Intel's (INTC) $17 to $50 resurrection is just the beginning - what tomorrow's earnings could unlock

The chip giant reports Q4 tomorrow with massive momentum, government backing, and a new manufacturing process that could change everything

Intel ($INTC) reports Q4 2025 earnings tomorrow after market close, and the stock has been on an absolute tear. We're talking about a company that traded at $17 last April - its lowest point in over a decade - now touching $50 for the first time since late 2023. That's nearly a 200% recovery in less than a year.

But here's the thing: the expectations for tomorrow's report are actually pretty muted. Wall Street is looking for $0.08 EPS (down 38.5% YoY) on revenue of $13.38-$13.40 billion (down about 6% YoY). So why is the stock ripping higher heading into what looks like a mediocre quarter?

The answer is simple:

Nobody is trading Intel on current fundamentals. This is a turnaround story backed by the U.S. government, Nvidia, SoftBank, and a new CEO who's proving he can get deals done

What's driving this rally

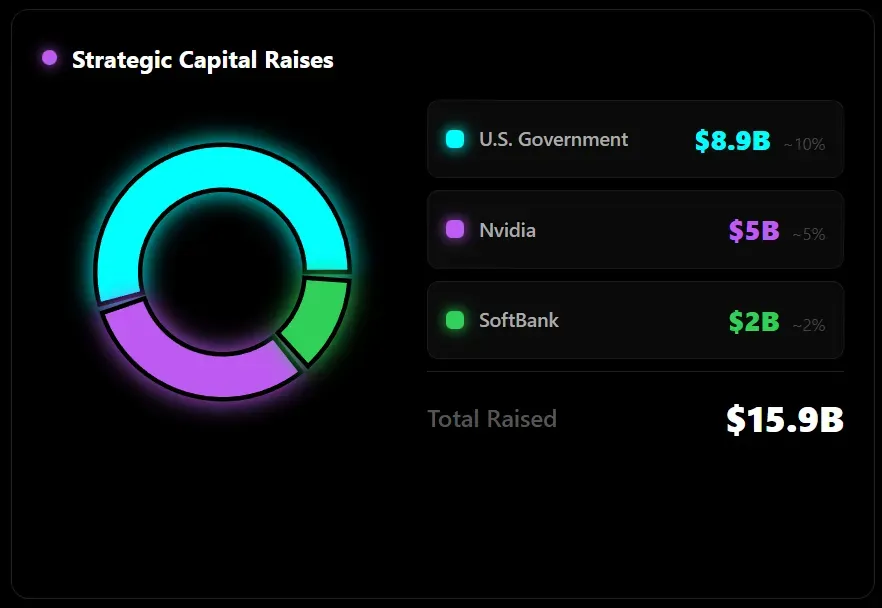

1. U.S. government takes ~10% stake

This is huge. The Trump administration converted Intel's remaining CHIPS Act grants into an $8.9 billion equity investment, making the federal government Intel's largest shareholder at roughly 10%. The deal was structured at $20.47 per share - well below current levels - meaning taxpayers are already sitting on significant gains. Intel is now effectively "too strategic to fail." There's also a five-year warrant for an additional 5% stake at $20 if Intel sells more than 49% of its foundry business.

2. Nvidia's $5 billion investment

Jensen Huang and Intel CEO Lip-Bu Tan announced a strategic partnership in September that includes Nvidia taking a 5% stake in Intel. The collaboration focuses on developing custom x86 CPUs for Nvidia's AI infrastructure and creating x86 system-on-chips integrating Nvidia RTX GPU chiplets. This isn't about foundry services - Nvidia explicitly didn't commit to manufacturing at Intel - but it validates Intel's strategic importance and provides a major cash infusion.

