a rise in this sector is almost inevitable for a positive end to the year. I am currently still underweight here, but if the return to relative strength is successful, I will overweight the technology sector at the end of the year.Everything is going according to plan for the Russell2000, even if the relative strength against the S&P500 and the Nasdaq100 has waned again. In such phases, when the sector trend diverges so widely between offensive and defensive sectors, I focus on good individual stock settings. If you are interested in the details, you can read the stock selection criteria at Traderfox: https://lnkd.in/dV56c2r4 The basic scenario therefore remains positive, but it is unclear whether the cyclical or defensive sectors will lead the next breakout. What do you think? Share your opinions and experiences in the comments!

MSCI China ETF

The ETF gives investors exposure to a broad range of sectors, with a significant focus on technology, finance, healthcare, and consumer discretionary industries. Some of the largest companies within this ETF include:

Bitcoin - Price target 48,000 U.S. dollars

The most likely scenario for me is therefore the next upward trend at around 48,000 U.S. dollars. My liquidity planned for cryptocurrency investments will remain “in the dry” until this point and only then will I take a closer look at other cryptocurrency pairs and crypto stocks. Patience is the top priority here.#Bitcoin #Kryptowährungen #Marktanalyse #Coaching #Blockchain

UPS Comeback ?

The main reasons for this are a weaker demand for delivery services and ongoing inflation, which has increased operating costs. Additionally, the labor dispute with the Teamsters union forced the company to agree to higher wages, further squeezing profit margins. The latest quarterly report also showed a decline in revenue and profit, which has weakened investor confidence. Analysts at JPMorgan recently lowered their earnings forecasts for UPS, further contributing to the downward trend

AMD Update

Der AMD Kurs hat an dem 0.13 Fib vom grünen ABCD gedreht. Fürs Erste sieht alles nach Plan aus.

Bitcoin

Euphoria and extreme fear alternate weekly with Bitcoin. However, my main scenario remains that the short-term uptrend will still be reached at around 47,000 U.S. dollars. At this level, I will build a position, possibly also in particularly heavily sold Bitcoin alternatives. After that, I expect another breakout attempt in the region of 73,000 U.S. dollars. Will it happen like this? I don't know, but in such volatile markets, I need a clear scenario that I derive from chart analysis and existing trends. This way, I can enter the next trading week relaxed, because I have a roadmap in this wild "crypto world".

S&P 500, Nasdaq100 and Russell 2000

There is either an express scenario for the S&P500, which is currently my primary scenario. In this scenario, we still see a slight correction to the short-term uptrend and then a push to new highs above 5,670 points. A flat “cup with handle” formation is forming on the daily chart. This very strong formation has a cap at 5,670 points; if it is overtraded on a daily closing basis, I will take a long position with a target of 6,025 points.The Nasdaq100 has not yet admitted defeat and has regained strength against the S&P500 this week and is now in neutral territory. In the U.S. sectors, the defensive sectors “Real Estate” and “Utilities” are still in the lead, but this week “Technology” is ahead with a performance of 7.66 %. As this is a U.S. election year, there is a high probability that technology stocks will make a comeback, as the high weighting in the indices means that a rise in this sector is almost inevitable for a positive end to the year. I am currently still underweight here, but if the return to relative strength is successful, I will overweight the technology sector at the end of the year.Everything is going according to plan for the Russell2000, even if the relative strength against the S&P500 and the Nasdaq100 has waned again. In such phases, when the sector trend diverges so widely between offensive and defensive sectors, I focus on good individual stock settings. If you are interested in the details, you can read the stock selection criteria at Traderfox: https://lnkd.in/dV56c2r4 The basic scenario therefore remains positive, but it is unclear whether the cyclical or defensive sectors will lead the next breakout. What do you think? Share your opinions and experiences in the comments!

Why not Indian Markets?

One of the largest retail participation

Could BYD and Geely Take Over Porsche?

As BYD dominates the Chinese market and competes globally with Tesla, there is growing speculation about its expansion plans. One intriguing question is whether BYD could one day acquire the iconic German automaker Porsche, possibly alongside another Chinese automotive giant, Geely Holding Group.

MSCI China ETF

The ETF gives investors exposure to a broad range of sectors, with a significant focus on technology, finance, healthcare, and consumer discretionary industries. Some of the largest companies within this ETF include:

Boyd Gaming Corporation Update

Some time ago, I published an idea about BYD Gaming having upside potential, although I didn't like the indices at the time. I still don't like them, but the idea performed quite well :)

I Shares China Large Cap ETF

The I Shares China Large Cap ETF (FXI) is an exchange-traded fund focused on the largest and most liquid companies in the Chinese market, primarily listed on the Hong Kong Stock Exchange. These companies mainly come from the finance, energy, telecommunications, and consumer goods sectors. Some of the most prominent holdings include:

Bitcoin - Price target 48,000 U.S. dollars

The most likely scenario for me is therefore the next upward trend at around 48,000 U.S. dollars. My liquidity planned for cryptocurrency investments will remain “in the dry” until this point and only then will I take a closer look at other cryptocurrency pairs and crypto stocks. Patience is the top priority here.#Bitcoin #Kryptowährungen #Marktanalyse #Coaching #Blockchain

S&P 500, Nasdaq100 and Russell 2000: Focus on changing favorites 📊🔄

- S&P500: Critical zone 5,300 - 5,200 points in view- Nasdaq100: No longer relatively stronger than S&P500 for the first time since May 2023- Russell2000: Shows strength against S&P500 againMy strategy:- S&P500 hedge since last week, planned unwind in the next few weeks- Focus on single stock setups instead of strong sector focus- Technology sector currently “only” one of manyInteresting developments:- Defensive sectors (consumer goods, pharma, utilities, real estate) rotate into the foreground- Bullish divergence in market breadth argues against a significant break below 5,200 points in the S&P500Outlook:- Expected positive market development in the hot phase of the U.S. election campaign- Stronger sector focus in sight for the first half of 2025How do you see the current market situation? Share your thoughts in the comments! 💬#TechnicalAnalysis #WealthManagement #MarketRotation #SP500 #Nasdaq100 #Coaching

TSLA: Doomed To Succeed Or Fail

Tesla's always an interesting ticker for many stock traders because of its liquidity and volatility, but what do the technicals say right now?

UPS Comeback ?

The main reasons for this are a weaker demand for delivery services and ongoing inflation, which has increased operating costs. Additionally, the labor dispute with the Teamsters union forced the company to agree to higher wages, further squeezing profit margins. The latest quarterly report also showed a decline in revenue and profit, which has weakened investor confidence. Analysts at JPMorgan recently lowered their earnings forecasts for UPS, further contributing to the downward trend