TSMC dropped a monster quarter and the Street still doesn't get what's happening here

Record $16B profit, 35% growth, and they're about to spend $56B building the AI backbone - this is the tollbooth play of the decade

TSMC just broke out of a textbook inverted head-and-shoulders pattern on the daily chart - classic bullish reversal setup that technical traders dream about. We had the left shoulder forming in late November, the head dipping to the $280s in December, and now we've punched through the $314 pivot with conviction.

What makes this particularly interesting: TSM reclaimed both the 21-day EMA and the 50-day SMA before earnings, which gets swing traders and institutional players aligned on the same side. The RSI is sitting at 73.65 - elevated but not overbought enough to signal exhaustion. Relative strength is accelerating into the breakout.

The stock hit fresh all-time highs at $349.10 this morning. Up 21.75% in the last month while the S&P barely moved.

Key technical levels

- All-time high: $349.10 -- Fresh breakout today

- Breakout pivot: $314 -- H&S neckline / trigger

- 50-day SMA: $297 -- Critical support / stop zone

- 200-day SMA: $265 -- Major trend support

The numbers that matter

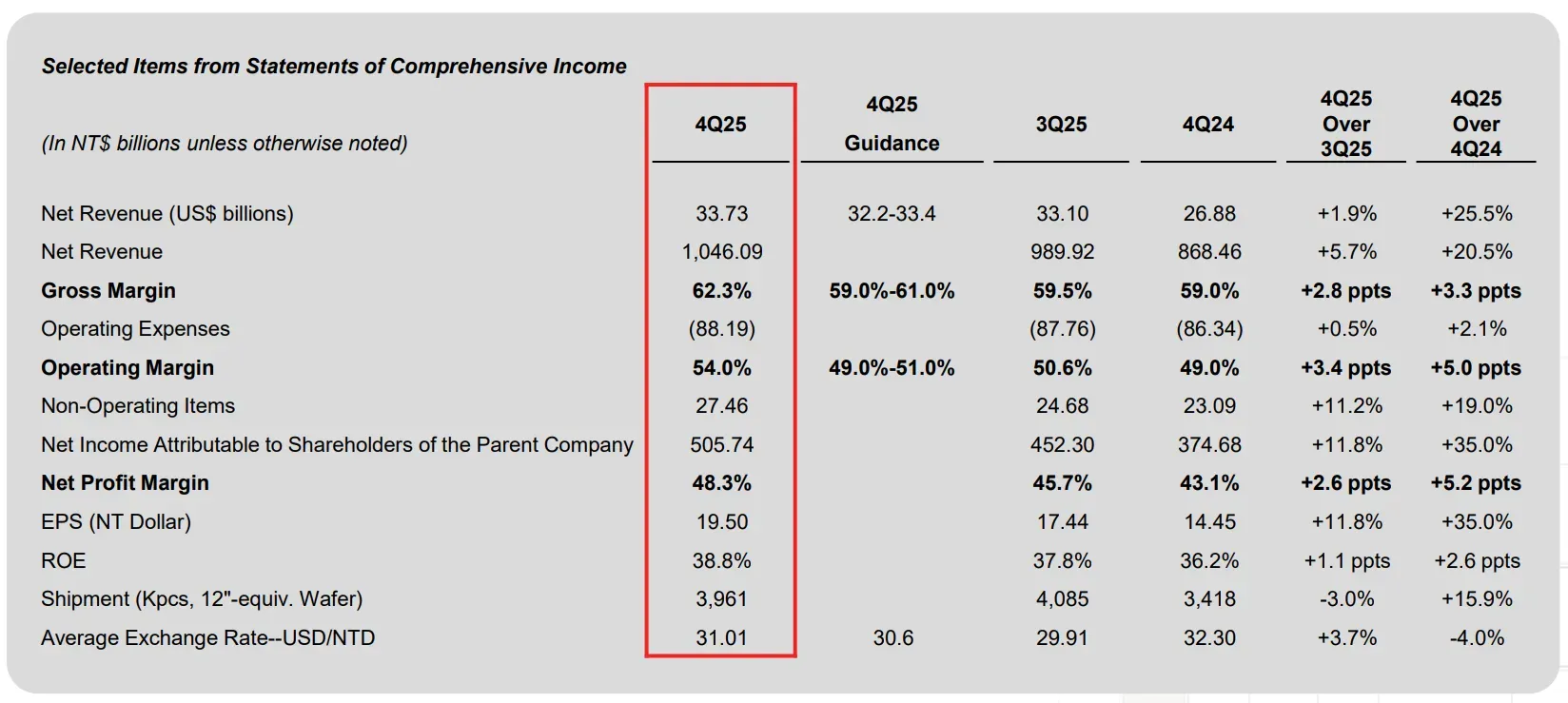

Q4 2025 just came in and it's a record-breaker across the board:

Net profit: NT$505.74 billion ($16B USD) - up 35% YoY, crushing the NT$467B consensus

Revenue: NT$1.046 trillion ($33.73B) - beat expectations by nearly $1B

EPS: $3.14 per ADR vs. $2.90 expected - 16 cent beat

Gross margin: Holding above 60% despite massive capex expansion

This is the eighth consecutive quarter of profit growth. The company is printing money.

The real story the Street is missing

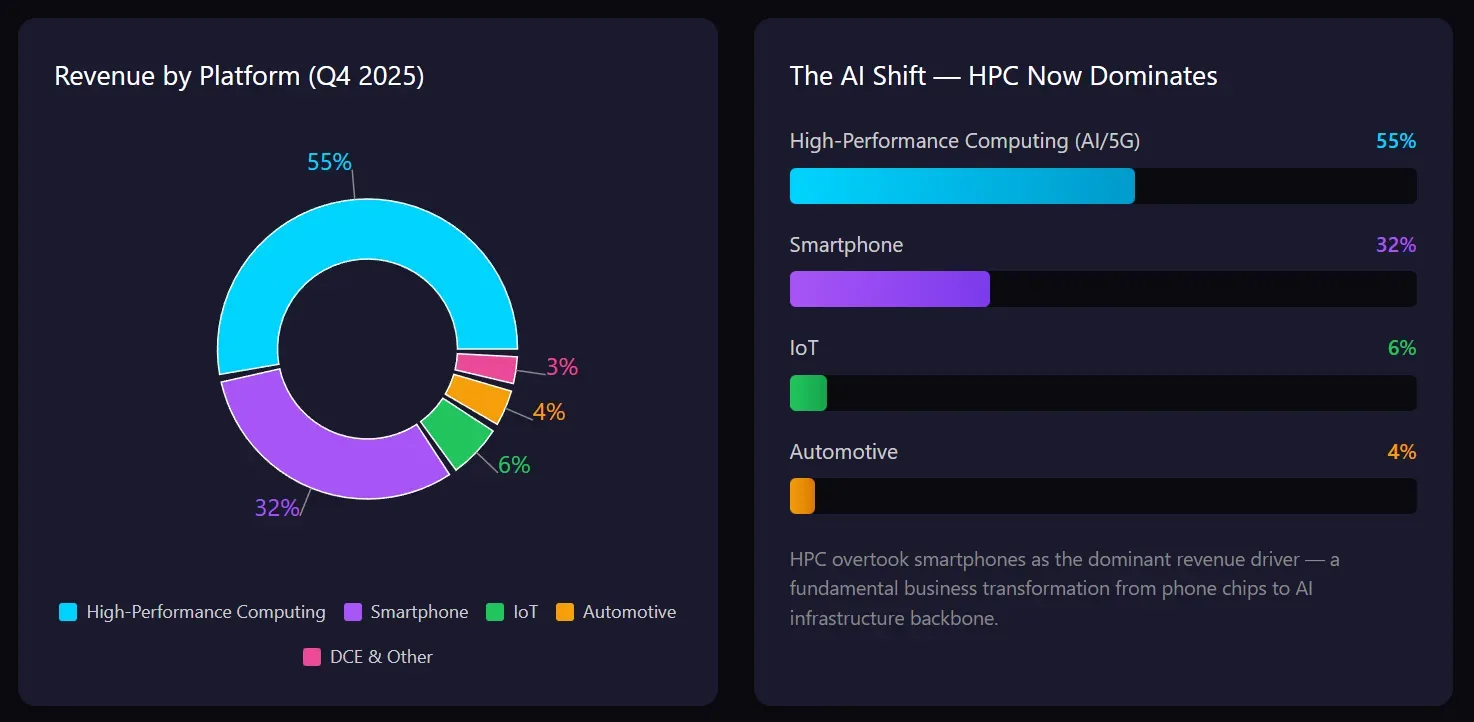

Everyone's focused on the headline beat. That's not what I'm looking at. The real signal is in the revenue mix and where the growth is coming from.

