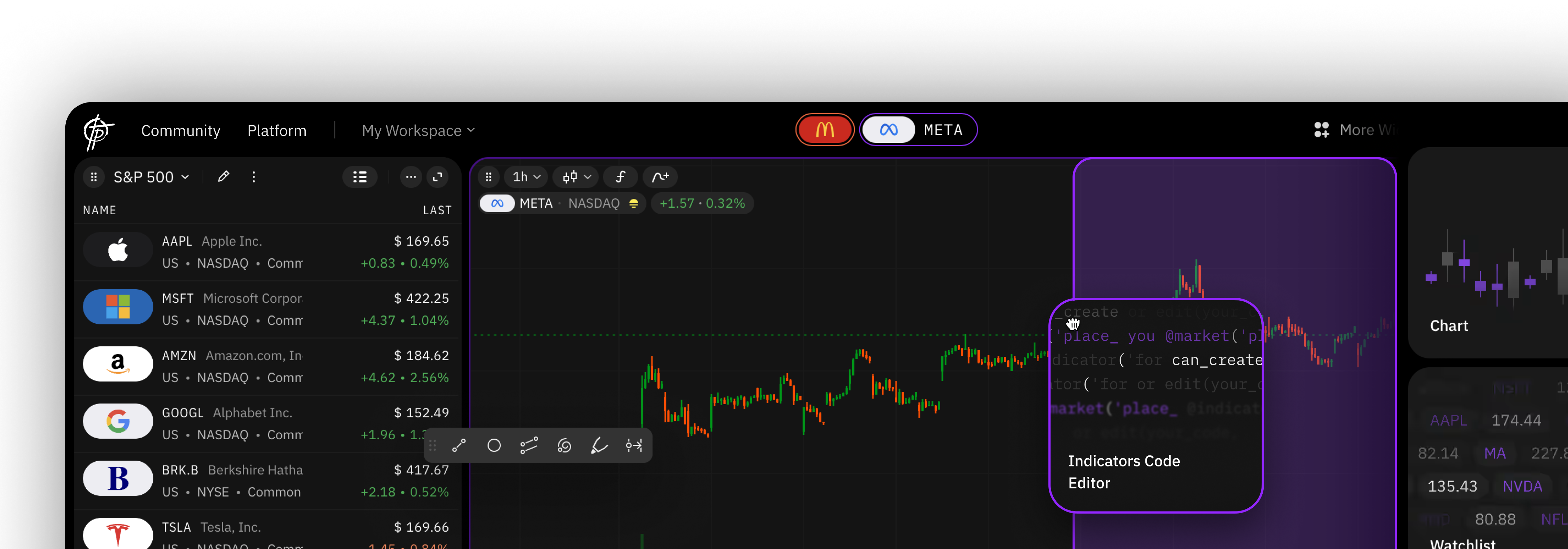

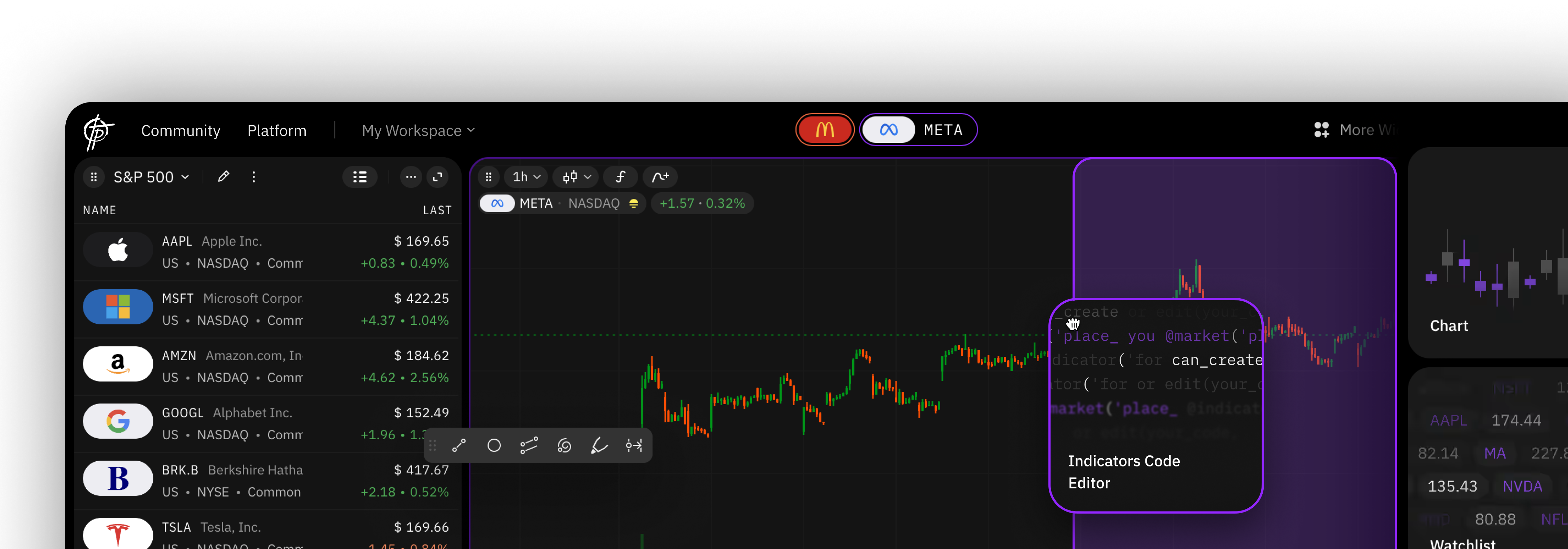

Community-Driven Trading Platform

TakeProfit

![MTC Education - Elliott Impulses [English] big image](https://media-files.takeprofit.com/QMhKa-U8-rkey80Dtgx3g.webp?height=472&width=944&quality=80)

Last week I still had the correction on the chart, now I am assuming a direct "march through" towards 5,400 points and even then I only expect a moderate correction. This is because a positive divergence has formed in the "advanced/declineline". Roughly speaking, this indicator shows the market breadth and has expanded to a new high. At the same time, the S&P500 has not (yet) managed to do so. However, this divergence was the "tip of the scales", which is why I expect a clear continuation of the upward trend. It is interesting to note that it is no longer the technology stocks that are generating the momentum, but rather the representatives of the sectors: Energy, Utilities, Materials, Industry and Communication Services. What is particularly exciting here is the "utilities" theme, behind which the "smart grid or energy infrastructure" theme also lies.

Here's a little update on the Trade I posted yesterday:

The two often overlooked factors that can significantly grow a small trading account into a substantial one are the power of compounding and time.

As human beings, it's natural for us to seek control and order in our lives. From an early age, we are guided to follow a set path – study hard, heed our parents' advice, respect authority, secure a good job, start a family, and so on – in pursuit of what society deems as the perfect life. However, this standardized approach may not align with the uncertainties inherent in activities like trading.

Compared to gold or shares, for example, Bitcoin is still more or less an "asset class baby". Cryptocurrencies are also attracting many young investors. Young people are characterized by a lot of courage and strength. However, young people are also impatient. Bitcoin is forming a very nice correction scenario that would end with a weekly close above 70,000 U.S. dollars. Young investors find it difficult to watch, because they are used to fast and powerful movements and not this kind of pushing and shoving. I see a very positive scenario for this year, I am fully invested and will wait patiently for the breakout.

In the Daily Chart, we have a big expansion to the downside. The Fib 0.382 & 0.618 represent swing trading targets TP1 and TP2.

