Trend Momentum Crossover

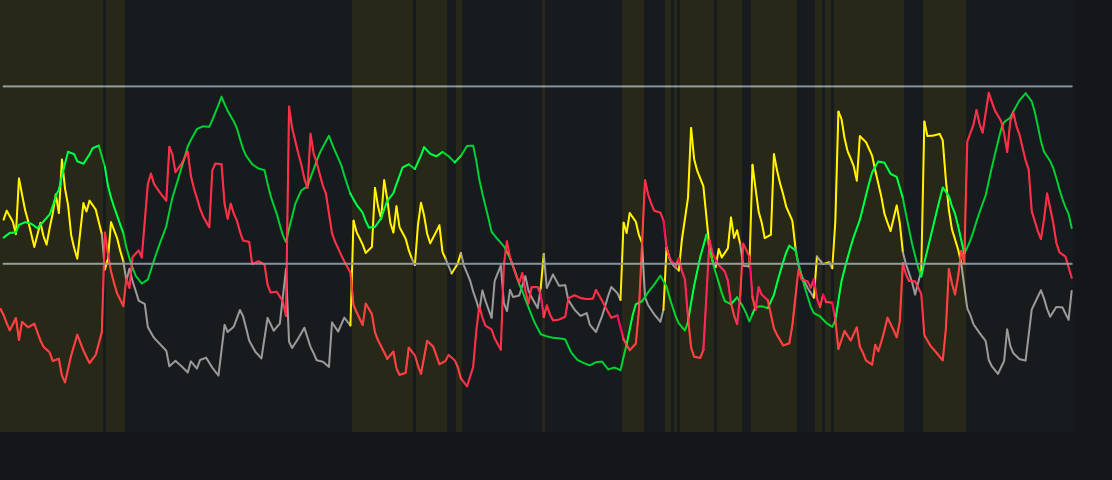

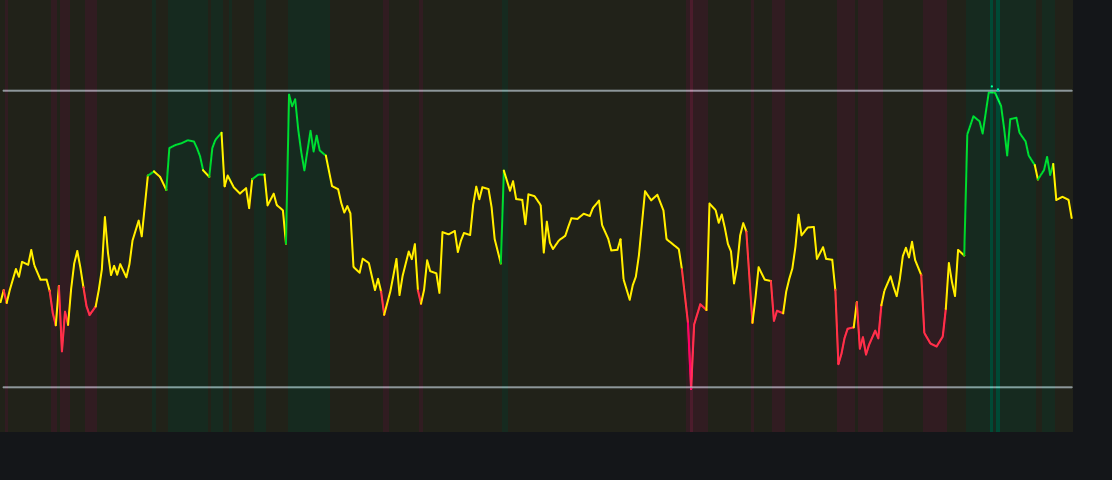

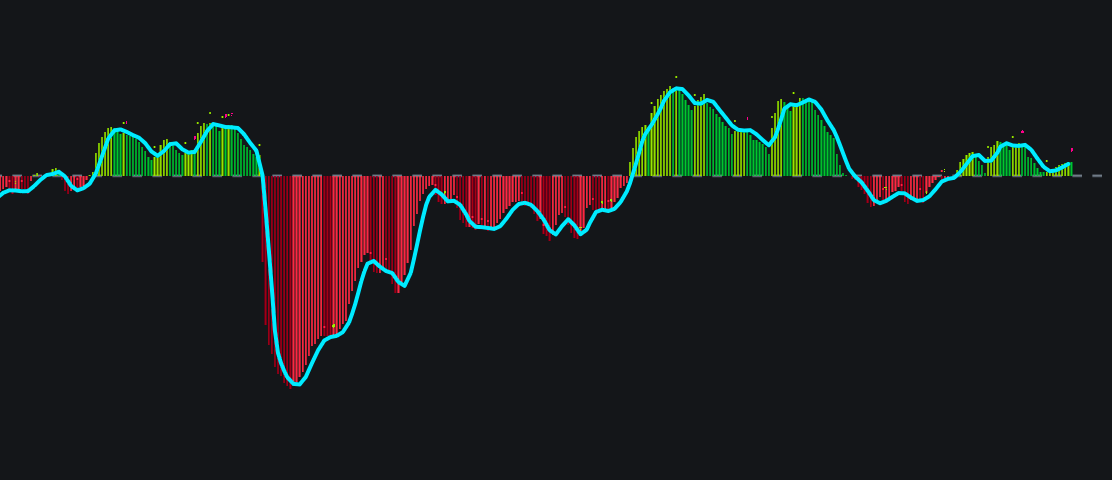

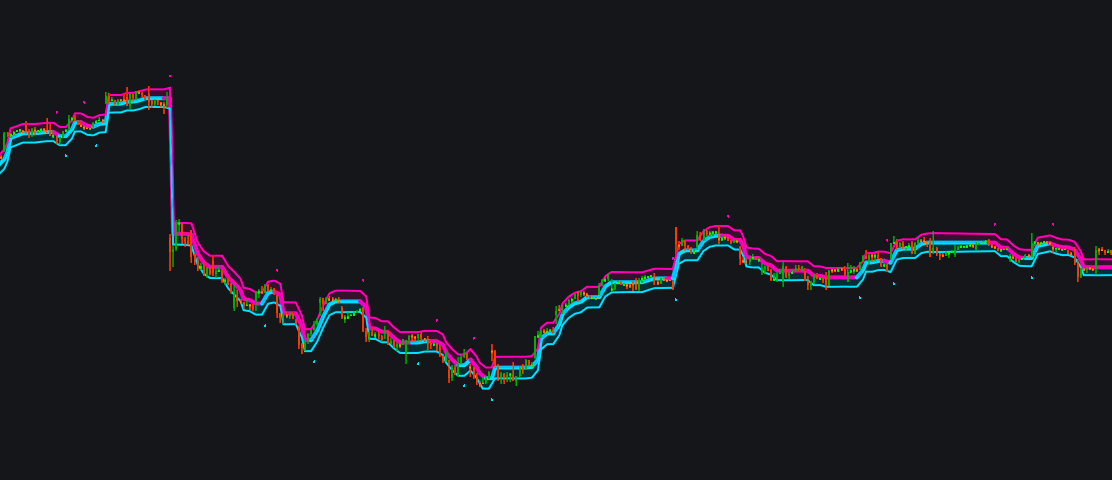

Trend Momentum Crossover is a trend-following indicator that identifies high-probability buy and sell opportunities by combining moving average crossovers with momentum confirmation. The indicator plots two Simple Moving Averages (fast and slow) to defi…

Trend Momentum Crossover is a trend-following indicator that identifies high-probability buy and sell opportunities by combining moving average crossovers with momentum confirmation. The indicator plots two Simple Moving Averages (fast and slow) to defi…