Plan Trades Visually with the New Long/Short Tool

Simulate entries, control risk, and manage multiple TP/SL targets — all directly on your chart

What is the Long / Short Tool?

The Long/Short Tool lets you simulate a trade based on your custom entry, stop loss (SL), and take profit (TP).

It helps visualize a position, measure risk vs. reward, and understand how much you'd be risking or gaining — before placing a real order. Use it to set up multiple profit targets, layered stop losses, and dynamic position sizing — all directly on the chart.

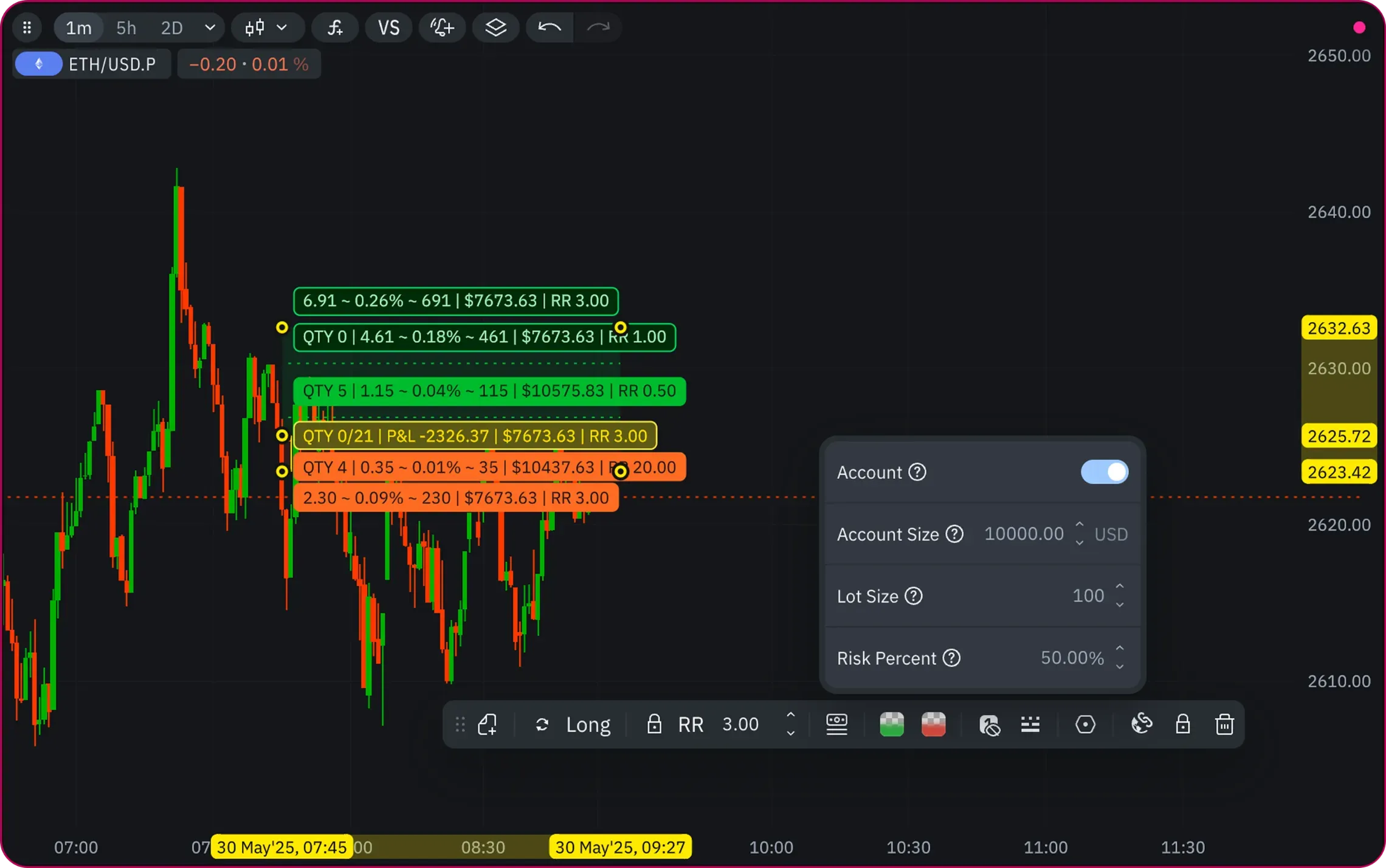

Setup: Defining Your Risk

Start by setting your Account Size and Risk Percent.

