UNH earnings breakdown: the ugly truth and the hidden bullish case

The nation's largest insurer is intentionally shrinking revenue while growing earnings 26% - that's not a crisis, that's a turnaround playbook

UNH just delivered what I'd call a 'relief beat with a painful outlook.'

The real story here is the 2026 guidance that's forcing a complete reset of investor expectations.

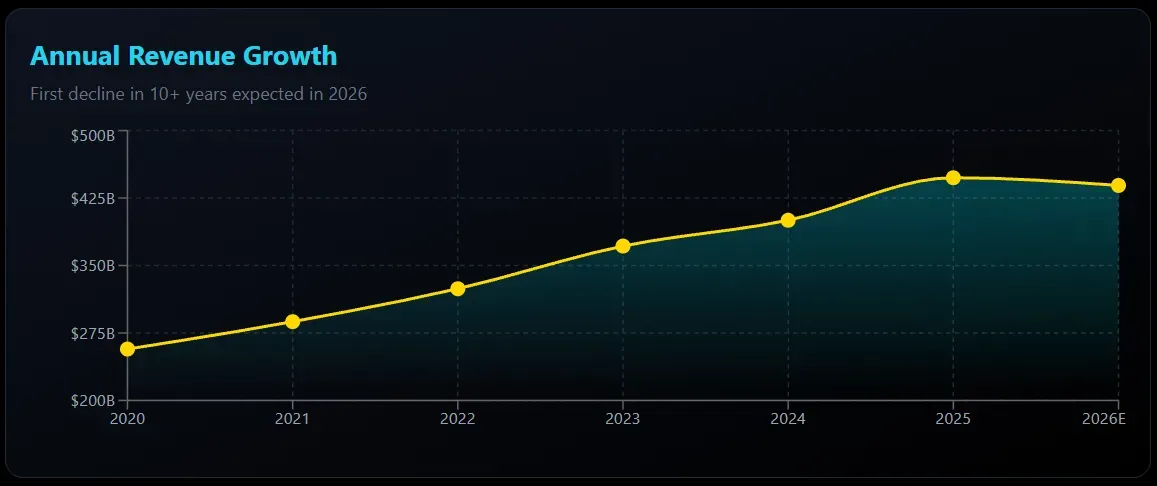

For the first time in over a decade, UNH is guiding for a revenue decline.

Let that sink in.

The nation's largest health insurer, a company that's been a compounding machine, is now telling investors to expect $439B+ in 2026 versus $447.6B in 2025. That's roughly a 2% contraction, and it comes with three very intentional drivers: divestitures of international operations (UK, South America), a massive 3 million+ membership decline, and the final year of Medicare's V28 coding transition that's creating a $6B revenue headwind.

CEO Stephen Hemsley isn't pretending this is anything other than what it is - a turnaround. His quote says it all:

We confronted challenges directly and finished 2025 as a much stronger company.

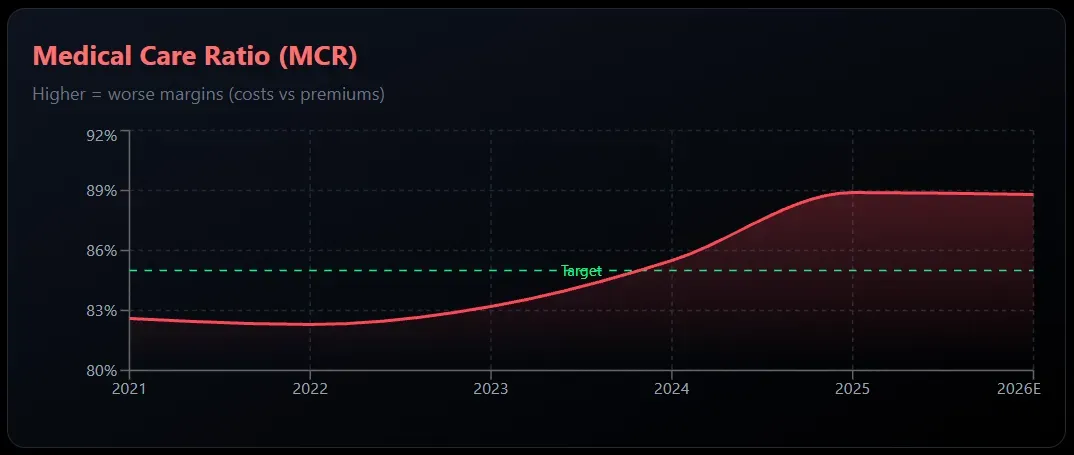

Translation: 2025 was brutal, and we're still cleaning up the mess. The medical care ratio spiked to 88.9% from 85.5% last year, reflecting everything from Medicare funding cuts to higher-than-expected claims activity in Medicare Advantage.

