Back to Basic!

In times of a strong correction, I always look at my trading system. This conscious return to the basic strategy strengthens me psychologically for two scenarios.

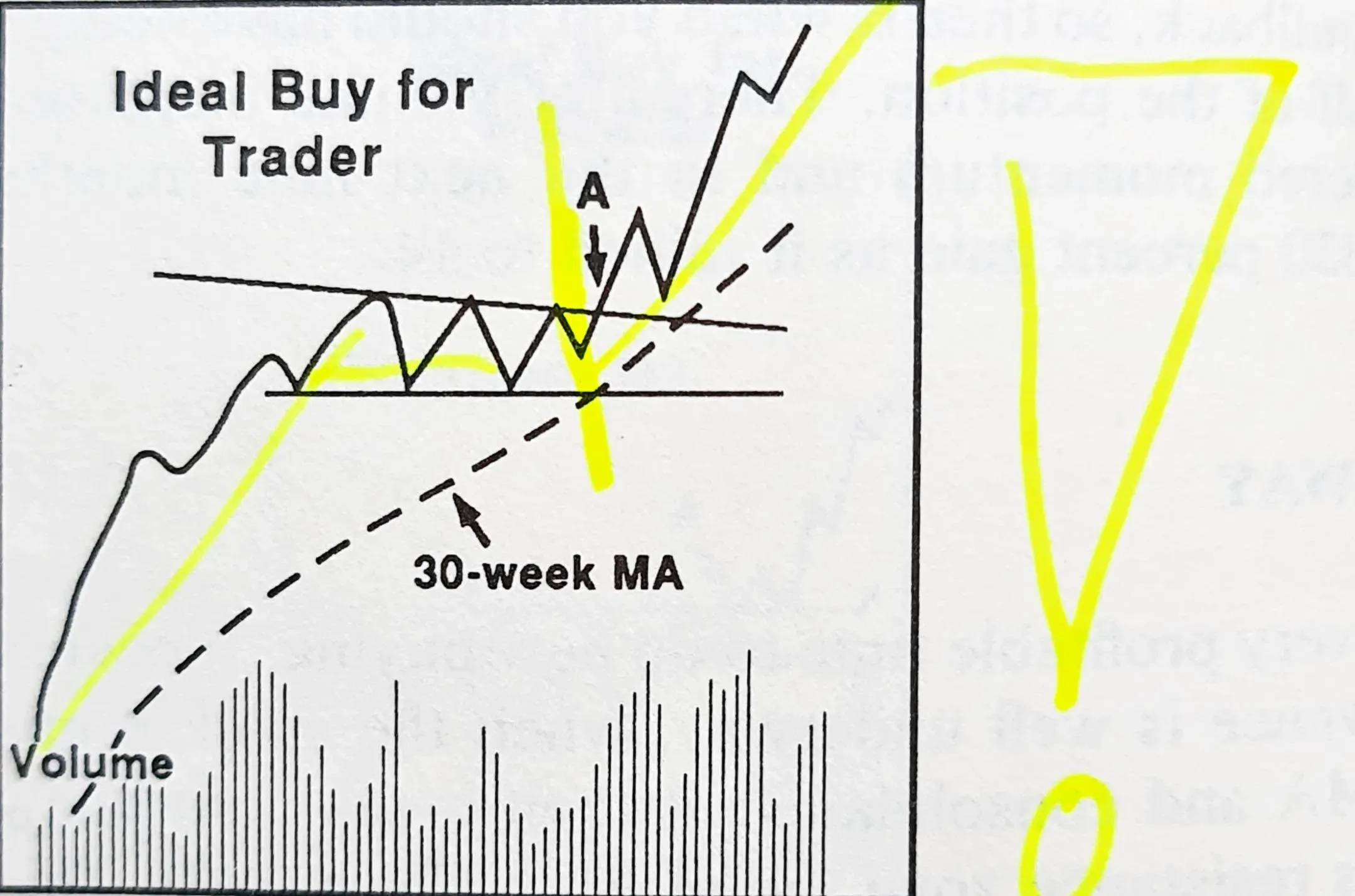

Scenario 1 "The ideal trading buy" (currently my primary scenario) with a test of the 30-week average of my basic index S&P500 with a rise in volume at a turning point on a weekly basis. This means again: look for sector leaders, select stocks, increase the investment ratio towards 100%.

