My Investment Week

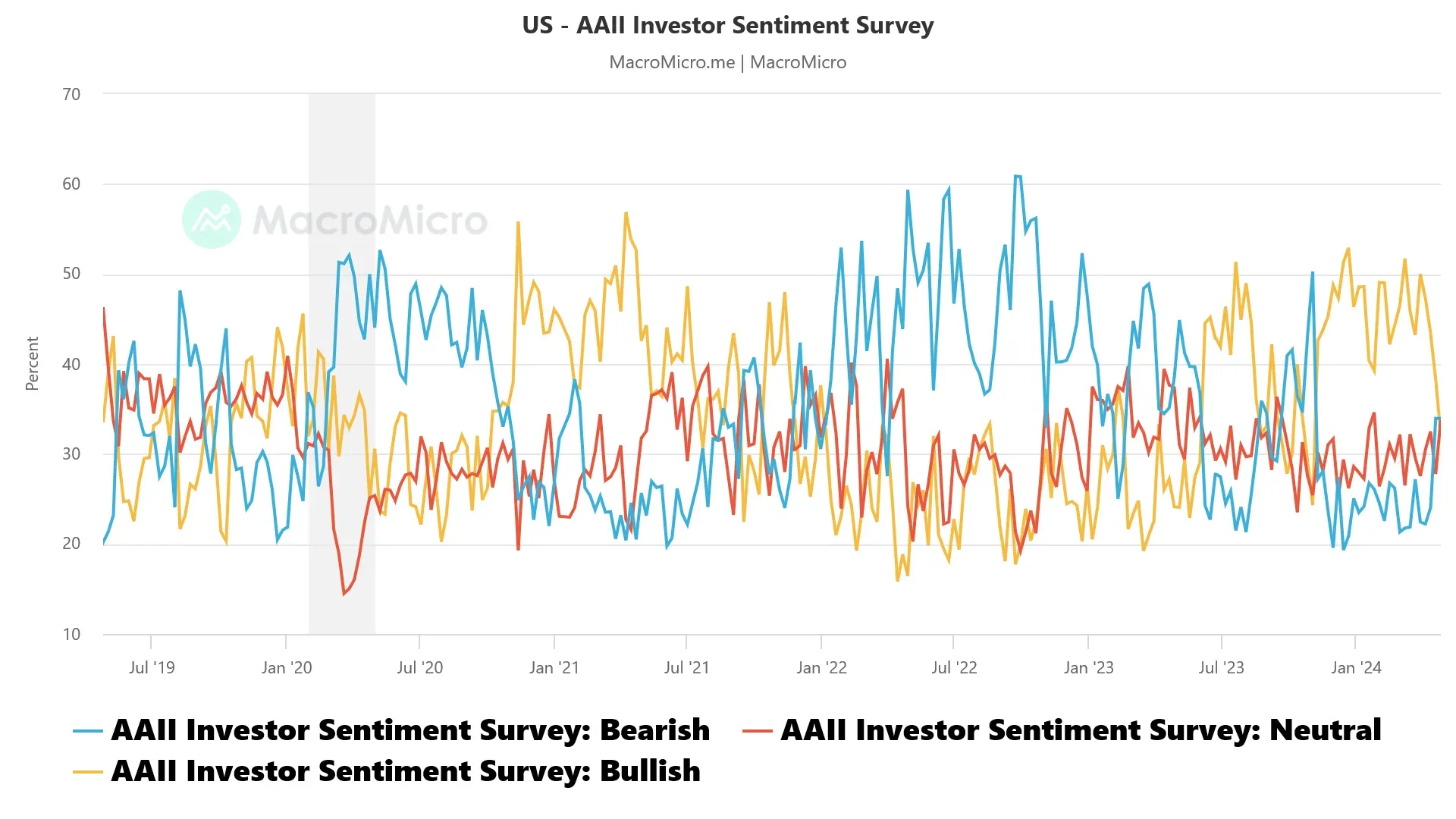

Last week was mixed to slightly positive on the markets. Sentiment has cooled to such an extent that there are signs of a delicate bottoming out and I have slightly reduced my liquidity ratio. What is exciting is that on my sector radar, technology stocks are still in troubled waters and industrials and now also materials are showing strength and momentum. It shows the more differentiated perception of equities on the market and confirms my somewhat broader sector focus outside "AI". At the same time, Chinese equities are also showing signs of life, which fits in well with the commodities sector. However, this also shows how much the media mainstream differs from market movements, as the German media in particular are still talking strongly about recession and a weak China. Fortunately, I don't have to answer the question "Who is right now?" for myself, but am following the market and expanding my investments again somewhat, including a closely hedged index investment. The figures season, which is continuing at full speed, will show whether the trend towards the "old economy" will continue and whether it is just a "selective tec trend" or whether the quarterly figures will trigger a deeper correction. My caution is mainly based on the fact that the sentiment indicators are already buyable, but not in my favored "panic zone". #stockmarket#investmentroutine#trading#coach#wealthmanagement

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.