Example: If your account is $10,000 and you risk 50%, the tool allocates $5,000 to the trade.

Based on your entry price, it will calculate how many lots you could theoretically buy.

This gives you a realistic sense of position size and potential exposure.

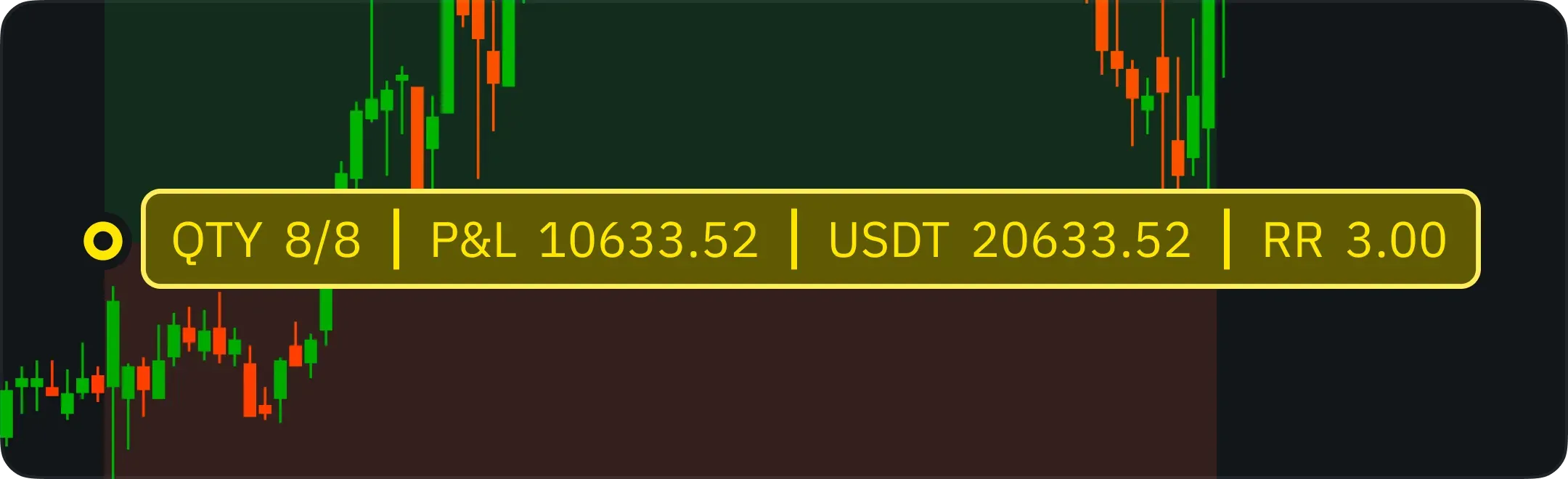

Entry Level

Your selected entry price is shown as a yellow horizontal line. Next to it, a timestamp marks when the position starts.

The QTY label shows your total and remaining lots, like 8/8. This makes it easy to track how much of the position is still open after partial exits.

