🔴Intel POST-EARNINGS UPDATE: INTC beats Q4 but tanks 6% on weak guidance

TL;DR

Intel crushed Q4 expectations with $0.15 EPS (vs $0.08 est) and $13.7B revenue (vs $13.4B est), but the stock dropped ~6% after-hours on disappointing Q1 2026 guidance. Classic "beat and retreat" setup - strong quarter, but the forward outlook is concerning.

The midpoint of revenue guidance ($12.2B) is about 3% below Street expectations. More importantly, guiding for breakeven EPS when the Street expected $0.05 is a clear negative signal for near-term profitability. This is classic "beat the quarter, lower the bar" playbook.

Management commentary

CEO Lip-Bu Tan:

Our conviction in the essential role of CPUs in the AI era continues to grow. We delivered a solid finish to the year and made progress on our journey to build a new Intel. The introduction of our first products on Intel 18A - the most advanced process technology developed and manufactured in the United States - marks an important milestone, and we're working aggressively to grow supply to meet strong customer demand.

CFO David Zinsner:

We exceeded Q4 expectations across revenue, gross margin, and EPS even as we navigated industry-wide supply shortages.

The positives

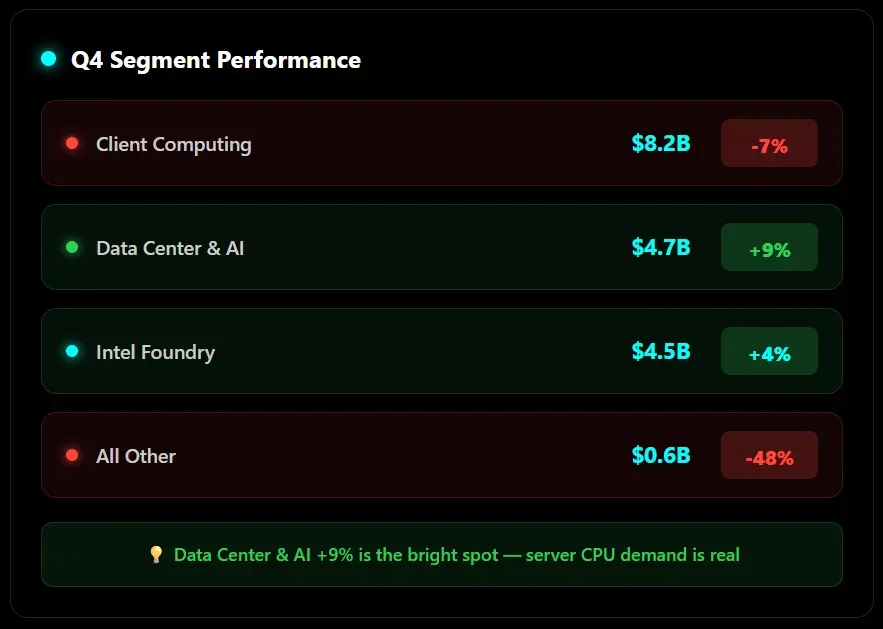

✅ Data Center & AI up 9% YoY - Server CPU demand is real, validating the AI infrastructure thesis

✅ Intel Foundry up 4% YoY - Small positive sign for the foundry business

✅ 18A on track - Management highlighted 18A as "most advanced process in the US," now in high-volume manufacturing

✅ Nvidia deal closed - The $5B stock sale to Nvidia was completed during Q4, strengthening the balance sheet

✅ Strong Panther Lake demand - Company says they're "working aggressively to grow supply" to meet customer demand

The negatives

❌ PC business weak - Client Computing down 7% YoY, the largest segment is still shrinking

❌ Q1 guidance well below estimates - Revenue ~3% below, EPS at breakeven vs $0.05 expected

❌ Widening GAAP losses - GAAP loss of $600M this quarter vs $100M loss YoY

❌ Supply constraints - CFO mentioned "industry-wide supply shortages" affecting results

