S&P 500, Nasdaq100 and Russell 2000

Focus on the 5,500 mark on the S&P 500

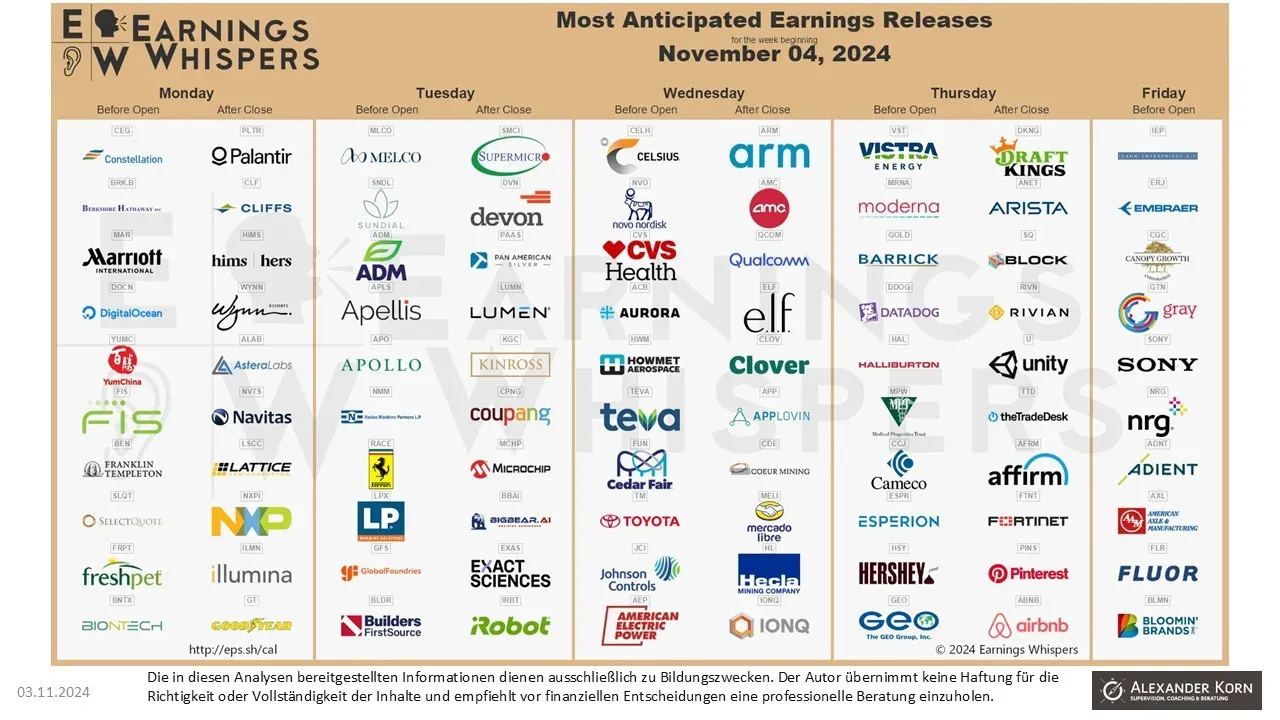

This week was in line with my primary scenario of a correction. Next week is “crunch time” as exciting corporate earnings are due and there will be a little more clarity on who will be U.S. President for the next four years. This points to further volatility and I expect a test of the 30-week moving average, which is also the short-term uptrend. For the S&P 500, this is in the region of 5,500 points. I expect a positive interim reaction here, which could serve as a prelude to a move towards 6,500 points.

If the price falls below this level on a weekly closing basis, the secondary scenario will be activated, which envisages a test of the longer-term upward trend around 5,000 points. I do not expect the Nasdaq100 and Russell2000 to take on a strong life of their own this week and expect a similar development to the S&P 500. If the level around 5,500 points is reached, I plan to unwind my partial portfolio hedge.

Whether we will know more clearly by the end of next week where the year-end spurt is heading depends on whether there is a clear decision on the outcome of the presidential election.

It should also be noted that the U.S. government bond yield has now risen above the dividend yield again. In addition, retail investors in the USA are more optimistic than ever before about the stock market trend over the next 12 months - both are warning signals for the medium-term trend, but not (yet) a reason not to follow the positive trends in individual stocks.

(Personal opinion - no advice - no recommendation to buy securities - no financial advice)

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.