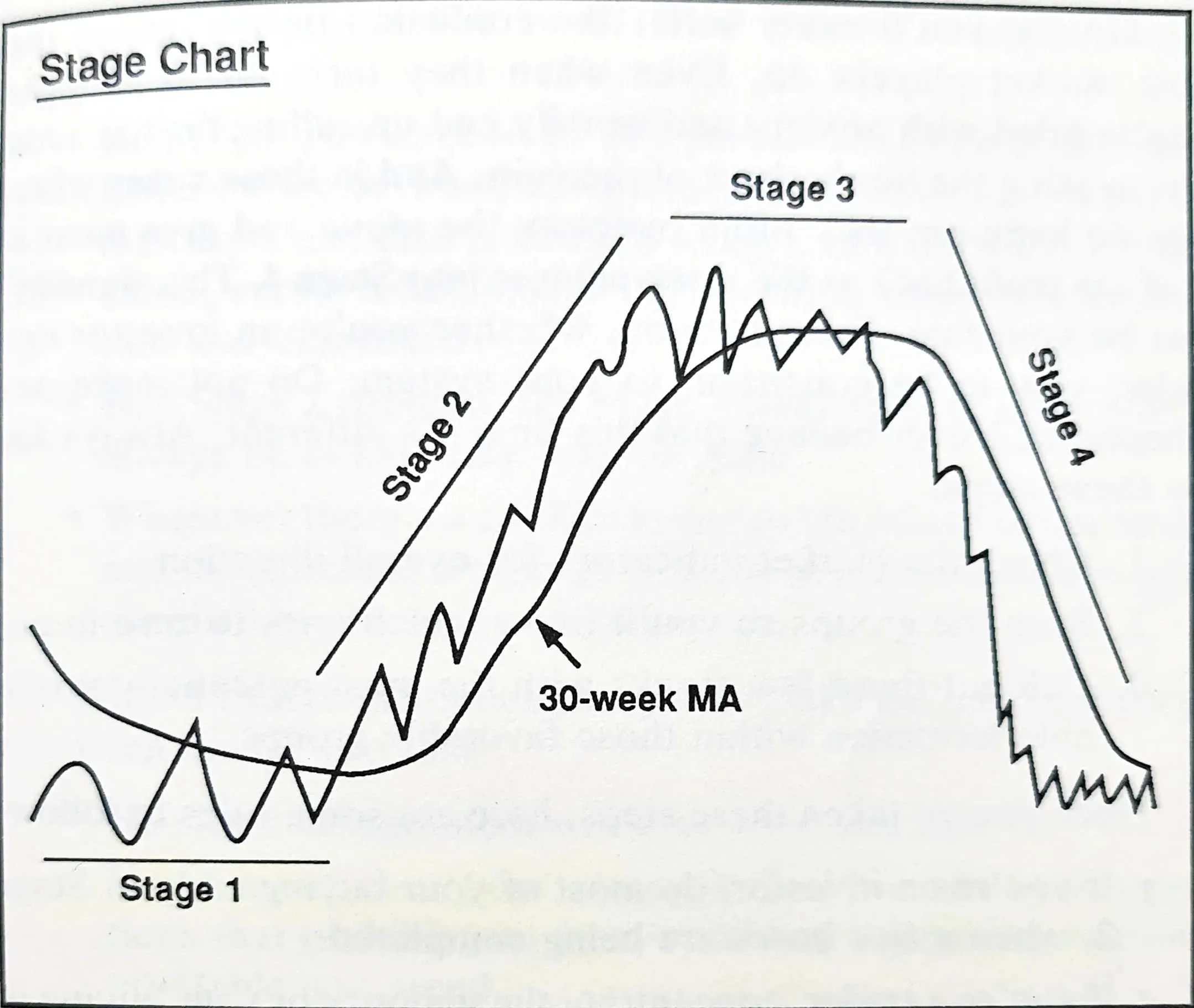

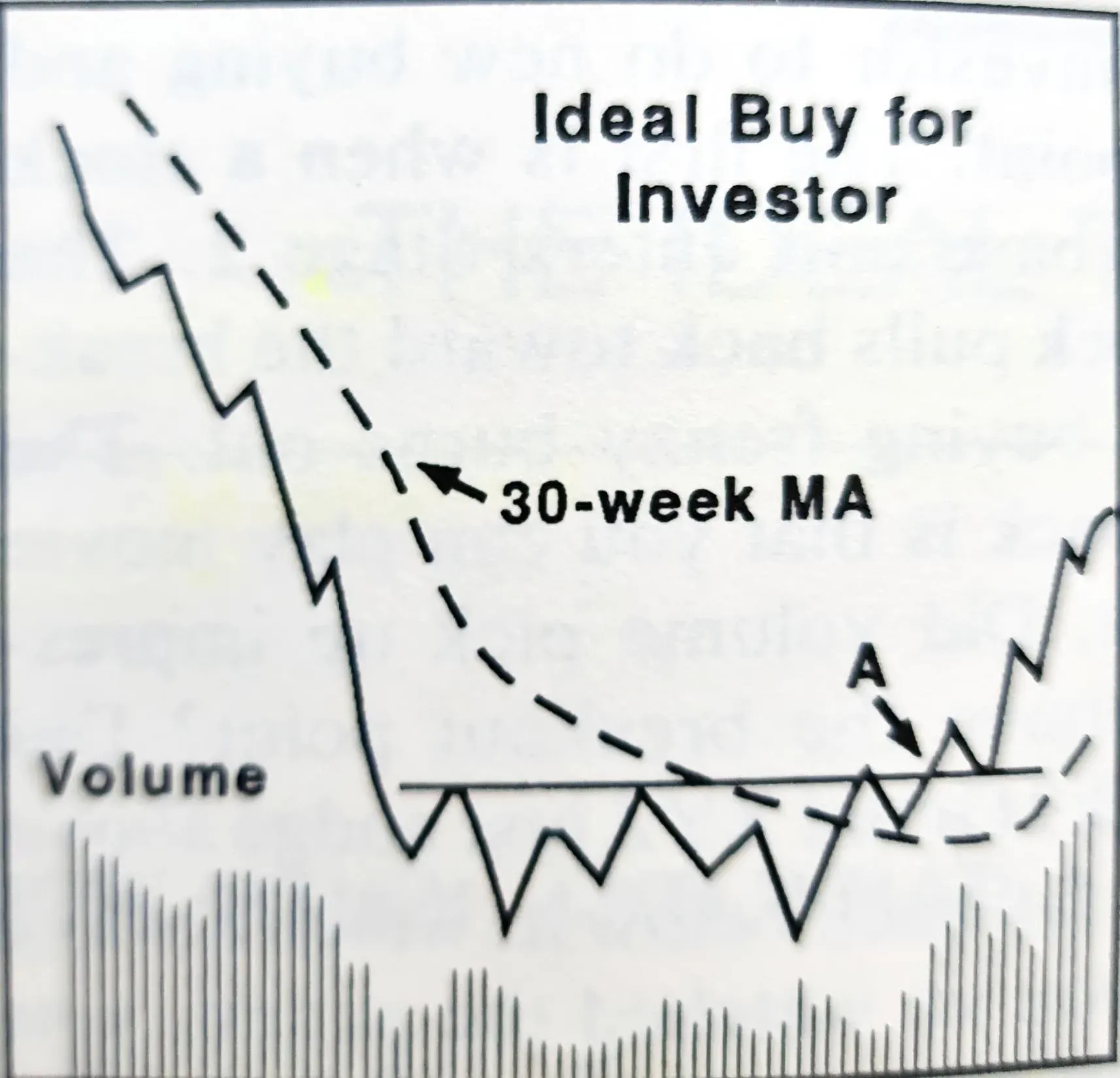

Scenario 2 "Phase change" An unmotivated rebound with no significant pressure and thus the risk of switching to phase 3. This neutral phase can either lead to a sideways movement in which I trade individual setups or outside the equity market (e.g. precious metals/commodities), but keep tight risk hedges and always maintain a liquidity ratio. This phase can either lead to a new phase 2 or the whole scenario can turn towards liquidity and short investments with a phase 4.

This awareness of the options prevents me from sticking to my desired scenario and letting myself be driven by the news, but instead looking exclusively at the only two relevant facts that exist for me when investing in such phases: Price and volume.

P.S. Stan Weinstein's book "Secrets for Profiting in Bull and Bear Markets" (source of the charts) is more relevant than ever, despite or perhaps because of its historical age of 36 years.