Q4 Summary

Technical update

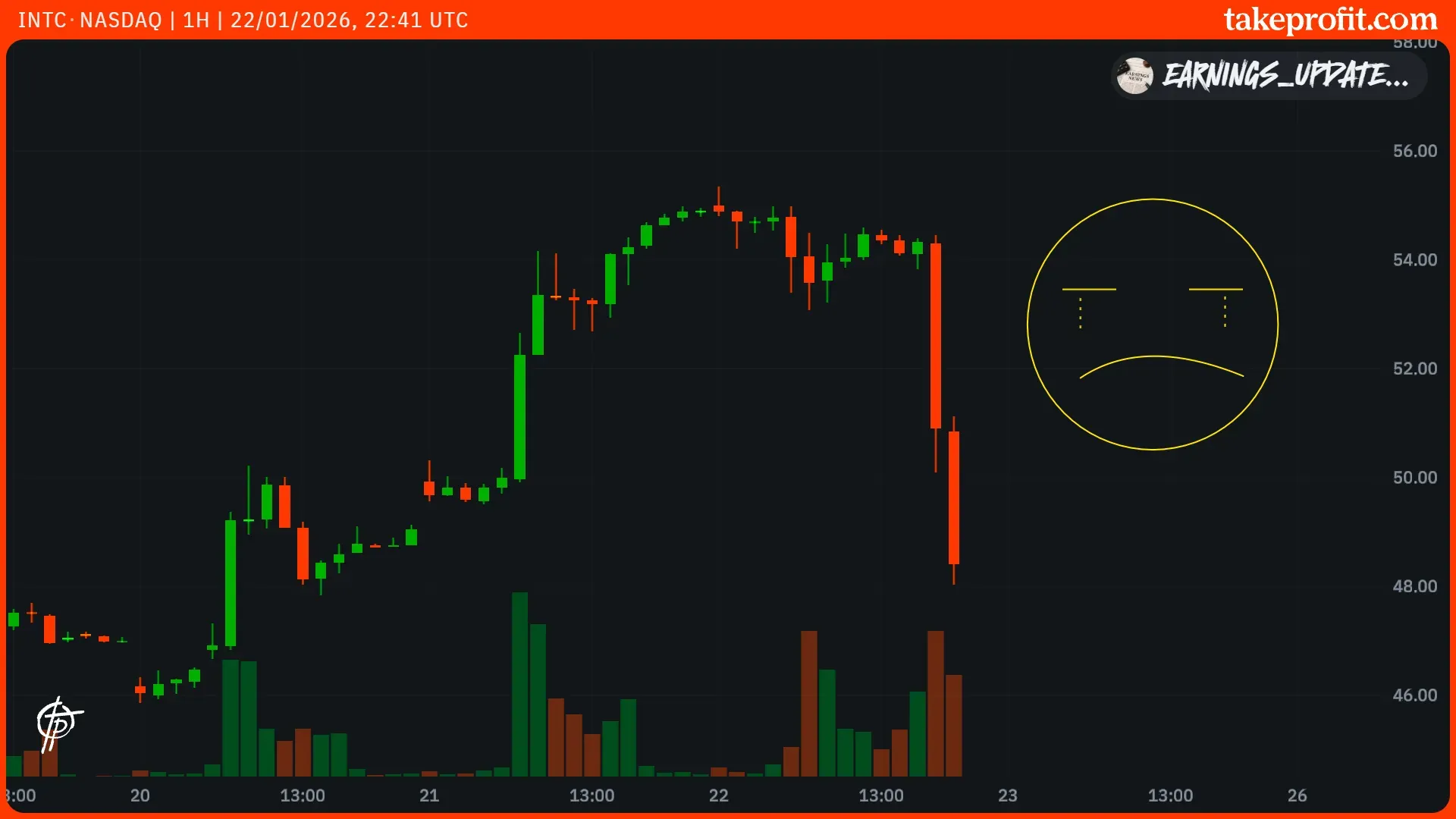

Stock dropped from ~$54 to ~$50 in after-hours (-6% to -7%). This brings us right back to the 0.786 Fibonacci level ($46.71) and the key technical support zone I identified in the pre-earnings analysis. If this level holds tomorrow, the pullback could be a buying opportunity. If it breaks, next support is at $44.50 (recent low) and $40.77 (0.618 fib).

Updated take

NEUTRAL → CAUTIOUSLY BULLISH on dip

This is actually the setup I was waiting for. The quarter was solid - they beat on everything that matters and the Data Center business is accelerating. The weak guidance is disappointing but likely reflects conservatism from a new management team that's setting the bar low to beat it later.

The turnaround thesis is intact: 18A is shipping, Panther Lake has strong demand, the strategic investments from the government, Nvidia, and SoftBank remain in place, and the server CPU business is growing. A 6% pullback from 52-week highs on cautious guidance - not fundamental deterioration - is exactly the kind of entry I wanted.

Key level to watch: $46-47 (0.786 fib). If it holds, I'm adding. If it breaks, waiting for $44-45.

Bottom line

Beat the quarter, missed on guidance. Classic "sell the news" reaction after a massive run-up. Long-term thesis unchanged - Intel is executing on 18A, the strategic backing is real, and the server business is growing. This dip is a feature, not a bug.

Watch the $46-47 level tomorrow. That's where the trade is.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.