High-performance computing (that's AI and 5G) now makes up 55% of total sales. Smartphones dropped to 32%. This is a fundamental business transformation - TSMC has pivoted from a phone chip maker to the backbone of the entire AI infrastructure stack.

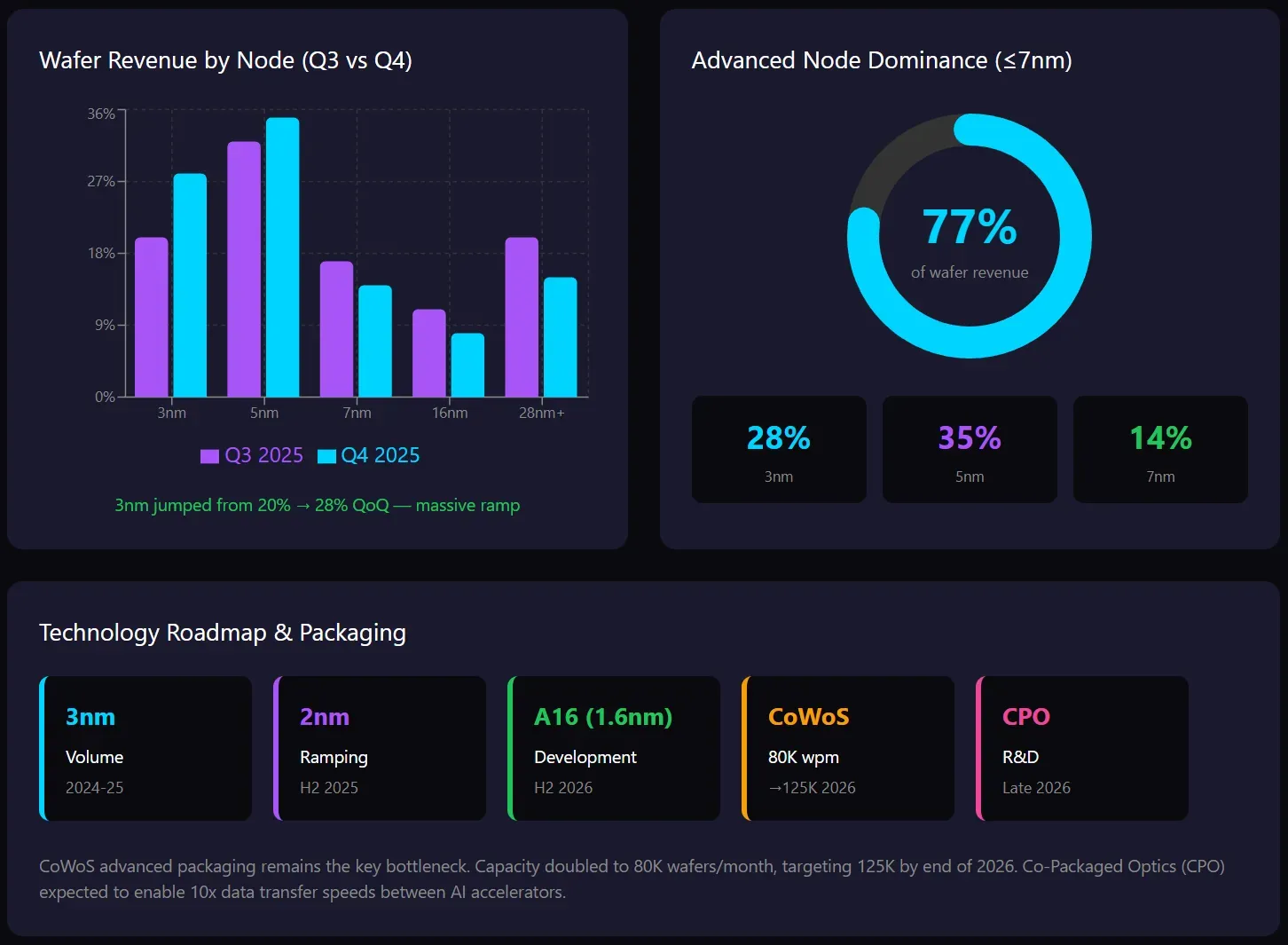

Advanced chips at 7nm and below now account for 77% of wafer revenue. The 3nm node alone contributed 28% of total wafer revenue this quarter. Combined with 5nm, that's 63% of the business running on the most advanced processes in the world.

Here's the kicker: CEO C.C. Wei called this an "AI gold rush" and said it's the "hardware peak" following ChatGPT's "software moment."

The capex signal that changes everything

TSMC just guided 2026 capex at $52-56 billion. That's up from $40.9 billion in 2025 - a 35% increase. When asked if this was speculative, management was clear: this spending reflects "confirmed AI-driven demand" from their largest customers, not hopes and dreams.

Goldman Sachs projects over $150 billion in capex from 2026-2028. That's an unprecedented infrastructure buildout. The company is essentially constructing the physical plumbing that will power AI for the next decade.

The Arizona expansion is accelerating - fourth factory confirmed plus the first advanced packaging facility in the US. They also raised the quarterly dividend 20%. This is a company with conviction about its future cash generation.

The packaging bottleneck nobody talks about

The CoWoS advanced packaging capacity is the real choke point for the entire AI chip industry. TSMC's Chip-on-Wafer-on-Substrate technology is essential for high-bandwidth memory integration in AI accelerators — without it, Nvidia's GPUs don't ship on time.

TSMC doubled CoWoS capacity to approximately 80,000 wafers per month over the last year. Bernstein estimates capacity will hit 125,000 wafers by end of 2026. But even with this ramp, Nvidia has been blunt: packaging constraints will persist.

This scarcity gives TSMC pricing power. When you're the only game in town for advanced packaging and your customers are willing to spend billions to secure capacity, margins expand. Goldman expects gross margins above 60% through 2028.