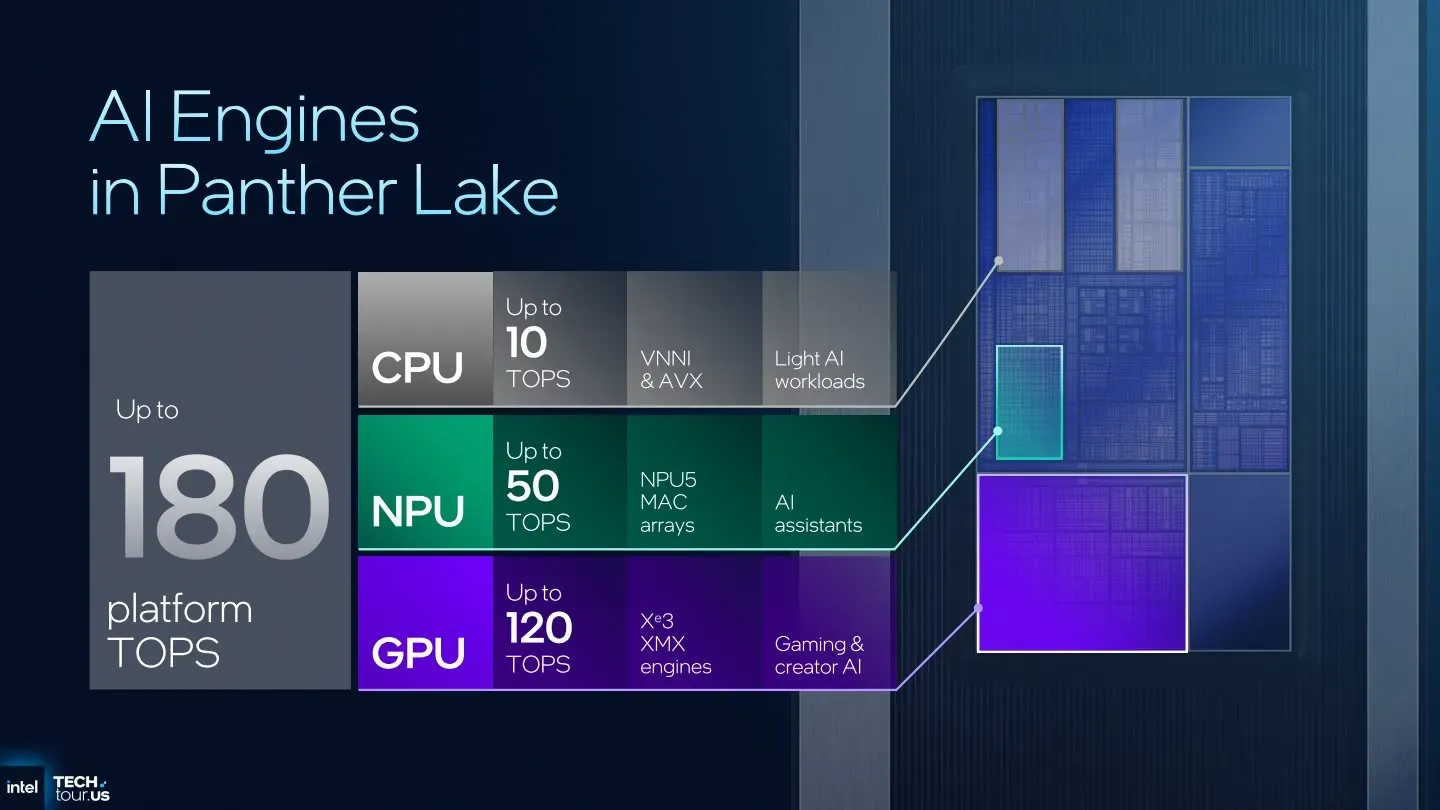

3. Panther Lake launch at CES

Intel just launched its Core Ultra Series 3 "Panther Lake" processors at CES 2026 -and this is a massive milestone. These are the first chips built on Intel's 18A manufacturing process (roughly equivalent to 2nm). Intel is claiming 60% better multi-threaded performance versus Lunar Lake at the same power, up to 180 TOPS of AI performance, and up to 27 hours of battery life. Over 200 laptop designs are planned from partners, with systems hitting stores January 27th. PC makers at CES gave positive feedback on demand, which is encouraging heading into earnings.

4. SoftBank's $2 billion investment

Masayoshi Son adding another $2 billion gives Intel additional validation from one of the world's most aggressive tech investors. This brings total strategic capital raises to over $15 billion when combined with government and Nvidia investments.

Q4 earnings expectations

Metric -- Estimate -- YoY Change

Revenue -- $13.38-13.40B -- -6%

EPS (Adjusted) -- $0.08 -- -38.5%

Implied Move (Options) -- ±8.82% -- 2x avg post-ER move

What I'm watching on the call

18A Yield Updates: Intel says yields have surpassed 60%, which is solid for a leading-edge node. But Nvidia reportedly tested 18A and paused moving forward, so we need clarity on external customer traction beyond Microsoft and Amazon deals.

PC Demand Signals: Jefferies warns PC market could weaken from March due to higher memory costs. Management commentary on Q1/H1 outlook will be crucial.

Server CPU Recovery: HSBC analyst Frank Lee upgraded Intel partly because he expects server shipments to grow 15-20% YoY in FY26 driven by agentic AI demand - well above Street's 4-6% estimate. Any validation here is bullish.

Foundry Business Update: This segment lost $18.8 billion in 2024. Any signs of improved customer interest, 14A node progress (targeting 2027), or Apple foundry partnership details would be significant catalysts.

Margin Trajectory: Lunar Lake and 18A ramps are expected to pressure margins near-term. Need to see a path to profitability for the foundry business.