The key factor that one must consistently analyze in trading is the existing market conditions. Market conditions are constantly changing, transitioning from trending to ranging and vice versa, as well as shifting from periods of low volatility to high volatility.

Important figures for my portfolio are due this week, some second-tier tech stocks (chip & AI stocks), which have outperformed the market in recent weeks, will show whether this part of my portfolio remains invested. The relative strength of technology stocks (especially Big Tech) means that they are no longer investments. What is exciting is the utilities sector, which has not shown any signs of life for a long time, but is apparently being rediscovered by the major analyst firms, with Goldman Sachs publishing two detailed studies with the following headlines:- "Electrify Now: Powering Up Europe: AI, Datacenters, and Electrification to Drivec. 40% Growth in Electricity Consumption"- "Generational Growth: AI, Data Centers and the Coming US Power Demand Surge"At its core, this is about the energy requirements of the AI trend, so it's no surprise that some utility stocks have made it onto my watchlist. In addition to the increased growth prospects, they currently offer low valuations and, in some cases, attractive dividends. It's not just chart technicians who are taking advantage of this. This example is another wonderful example of the "power" of technical analysis, which picks up on the first signs of new sector trends a few weeks before the analysts' studies are published.If you want to know more about the analyses, just write a comment, if you are interested I will add a new article.#charting #KI #coaching #supervision #wealthmanagement

Within the last 7 days we've seen some very interesting price action on the GME chart which visually showcases how accurate technical analysis can be and how much reward is actually possible using the right kind of strategies.

Even though I only trade intraday, I still go into timeframes that are way beyond that in order to build my bias for the respecting smaller timeframe. So even though this is a 1h analysis, let's look at the weekly chart first ⬇️

Let take a look at the relationship between time and money, especially in the context of trading. While it is commonly understood that time is money in many professions, trading, particularly day trading, operates differently.