What Wall Street is saying now

The analyst upgrades are pouring in post-earnings:

Goldman Sachs: Just raised to NT$2,600 (~$416 ADR implied) - Street high. Conviction buy rating. "AI is a multi-year growth engine."

JPMorgan: Raised 24% to NT$2,100, citing strong revenue growth and improving profitability

Morgan Stanley: Projects 30% revenue growth in 2026, gross margins holding above 60%

Wedbush: "The company remains one of our favorite names in hardware" - sees 30% discount to PT

At least six brokerages have raised targets since January started. The consensus is moving higher fast.

The bigger picture - why this is the tollbooth play

Bank of America forecasts global semiconductor sales will surge 30% in 2026, finally pushing past the $1 trillion annual milestone. The total addressable market for AI data center systems is projected to hit $1.2 trillion by 2030 with a 38% CAGR. AI accelerators alone represent a $900 billion opportunity.

TSMC sits at the center of all of this. Nvidia, AMD, Broadcom, Apple, Qualcomm - they all need TSMC to manufacture their chips. The company has 70-75% market share in advanced nodes. There is no alternative at scale.

Think of it this way:

TSMC is the tollbooth that every AI dollar has to pass through. Whether hyperscalers buy Nvidia GPUs, Broadcom ASICs, or AMD accelerators, the silicon comes from TSMC fabs.

Final take

TSMC isn't just another semiconductor stock - it's the infrastructure layer that the entire AI revolution runs on. Record profits, massive capex commitments, pricing power from packaging scarcity, and a technical breakout that's drawing in both swing traders and institutions.

The Street is scrambling to raise targets. Goldman went to NT$2,600, JPMorgan hiked 24%, and at least six brokerages upgraded in the first two weeks of January. When the analysts are chasing the stock higher, something fundamental is shifting in the narrative.

Verdict: Bullish. Buy the pullback. The AI tollbooth is collecting fees.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.