Investment process 51st week 2024 - S&P 500, Nasdaq100, Bitcoin & Co.

Annual financial statements & stable trends

Disclaimer: The contents of this article are for information purposes only and do not constitute investment advice. Please note that every investment involves risks and individual advice is recommended.

📩 Your market analyses straight to your inbox! Want the latest trends and analysis on U.S. stocks, crypto and precious metals? My Substack newsletter delivers: ✔️ Sound analysis and clear strategies ✔️ Current market trends and chart analyses ✔️ Everything conveniently in your email inbox 💡 Subscribe now and start the week prepared! 🔗 https://boersenoase.substack.com/

Weekly strategy

In the coming weeks, we expect trading to be heavily thinned out and I have decided not to make any new investments before January 13, 2025, except for risk management. This means that the next investment process will take place on the weekend of January 11/12, 2025. This strategy will allow me to carefully analyze market conditions and make informed decisions once the full trading week begins. Stay tuned for more updates and analysis!

The next few holiday weeks will not be very meaningful, although the movements may well be dynamic due to turnover, but the turnover will be in.

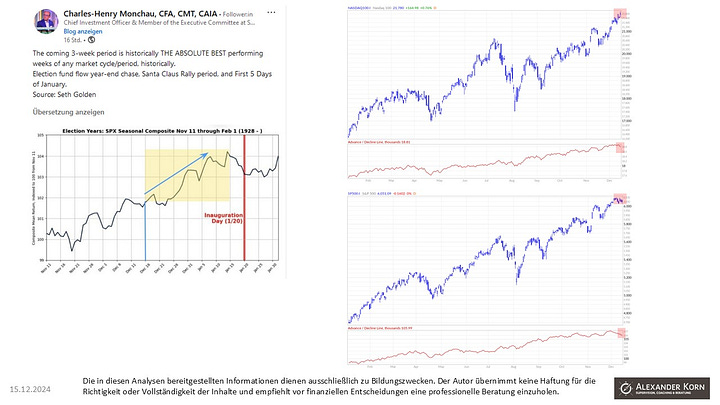

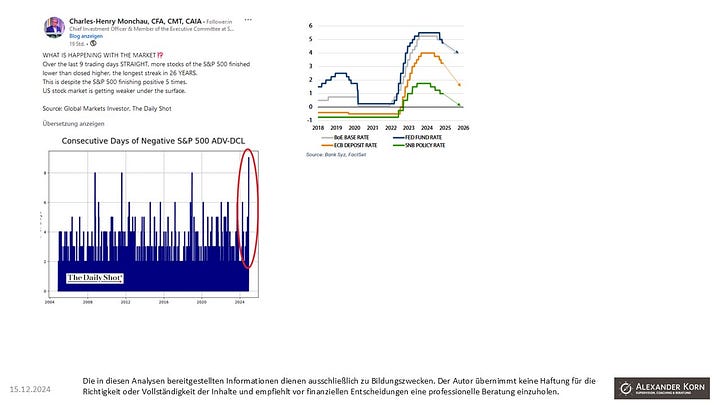

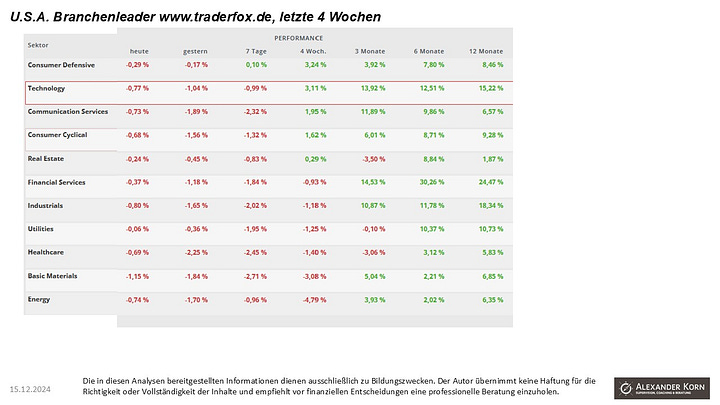

S&P 500, Nasdaq100, Russell 2000 - signs of fatigue, but close above the 6,000 mark and not strong momentum again until 2025

After an impressive annual run, the S&P 500 is showing signs of fatigue shortly before the home stretch. The number of stocks closing higher than they opened is decreasing. Only the heavyweights and a few special stories are keeping the indices at their level. However, I do not expect a stronger correction until December 31, as fund managers will not destroy their annual results, but rather support the market. On the few remaining trading days, I expect the markets to be pushed upwards in a stabilizing manner. The Russell 2000 small cap index, on the other hand, was very weak and has reached the upper end of the “Trump Gap Up”.