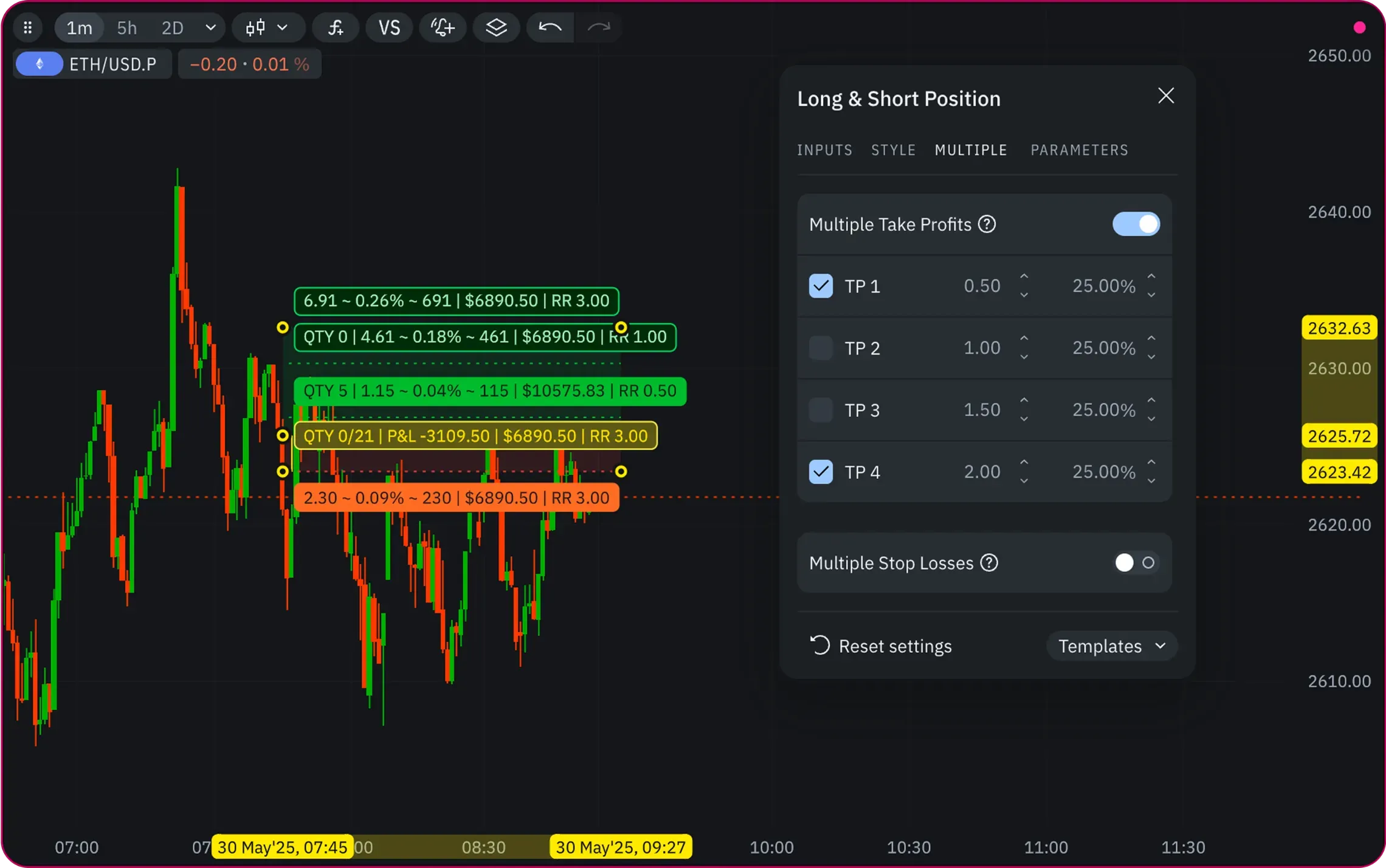

Stop Loss & Take Profit

The lowest level below entry is your stop loss (SL). The highest level above entry is your take profit (TP). These levels are calculated based on your configured Risk/Reward ratio, or you can place them manually.

Everything is visualized on the chart in real time.

