Trump's tariffs are hitting crypto again - $875M liquidated in 24 hours, and this might just be the beginning

Breaking down the crash mechanics, BTC price scenarios, and my trading strategy amid the Greenland crisis

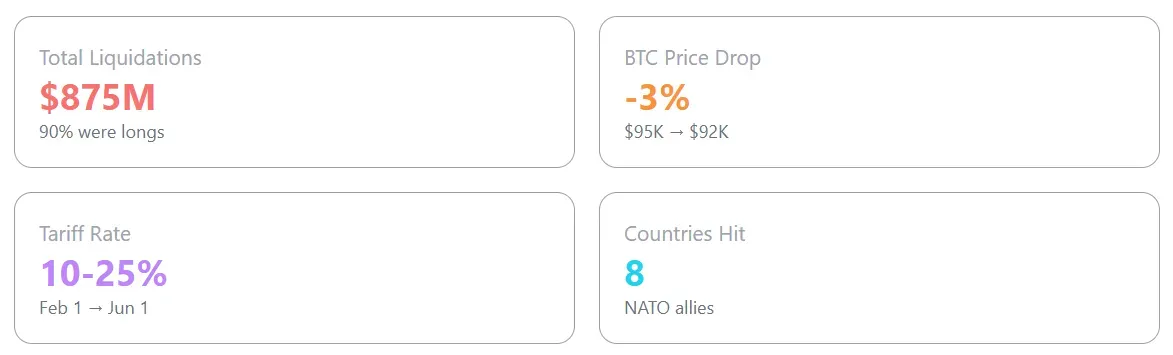

The weekend brought another Trump surprise, and the crypto market found itself at the epicenter of geopolitical turbulence once again. On Saturday, the President announced 10% tariffs on imports from eight European countries starting February 1, escalating to 25% by June - all because they won't sell Greenland. Within 24 hours, this triggered $875 million in liquidations and sent Bitcoin crashing from $95,000 to $92,000.

This situation got me thinking: are we seeing a repeat of October's China scenario, or has the market adapted? Let's break down what's happening and figure out how to play this.

What happened: anatomy of the crash

Trump posted on Truth Social announcing tariffs on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. The reason? These countries refuse to support the "complete and total purchase of Greenland." This isn't a joke - this is actual 2026 geopolitics.