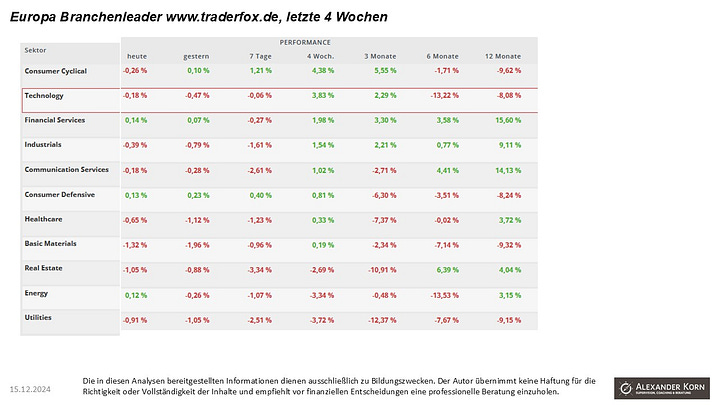

However, I do not expect weakness from the small caps, but rather stabilization by the end of the year. What is exciting is that the US indices are losing relative strength against the DAX and thus Europe. I will be keeping a close eye on this trend for 2025, as a change of favorites at the turn of the year would not be unusual. However, I am leaving this to the market by hedging my positions relatively tightly at the end of the year in order to maintain the annual result. If stocks are taken out, I will take my time with further considerations. At the moment, risk management is tighter, but there is no reason to fundamentally question the upward trend. Like me, SyzGroup expects interest rates to ease further in 2025, which currently also suggests that the bull market will continue in 2025.

DAX & Co. - Year-end close above the 20,000 mark?

The DAX held up well last week, but is likely to test the 20,000 mark once again. Overall, it looks as if the index could close 2024 above this mark - possibly with a new high, supported by the usual low turnover at the end of the year.

Another market that could become interesting for 2025 is the MDAX. The DAX's “little brother” has stabilized and has been moving in a broad range since October. If it manages to break out, I will take a closer look at the strongest stocks in this index.

At the moment, however, Europe remains unattractive for me - whether DAX or MDAX - as the relative weakness against the S&P 500 and Co. continues.

Gold, silver, precious metal stocks - failed breakout to the upside, now to the downside

Gold was unable to hold the breakout above the top of the “diamond pattern”. This brings the downside scenario into focus for me, with a first stop at around 2,500 U.S. dollars. Although a move towards 3,000 U.S. dollars remains possible, it is not currently my primary scenario.

The relative strength of gold against the S&P500 has also deteriorated significantly and has slipped into the “red zone”. This sector is therefore uninteresting for me at the moment and I remain on the sidelines.

Bitcoin / Cryptocurrencies - buy the dip everywhere

This week it was that time again, the “buy the dip phase”. On Sunday, Bitcoin sold off, confirming once again that alternative coins only have a limited life of their own. All of my cryptocurrencies experienced this dip, which was immediately bought up again, which is a very positive signal. This means that I can continue to time the cryptocurrencies based on Bitcoin and use the alternative coins as leverage for this speculation. My interim price target of 113,000 U.S. dollars remains in place and I am relaxed about “working off” the 100,000 U.S. dollar mark; all Bitcoin prices above 88,000 U.S. dollars at the end of the week allow me to remain fully invested.

China - breakout attempt the second.... and again not

This week China announced further stimulus measures and as a result turnover in the largest China ETF traded in the U.S. rose sharply. Interest then leveled off sharply again and the price returned to the breakout level, albeit with lower turnover.

My scenario is based on this and I expect Chinese equities to stabilize further in the coming weeks, but I am intolerant of falls below the upward trend with correspondingly relevant turnover. In principle, however, I also agree with Syzgroup's 2025 thesis that it would be a not entirely unlikely surprise if China and the US were to get along better than expected after all.

My first investments in China focus directly on companies with a high or very high proportion of sales in China. However, I will only expand them when I am in the black with the positions and expect correspondingly positive sales trends for the ETF and the individual stocks.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.