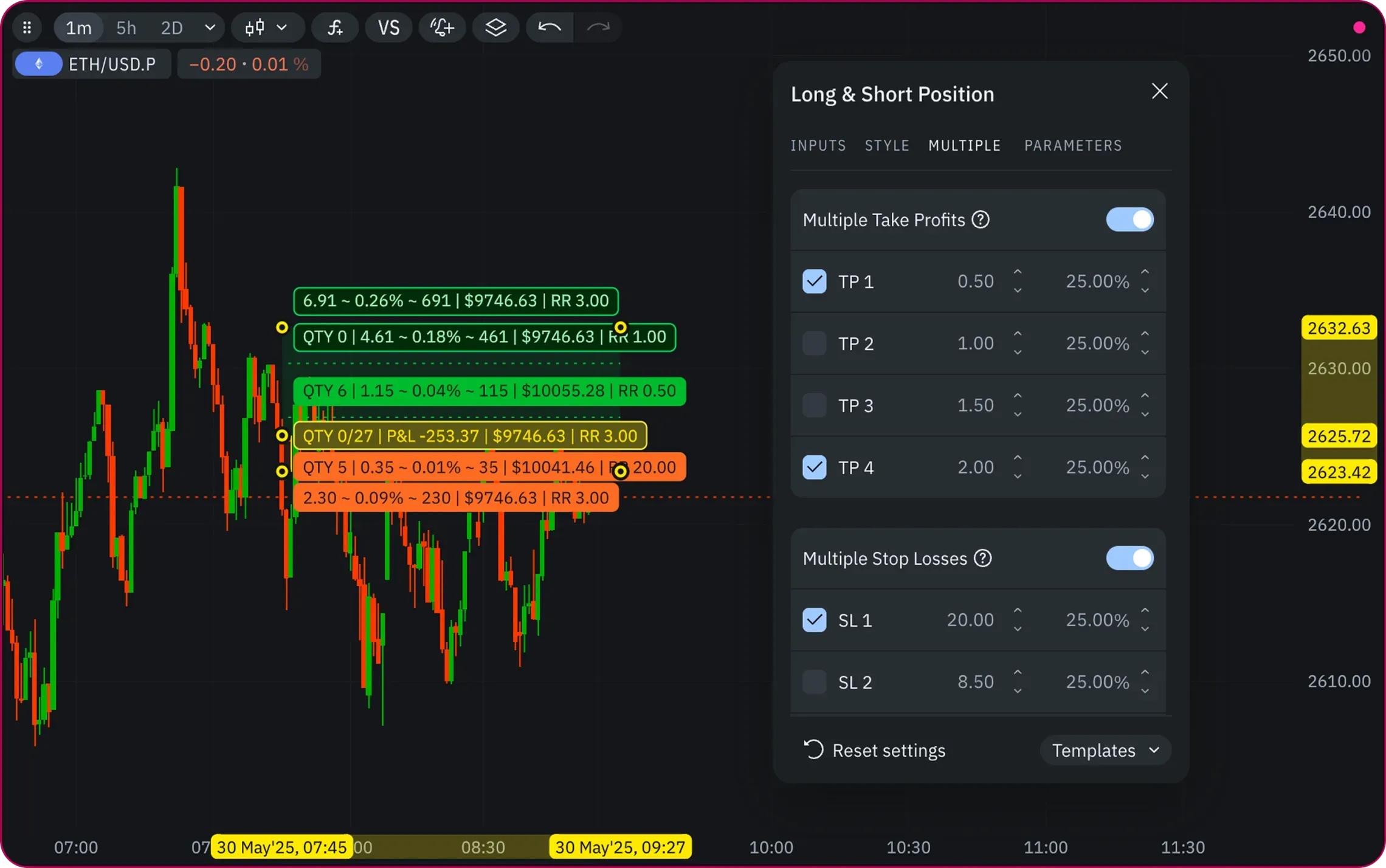

Multiple Take Profits & Stop Losses

Set up multiple profit targets or stop levels — each with:

- Absolute price change

- % change from entry

- Pips

For each level, define:

- What RR level to place it at

- What % of your position to close when that level is hit

This enables layered exits and smarter risk management.

Improve Clarity in Decision-Making

The Long/Short Tool isn’t just about drawing — it’s about trading with intention.

It gives you a clearer picture of your risk and reward — helping you plan trades that make sense.

Want to learn more? Check out the full guide with video demonstrations to see how the Long/Short Tool works in detail.

Still have questions? Join our community on Discord to ask and get support.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.