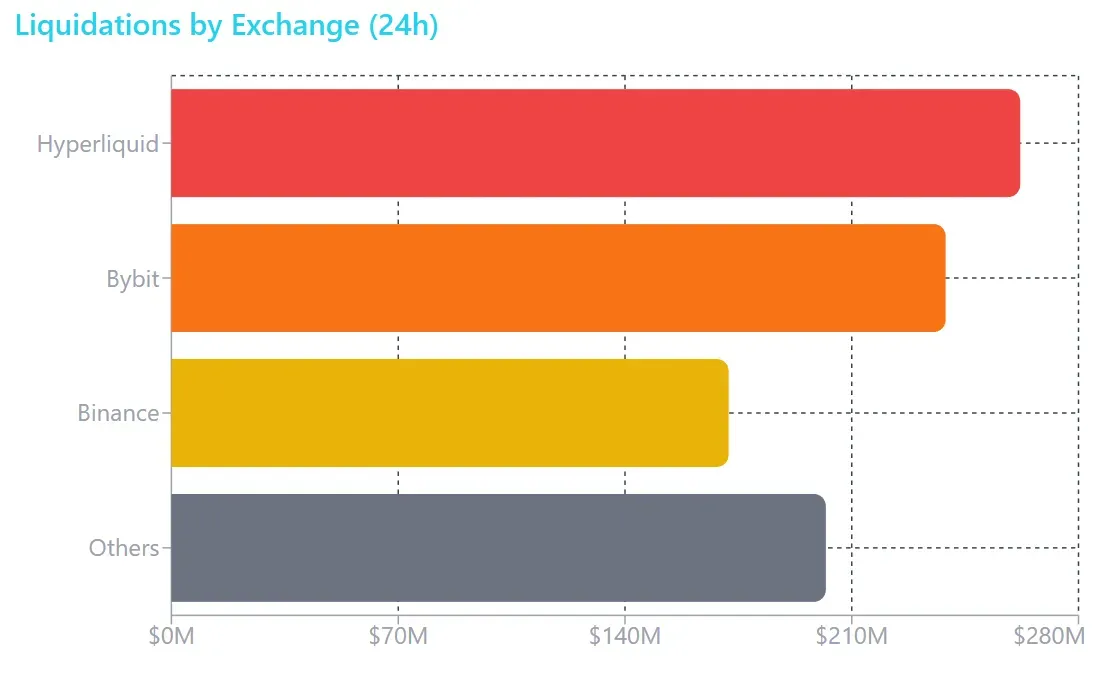

The market reacted instantly. With thin holiday liquidity (US exchanges were closed for the weekend), the liquidation cascade cut through crypto derivatives like a hot knife through butter. Hyperliquid led with $262 million in liquidations, followed by Bybit at $239 million and Binance at $172 million.

The critical detail: 90% of liquidated positions were longs. This means the market was overloaded with optimistic bets without adequate hedging.

Historical context: the October precedent

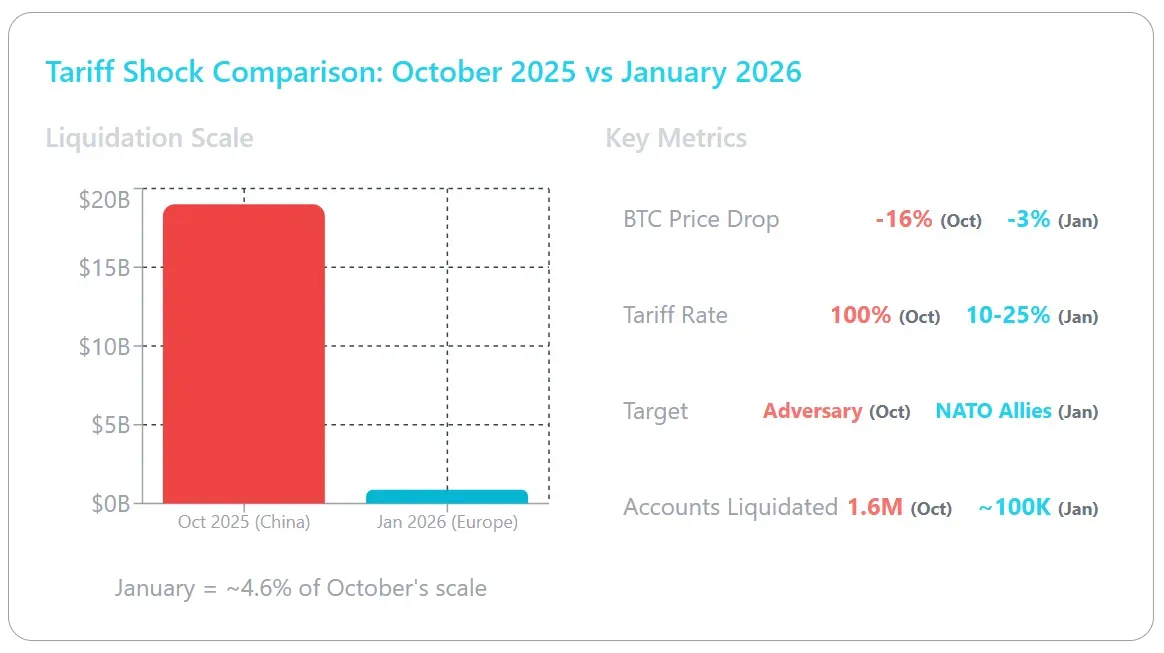

To understand the scale, we need to compare this to October 2025. When Trump announced 100% tariffs on China, the market experienced the largest liquidation event in crypto history: $19 billion in 24 hours, 1.6 million liquidated accounts, and Bitcoin crashed from $122,000 to $103,000 - a 16% drop.