Bitcoin has exhausted its correction scenario to the depths this week. The strong reaction now makes the bull scenario active and the next target is the 84,000 U.S. dollar mark. I will now increase my investment quota to 100%. I am invested in Avalanche, Worldcoin, Litecoin an Ethereum. I have based my selection on their relative strength compared to Bitcoin. The specific characteristics of the individual cryptocurrencies do not play any role for me. The "driver" of the crypto theme for me remains supply and demand, which works purely according to psychological factors. Please note the risk warnings in my previous posts.#Bitcoin #Cryptocurrencies #Portfoliomanagement #Coaching #Supervision

Last week I still had the correction on the chart, now I am assuming a direct "march through" towards 5,400 points and even then I only expect a moderate correction. This is because a positive divergence has formed in the "advanced/declineline". Roughly speaking, this indicator shows the market breadth and has expanded to a new high. At the same time, the S&P500 has not (yet) managed to do so. However, this divergence was the "tip of the scales", which is why I expect a clear continuation of the upward trend. It is interesting to note that it is no longer the technology stocks that are generating the momentum, but rather the representatives of the sectors: Energy, Utilities, Materials, Industry and Communication Services. What is particularly exciting here is the "utilities" theme, behind which the "smart grid or energy infrastructure" theme also lies.

Compared to gold or shares, for example, Bitcoin is still more or less an "asset class baby". Cryptocurrencies are also attracting many young investors. Young people are characterized by a lot of courage and strength. However, young people are also impatient. Bitcoin is forming a very nice correction scenario that would end with a weekly close above 70,000 U.S. dollars. Young investors find it difficult to watch, because they are used to fast and powerful movements and not this kind of pushing and shoving. I see a very positive scenario for this year, I am fully invested and will wait patiently for the breakout.

Within the last 7 days we've seen some very interesting price action on the GME chart which visually showcases how accurate technical analysis can be and how much reward is actually possible using the right kind of strategies.

Here's a little update on the Trade I posted yesterday:

In the Daily Chart, we have a big expansion to the downside. The Fib 0.382 & 0.618 represent swing trading targets TP1 and TP2.

Even though I only trade intraday, I still go into timeframes that are way beyond that in order to build my bias for the respecting smaller timeframe. So even though this is a 1h analysis, let's look at the weekly chart first ⬇️

The two often overlooked factors that can significantly grow a small trading account into a substantial one are the power of compounding and time.

The key factor that one must consistently analyze in trading is the existing market conditions. Market conditions are constantly changing, transitioning from trending to ranging and vice versa, as well as shifting from periods of low volatility to high volatility.

Let take a look at the relationship between time and money, especially in the context of trading. While it is commonly understood that time is money in many professions, trading, particularly day trading, operates differently.

As human beings, it's natural for us to seek control and order in our lives. From an early age, we are guided to follow a set path – study hard, heed our parents' advice, respect authority, secure a good job, start a family, and so on – in pursuit of what society deems as the perfect life. However, this standardized approach may not align with the uncertainties inherent in activities like trading.

Important figures for my portfolio are due this week, some second-tier tech stocks (chip & AI stocks), which have outperformed the market in recent weeks, will show whether this part of my portfolio remains invested. The relative strength of technology stocks (especially Big Tech) means that they are no longer investments. What is exciting is the utilities sector, which has not shown any signs of life for a long time, but is apparently being rediscovered by the major analyst firms, with Goldman Sachs publishing two detailed studies with the following headlines:- "Electrify Now: Powering Up Europe: AI, Datacenters, and Electrification to Drivec. 40% Growth in Electricity Consumption"- "Generational Growth: AI, Data Centers and the Coming US Power Demand Surge"At its core, this is about the energy requirements of the AI trend, so it's no surprise that some utility stocks have made it onto my watchlist. In addition to the increased growth prospects, they currently offer low valuations and, in some cases, attractive dividends. It's not just chart technicians who are taking advantage of this. This example is another wonderful example of the "power" of technical analysis, which picks up on the first signs of new sector trends a few weeks before the analysts' studies are published.If you want to know more about the analyses, just write a comment, if you are interested I will add a new article.#charting #KI #coaching #supervision #wealthmanagement

Bitcoin has exhausted its correction scenario to the depths this week. The strong reaction now makes the bull scenario active and the next target is the 84,000 U.S. dollar mark. I will now increase my investment quota to 100%. I am invested in Avalanche, Worldcoin, Litecoin an Ethereum. I have based my selection on their relative strength compared to Bitcoin. The specific characteristics of the individual cryptocurrencies do not play any role for me. The "driver" of the crypto theme for me remains supply and demand, which works purely according to psychological factors. Please note the risk warnings in my previous posts.#Bitcoin #Cryptocurrencies #Portfoliomanagement #Coaching #Supervision