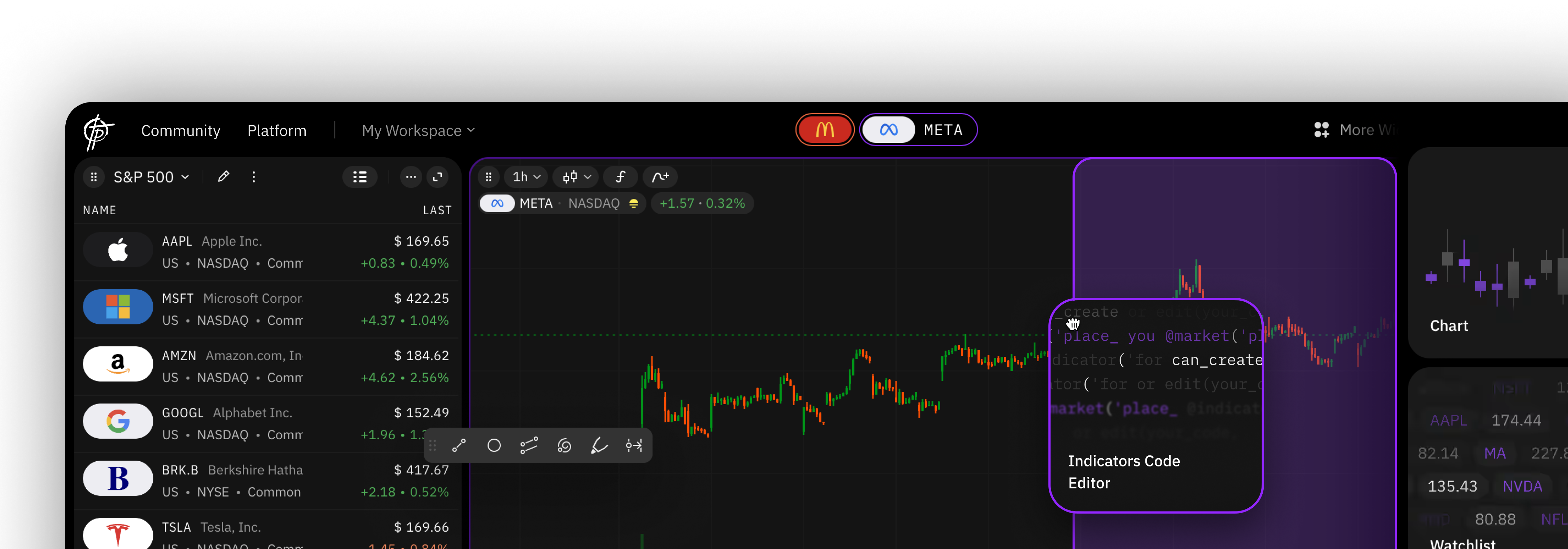

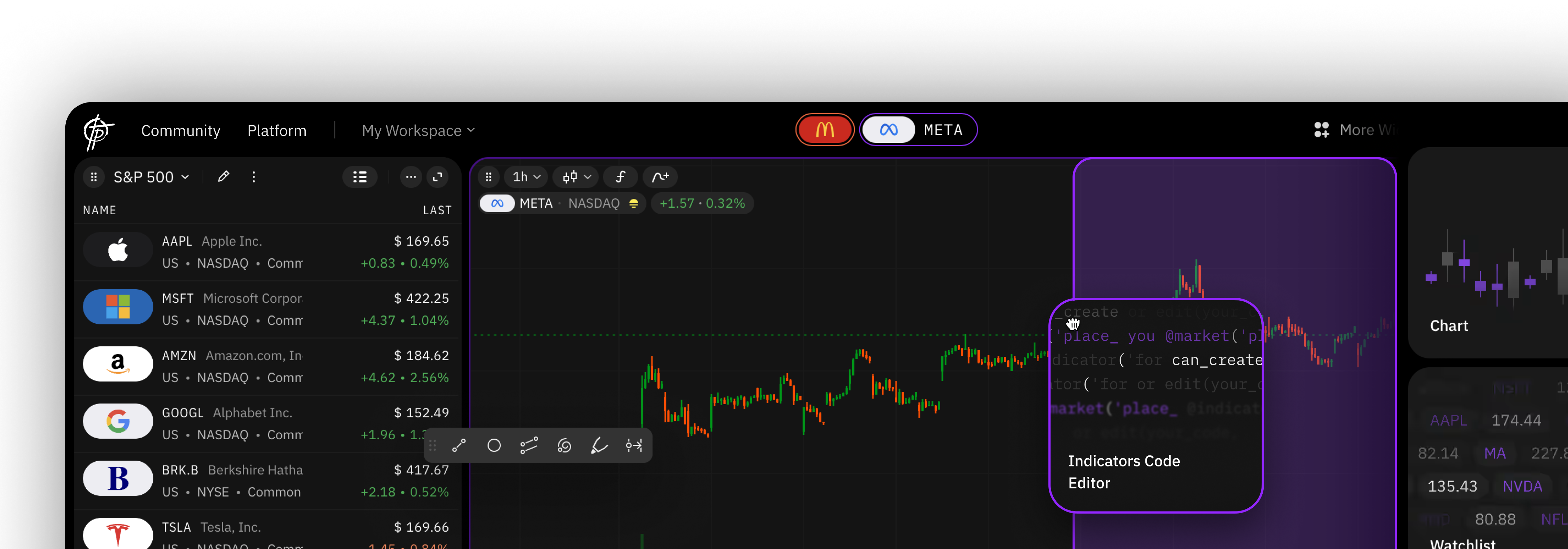

Community-Driven Trading Platform

TakeProfit

![MTC Education - Elliott Impulses [English] big image](https://media-files.takeprofit.com/QMhKa-U8-rkey80Dtgx3g.webp?height=472&width=944&quality=80)

MTC Education - Elliott Impulses [English]

CME: A Good Buy Right Now?

CME has tapped that downward support line multiple times now, indicating strong support.

Advance reserval Pattern

Victors Trading Blog 08.07.2024

Here again the chart I posted at the beginning of June ⬇️

Formation

Es besteht aus 3 Tops mit einem höheren Hoch in der Mitte, dem sogenannten Kopf. Die Linie, welche die zwei Täler verbindet, ist die Nackenlinie. Die Höhe des letzten Tops kann höher sein als das erste, aber nicht höher als der Kopf. Mit anderen Worten, der Preis hat versucht, ein höheres Hoch zu machen, ist aber gescheitert. Je näher die beiden äußeren Tops am gleichen Preis liegen, desto genauer ist das Muster.Wenn eine Kerze die Nackenlinie durchbricht und unterhalb dieser schließt, ist das Muster abgeschlossen. Das Ziel kann geschätzt werden, indem man die Höhe des Musters (von Nackenlinie bis zum Kopf) misst und dieses nach unten projiziert. Übliche Stop-Level befinden sich oberhalb der Nackenlinie oder oberhalb der rechten Schulter. Eine weitere Methode ist das der Stop an der 50% Strecke des Kopfes gesetzt wird. Dies verbessert das Chancen Risikoverhältnis.

Let´s get started

Hi guys!

Quick Question