The current drop is roughly 4-5% of October's scale in terms of liquidations. But here's the important nuance: back then, BTC recovered above $114,000 within just a few days. The market showed resilience. October targeted a geopolitical adversary with 100% tariffs. January targets NATO allies with 10-25% tariffs. The stakes and the market reaction are calibrated accordingly.

Technical analysis: key levels

Looking at the chart, I see consolidation within an $88,000-$97,000 rectangle on higher timeframes. The current move is testing critical zones.

Key support levels: $90,000 serves as the psychological level combined with a high-volume node — this is where analysts see key support amid heavy leveraged liquidations. Below that, $88,000 marks the lower boundary of the rectangle formation identified on daily and weekly charts. The critical floor sits at $84,000 — closing any weeks below this level sets bears up to drop the price to the low $70,000 range.

Key resistance levels: The immediate ceiling is at $96,000-$97,000, where the 100-day EMA and top of the current range converge. The psychological $100,000 barrier requires sustained weekly closes above it to turn the long-term trend around. Strong resistance extends from $103,000 to $107,000, where Supertrend resistance and historical highs create a zone that's extremely tough to conquer.

On indicators: RSI sits at 52 (neutral zone), MACD shows weakening bearish momentum but no clear bullish signal yet. Price is trading below both the 100-day and 200-day EMAs ($96,000 and $99,500 respectively), which form overhead resistance.

Price movement scenarios

Scenario 1: Quick recovery (45% probability). If the EU and US reach a compromise at the emergency Brussels summit (scheduled for Thursday), the market could quickly recover losses. In this case, BTC returns to $95,000-$97,000 within a week. Key triggers: softened rhetoric, tariff delays, or the start of negotiations.

Trade idea: Build a long position in the $91,000-$92,500 zone targeting $97,000. Stop below $89,500. R/R approximately 1:2.

Scenario 2: Extended consolidation (35% probability). The conflict drags on but doesn't escalate. Bitcoin stays in the $88,000-$96,000 range for several weeks. CryptoQuant founder Ki Young Ju expects exactly this scenario — "just boring sideways for the next few months." Institutional holders aren't selling, but new capital inflows are limited.

Trade idea: Range-trade: buy at $89,000-$90,000, sell at $95,000-$96,000. Reduce position size, focus on short-term trades.

Scenario 3: Escalation and deep correction (20% probability). The EU activates its retaliatory tariff package on €93 billion of US imports, and the US introduces additional restrictions. Deutsche Bank warns about the risk of "weaponization of capital" — European investors hold $8 trillion in American assets, and repatriation of these funds could crash markets. In this scenario, BTC falls to $84,000-$80,000. Altcoins lose 20-40% like in October.

Trade idea: Hedge through puts or short positions above $95,000. Only build spot positions on a confirmed break of $84,000 with volume confirmation.

What to expect from Europe

The EU is already preparing countermeasures. According to Reuters, three options are on the table:

- reactivation of suspended tariffs on $107 billion in US imports (automatic start February 6),

- activation of the Anti-Coercion Instrument (restricting access to banking services and trade in services),

- and suspension of the EU-US trade agreement ratification from July 2025.

Goldman Sachs estimates 10% tariffs would drag European earnings-per-share growth by 2-3 percentage points. ING projects the levies would shave a quarter of a percentage point off European GDP this year. This creates a risk-off environment where crypto traditionally suffers.

Key risks

Conflict escalation: If the US moves from tariffs to actual attempts to "purchase" Greenland (Trump has already mentioned the military option), this becomes a black swan for all risk assets.

Regulatory delays: The US crypto regulatory bill has been postponed due to objections from Coinbase. This adds uncertainty.

Macro calendar: This week brings China GDP data, Bank of Japan meeting, and leaders heading to Davos. Any of these factors could amplify volatility.

Capital flows: Deutsche Bank's warning about potential movement of $8 trillion in European capital out of American assets - this is a scenario that could dwarf any tariffs in terms of market impact.

My position: moderately bullish with emphasis on capital protection. I'm accumulating spot in the $89,000-$91,000 zone, ready for additional buys on a dip to $84,000-$85,000. Stop-loss is tight, take-profits are distributed.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.