Technical picture

INTC broke out of an 18-25 accumulation zone in mid-September and hasn't looked back. The stock hit a 52-week high of $50.39 and is currently consolidating near $48-49. RSI was recently oversold at 29.6 which some traders see as a bounce setup.

Current Position: Price is trading between the 0.786 ($46.71) and 1.0 ($54.27) levels - in the upper green/yellow zone - indicating strong bullish momentum.

Key Levels to Watch:

- Immediate Support: $46.71 (0.786 fib) - needs to hold on any pullback

- Major Support: $40.77 (0.618 golden ratio) - would be a deep pullback but still bullish

- Upside Target: $54.27 (1.0 fib) - the measured move target from this swing

Trading Implications:

- Stock has successfully cleared all major fib levels up to 0.786

- A breakout above $54.27 would target fib extensions (1.272, 1.618)

- Any pullback to the $46-47 zone (0.786) is a potential buy-the-dip opportunity

- Breakdown below $40.77 (0.618) would signal the rally is losing steam

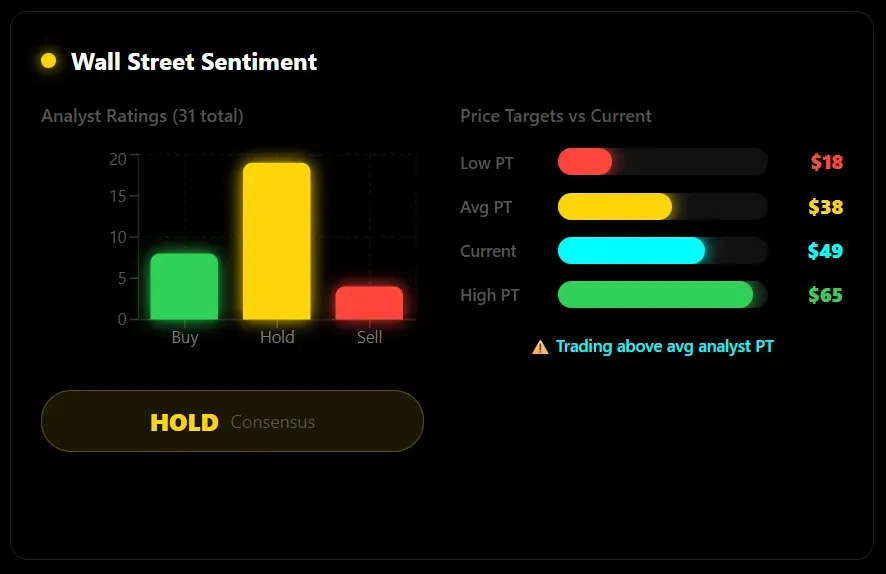

Analyst sentiment

The Street is cautiously warming up, but still mostly on the sidelines:

Consensus Rating: Hold (8 Buys, 19 Holds, 4 Sells)

Average Price Target: $35.67-$41.08 (below current price)

Street High: $60-$65 (Seaport Global at $65)

Recent upgrades ahead of earnings: HSBC upgraded to Neutral with $50 PT (from $26), Seaport upgraded to Buy with $65 PT, KeyBanc upgraded citing server demand. RBC Capital initiated at Sector Perform with $50 PT. Bernstein raised PT to $36 from $35. The fact that analysts are raising targets but still below current prices tells you the stock is trading on narrative, not fundamentals.

Risks to consider

Valuation Stretch: Stock is already 19% up in 2026 alone, trading above average analyst targets. A lot of good news is priced in.

18A Customer Risk: Nvidia pausing 18A testing is a concern. If Apple's reported 2027 foundry deal doesn't materialize or volumes are small, the foundry thesis weakens.

Margin Pressure: New chip ramps are expensive. Foundry business still bleeding money. Path to profitability remains unclear.

Competition: AMD continues taking server share with EPYC. TSMC maintains manufacturing leadership. Qualcomm's Snapdragon X2 Elite is competitive in laptops.

Implied Volatility: Options pricing an 8.82% move - nearly 2x the historical average. Market is bracing for a big reaction either way.

My take

CAUTIOUSLY BULLISH on the turnaround story, but NEUTRAL heading into earnings.

The fundamentals tomorrow will likely be ugly - declining revenue, compressed EPS, ongoing foundry losses. But that's not what this stock is trading on. Intel has become a "national champion" play with government backing, strategic partnerships, and a manufacturing roadmap that could restore U.S. chip leadership.

The risk-reward for new positions right here is challenging. Stock has already run 200% from April lows and is trading above analyst targets. If management guidance disappoints or raises concerns about 18A execution, we could see a sharp pullback given the elevated implied volatility.

For those already long, the thesis remains intact. For those looking to enter, I'd prefer waiting for a post-earnings dip to the $44-45 zone if we get it, or a clean breakout above $51.50 with volume confirmation.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.