What the numbers tell me

The full-year picture: $447.6B revenue (+12% YoY), $19.0B operating earnings, and $19.7B cash flows from operations (1.5x net income). Those cash flows are impressive and suggest the core business is still generating serious liquidity even during this rough patch. The 2.7% net margin is thin but not catastrophic for an insurer of this scale.

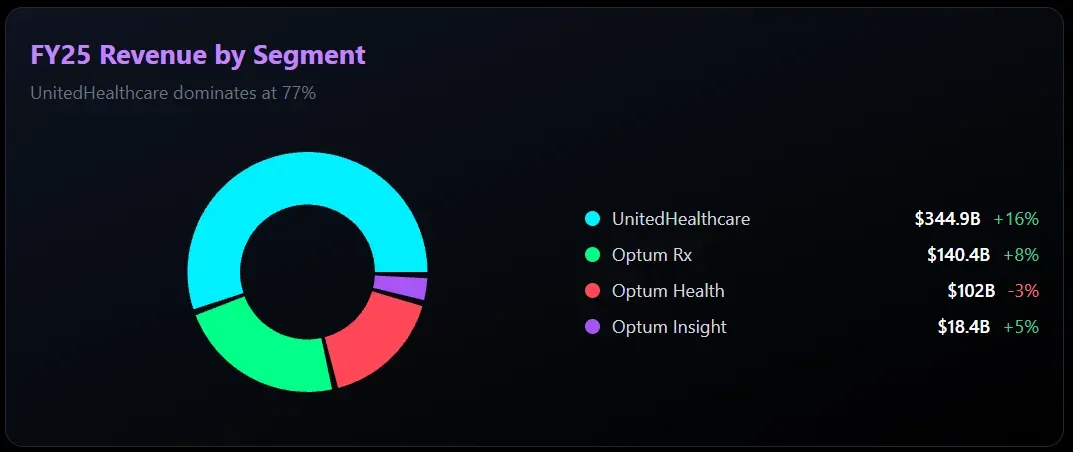

Segment -- FY25 Revenue -- YoY Growth

- UnitedHealthcare: $344.9B -- +16%

- Optum Health: $102.0B -- -3%

- Optum Rx: $140.4B -- +8%

The UnitedHealthcare segment grew 16% to $344.9B despite the Medicare pressures- that's actually resilient. Optum Rx continues to be a steady performer at +8%. The problem child is Optum Health, down 3% and swinging to an adjusted operating loss amid reimbursement squeezes. This segment is getting a complete overhaul with 550 site closures planned.

2026 guidance: the reset year

What They're Guiding

- Revenue: >$439B (-2% YoY)

- Operating Earnings: >$24B (+26%)

- Adjusted EPS: >$17.75 (+9%)

- Medical Care Ratio: 88.8% (±50bps)

Why It's Actually Bullish

- Revenue decline is intentional (divestitures)

- Operating earnings growing 26% on lower rev

- MCR improving 30bps = margin expansion

- Cleaning house for 2027 acceleration

Technical setup

The stock is getting absolutely hammered today, down roughly 20% to around $282.

This puts it firmly below all major moving averages and near critical support. Here's what I'm watching:

Key Support Levels: $280-$292 zone (immediate support from recent consolidation), $240 gap fill level (worst case technical target)

Key Resistance Levels: $320-$330 (prior support now resistance), $340 (200-day MA area), $360 (BofA price target)

52-Week Range: $234.67 - $606.36. Current price represents a 53% drawdown from the high.

Catalysts and risks

Potential Catalysts

- April CMS final rate notice (upward revision possible)

- Optum Health margin recovery (6-8% target)

- Share buyback resumption (H2 2026)

- Berkshire Hathaway stake (vote of confidence)

- AI-powered claims processing (+20% productivity)

Key Risks

- V29 risk adjustment changes for 2027+

- Medicare Advantage regulatory scrutiny

- Medical cost trend persistently elevated (~7.5%)

- Debt/capital ratio at 44.1% (targeting 40%)

- Senate scrutiny over MA upcoding practices

Bottom line

This isn't the UNH that was a set-and-forget compounder. It's a turnaround story now, and turnarounds are messy. But at $282 with a $318B market cap, you're paying roughly 16x 2026 adjusted earnings for the largest, most diversified healthcare company in America. The analyst consensus is still Strong Buy with an average target around $395-$400, implying 40%+ upside.

I'm buying the fear here, but doing it patiently. Let the dust settle, watch for the April CMS final rates, and scale in. The healthcare sector isn't going anywhere, and UNH remains the bellwether. When it recovers, it will lead the pack.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.