I just want to preface by saying that this charting platform is insanely good. The UI feel is incredible and I am considering of switching from tradingview to this platform for charting. I am adding some moving averages to my chart and I can't help but notice that I can see the moving average labels on the price scale and it's a bit annoying. Is there a way to turn it off? Also, is there a way to hide my list of indicators? I have a pretty long list now. Thanks in advance!

BTC Option NAVARRO 200

S&P500/Nasdaq 100: Detour likely

Both the S&P500 and the Nasdaq100 have attempted a direct trend continuation, but failed in the last trading week. This has significantly increased the probability of my primary scenario. However, the upward trend in both indices is clearly intact, the only question is whether the bottom is already in at the 10-week average or only at the 30-week average. Looking at the CNN Fear and Greed Index and taking into account that the normal summer lethargy does not tend to occur in election years, I also believe that a volatile sideways movement is likely, in which the shares within the indices develop quite differently. This is because the "fear indicator" is still far removed from "greed" and therefore also offers potential for increases in the coming months.

Edison International

The chart image indicates a continuation of the rage. There are currently two possible wolves at the top.

Lost in Trading

Hi guys!

Victors Trading Blog 04.07.2024

It's been a while since my last blog as I'm in the process of moving from Thailand to Indonesia and spent some time with my family in between. But now I'm back!

Bitcoin / cryptocurrencies - 84,000 or 44,000 US dollars?

