Netflix (NFLX) just beat earnings but the stock tanked 5%

Here's why this is a generational buying opportunity

Netflix just reported Q4 earnings that beat expectations - $12.05B in revenue vs $11.97B expected, EPS of $0.56 vs $0.55 consensus - and the stock dropped 5% after hours. The market is completely fixated on the WBD deal uncertainty, and I think they're missing the forest for the trees.

The stock has corrected 35% from its 52-week high of $134 down to $88. With 325 million subscribers (up 8% from 300M in January 2025), ad revenue expected to double in 2026, and the potential to acquire HBO Max and Warner Bros' legendary IP library, this might be the most asymmetric risk/reward setup in streaming.

Q4 2025 earnings breakdown

Metric -- Actual -- Expected

Revenue: $12.05B -- $11.97B

$12.05B

$11.97B

EPS: $0.56 -- $0.55

Paid Subscribers: 325M -- 300M (Jan 2025)

2026 Revenue Guidance: $50.7B-$51.7B -- $50.98B

Q1 2026 Guidance: $0.76 EPS / $12.16B Rev

The Warner Bros deal is the real story

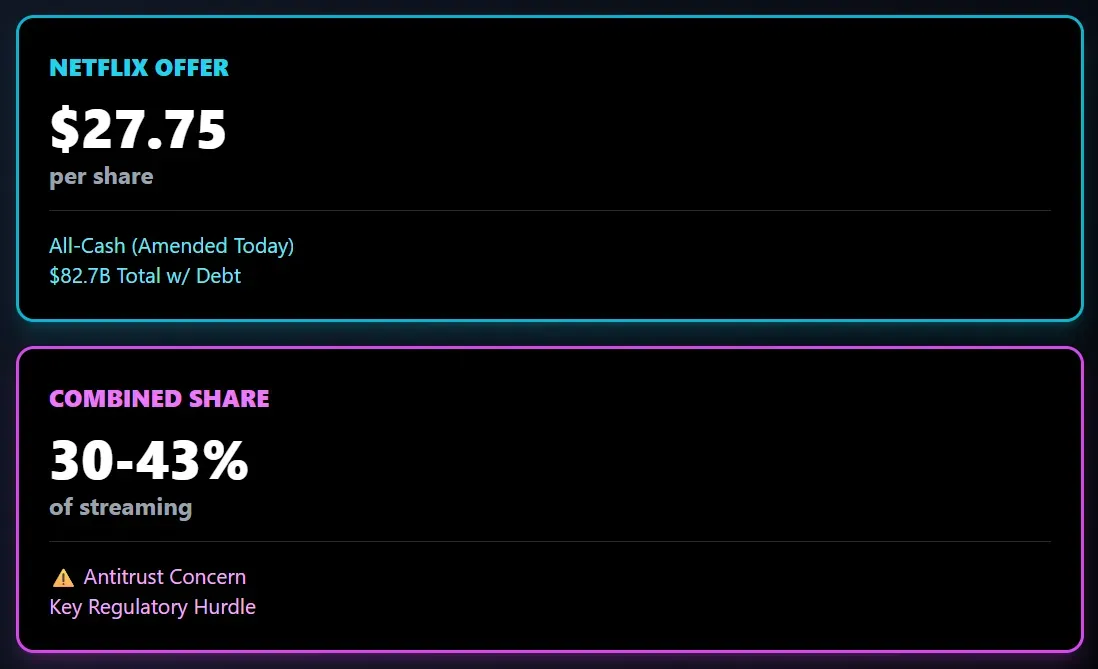

Earlier today, Netflix amended its bid to an all-cash offer at $27.75/share for WBD's streaming and studio assets - an $82.7B total deal including debt. This is massive. They're getting Game of Thrones, Harry Potter, DC Comics (Batman, Superman), HBO Max's 128 million subscribers, and one of Hollywood's most storied production studios.

The switch from cash-and-stock to all-cash is strategic - it simplifies the regulatory path and shows Netflix is serious. They've secured a $67.2B bridge loan and are pausing share buybacks to fund this. That's conviction.

The market's concern? Antitrust. Combined, Netflix and HBO Max would control roughly 30-35% of streaming hours watched. Paramount's competing $30/share bid for ALL of WBD (not just streaming/studio) is creating uncertainty. But here's what I think the market is missing: Netflix will likely argue it competes against YouTube, TikTok, and traditional TV - not just streaming services. If regulators use total TV watch time, Netflix's share drops dramatically.