Nervousness on the crypto market is on the rise. An exemplary double top has formed, which will be activated if the price falls impulsively below the USD 56,000 mark and sets a price target at USD 44,000. At the same time, Bitcoin is in an upward trend. As long as the USD 56,000 mark holds, my direct bull scenario remains in place. Below this level, an attractive scenario for me is activated. If this upward trend is tested and holds, I see a direct impulsive scenario. For some traders this is of course fatal and they will panic. I would like that very much because it would clear the market. My portfolio is invested and of course this would have a very negative impact on the current value, on the other hand it is also an opportunity for me to invest in shares in this sector, for example, which would then probably also be available for sale.#Bitcoin #cryptocurrenciesHashtag#cryptoHashtag#BTCHashtag#portfoliomanagementHashtag#altcoinsHashtag#coaching

CME: A Good Buy Right Now?

CME has tapped that downward support line multiple times now, indicating strong support.

Let´s get started

Hi guys!

Edison International

The chart image indicates a continuation of the rage. There are currently two possible wolves at the top.

Advance reserval Pattern

Quick Question

I just want to preface by saying that this charting platform is insanely good. The UI feel is incredible and I am considering of switching from tradingview to this platform for charting. I am adding some moving averages to my chart and I can't help but notice that I can see the moving average labels on the price scale and it's a bit annoying. Is there a way to turn it off? Also, is there a way to hide my list of indicators? I have a pretty long list now. Thanks in advance!

Lost in Trading

Hi guys!

Victors Trading Blog 08.07.2024

Here again the chart I posted at the beginning of June ⬇️

BTC Option NAVARRO 200

Victors Trading Blog 04.07.2024

It's been a while since my last blog as I'm in the process of moving from Thailand to Indonesia and spent some time with my family in between. But now I'm back!

Formation

Es besteht aus 3 Tops mit einem höheren Hoch in der Mitte, dem sogenannten Kopf. Die Linie, welche die zwei Täler verbindet, ist die Nackenlinie. Die Höhe des letzten Tops kann höher sein als das erste, aber nicht höher als der Kopf. Mit anderen Worten, der Preis hat versucht, ein höheres Hoch zu machen, ist aber gescheitert. Je näher die beiden äußeren Tops am gleichen Preis liegen, desto genauer ist das Muster.Wenn eine Kerze die Nackenlinie durchbricht und unterhalb dieser schließt, ist das Muster abgeschlossen. Das Ziel kann geschätzt werden, indem man die Höhe des Musters (von Nackenlinie bis zum Kopf) misst und dieses nach unten projiziert. Übliche Stop-Level befinden sich oberhalb der Nackenlinie oder oberhalb der rechten Schulter. Eine weitere Methode ist das der Stop an der 50% Strecke des Kopfes gesetzt wird. Dies verbessert das Chancen Risikoverhältnis.

S&P500/Nasdaq 100: Detour likely

Both the S&P500 and the Nasdaq100 have attempted a direct trend continuation, but failed in the last trading week. This has significantly increased the probability of my primary scenario. However, the upward trend in both indices is clearly intact, the only question is whether the bottom is already in at the 10-week average or only at the 30-week average. Looking at the CNN Fear and Greed Index and taking into account that the normal summer lethargy does not tend to occur in election years, I also believe that a volatile sideways movement is likely, in which the shares within the indices develop quite differently. This is because the "fear indicator" is still far removed from "greed" and therefore also offers potential for increases in the coming months.

Bitcoin / cryptocurrencies - 84,000 or 44,000 US dollars?

Nervousness on the crypto market is on the rise. An exemplary double top has formed, which will be activated if the price falls impulsively below the USD 56,000 mark and sets a price target at USD 44,000. At the same time, Bitcoin is in an upward trend. As long as the USD 56,000 mark holds, my direct bull scenario remains in place. Below this level, an attractive scenario for me is activated. If this upward trend is tested and holds, I see a direct impulsive scenario. For some traders this is of course fatal and they will panic. I would like that very much because it would clear the market. My portfolio is invested and of course this would have a very negative impact on the current value, on the other hand it is also an opportunity for me to invest in shares in this sector, for example, which would then probably also be available for sale.#Bitcoin #cryptocurrenciesHashtag#cryptoHashtag#BTCHashtag#portfoliomanagementHashtag#altcoinsHashtag#coaching