Technical picture - oversold at key support

Key Support (Fibonacci 0.382): $102

Secondary Support: $82 (52-week low)

Resistance 1: $108

Resistance 2 (Golden Ratio): $114

Resistance 3 / Analyst Target: $127

52-Week High: $134

RSI (14-day): 23-27 (OVERSOLD)

50-Day MA: ~$96

200-Day MA: ~$114

The technicals are screaming oversold. RSI in the low-to-mid 20s, a 35% drawdown from highs, and we're sitting right below a major Fibonacci support level at $89. Yes, there's a death cross on the daily chart (50-day below 200-day), but that's often a contrarian buy signal in quality names when combined with oversold RSI readings.

The catalysts that matter

1. WBD Deal Approval: If regulators approve the acquisition, Netflix gets HBO Max's 128M subscribers, the Warner Bros. content library (Game of Thrones, Harry Potter, DC), and a major production studio. This transforms Netflix from a streamer into a vertically integrated entertainment powerhouse.

2. Ad Revenue Doubling: Netflix guided for ad revenue to roughly double in 2026. With 94 million monthly active users on the ad tier, they're positioned to become a major player in the $600B global advertising market.

3. Live Sports Momentum: The Christmas Day NFL games were a massive success. Stranger Things final season drove 15 billion viewing minutes. The Sony pay-1 deal brings Spider-Man content globally. Netflix is evolving beyond on-demand.

4. Analyst Targets: Average price target of $127 implies 50%+ upside from current levels. 26 Buy ratings, 9 Holds, only 2 Sells. BMO has a $143 target.

The risks I'm watching

Antitrust Scrutiny: This is the big one. Elizabeth Warren called the deal an "anti-monopoly nightmare." The combined entity would control 30-43% of streaming depending on how you measure. If regulators block it or impose severe conditions, the stock could stay rangebound.

Paramount's Competing Bid: Paramount's $30/share offer for all of WBD is higher than Netflix's $27.75. WBD has rejected it citing financing concerns, but this bidding war could drag on.

Integration Execution: Merging two massive entertainment companies is complex. Netflix is pausing buybacks and taking on significant debt ($67B+ bridge loan). If integration stumbles, it could hurt near-term results.

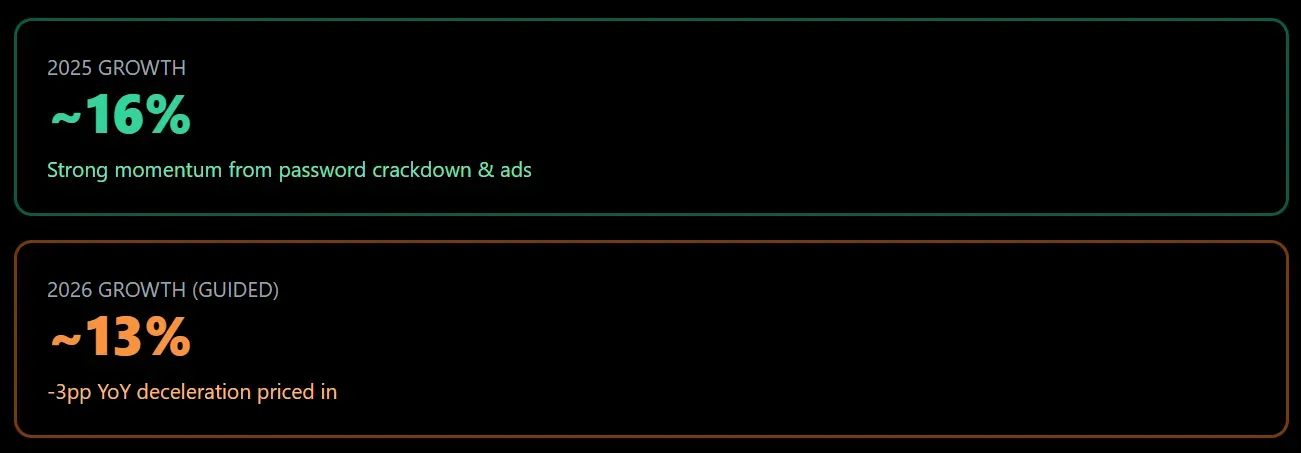

Growth Deceleration: 2026 revenue guidance at the low end ($50.7B) was below consensus ($50.98B). Growth is slowing to ~13% from ~16%. This is a maturing business.

My Rating: BULLISH

- Netflix beat earnings,

- Has 325 million subscribers,

- Ad revenue is doubling,

- They're about to potentially acquire one of the most valuable content libraries in entertainment history.

- The stock is down 35% from highs,

- RSI is screaming oversold, and we're sitting at major Fibonacci support.

Yes, antitrust is a real risk - but the market has already priced in a worst-case scenario. If the deal goes through, this stock reprices significantly higher. If it doesn't, Netflix is still a profitable, growing streaming leader trading at a reasonable valuation. That's asymmetric risk/reward.