Rocket Lab (RKLB) just became a national security asset and nobody's paying attention

Rocket Lab just landed $1.3B in Pentagon contracts and Neutron launches Q2 2026. Stock's up 550% but the defense pivot is underpriced. Path to EBITDA breakeven by year-end. Bullish on the space systems transformation.

I've been watching Rocket Lab transform from a small-launch provider into something much bigger. After the company secured its largest contract ever - an $816 million deal with the Space Development Agency for 18 missile-tracking satellites - and with Secretary of Defense Pete Hegseth personally touring their facilities, it's clear RKLB has crossed a threshold that most investors haven't fully priced in.

The stock is up 550%+ since November 2024 and trading near all-time highs around $90. Yes, the valuation looks stretched at 77x TTM sales. But here's what the market might be missing: this isn't just a rocket company anymore. It's becoming an end-to-end space systems powerhouse with strategic importance to U.S. national defense.

The chart actually supports more upside

RKLB just printed fresh all-time highs at $89.87 on January 8th after a monster December run (+65% in that month alone). The stock is in full breakout mode with a classic high tight flag pattern forming - exactly what you want to see in momentum names.

Key technical levels I'm watching:

ATH resistance: $89.87 (psychological barrier at $90)

First support: $77.55 (accumulated volume zone)

Secondary support: $70.52

52-week range: $14.71 - $89.87

The stock is holding well above both the 50-day and 200-day moving averages, with both signaling buy. Daily volatility has been high (8.9% average), which means position sizing matters, but the trend structure remains firmly bullish. Beta of 2.18 tells you this moves with the broader risk-on/risk-off flows.

Why the fundamentals justify premium pricing

Let me break down what's actually happening under the hood:

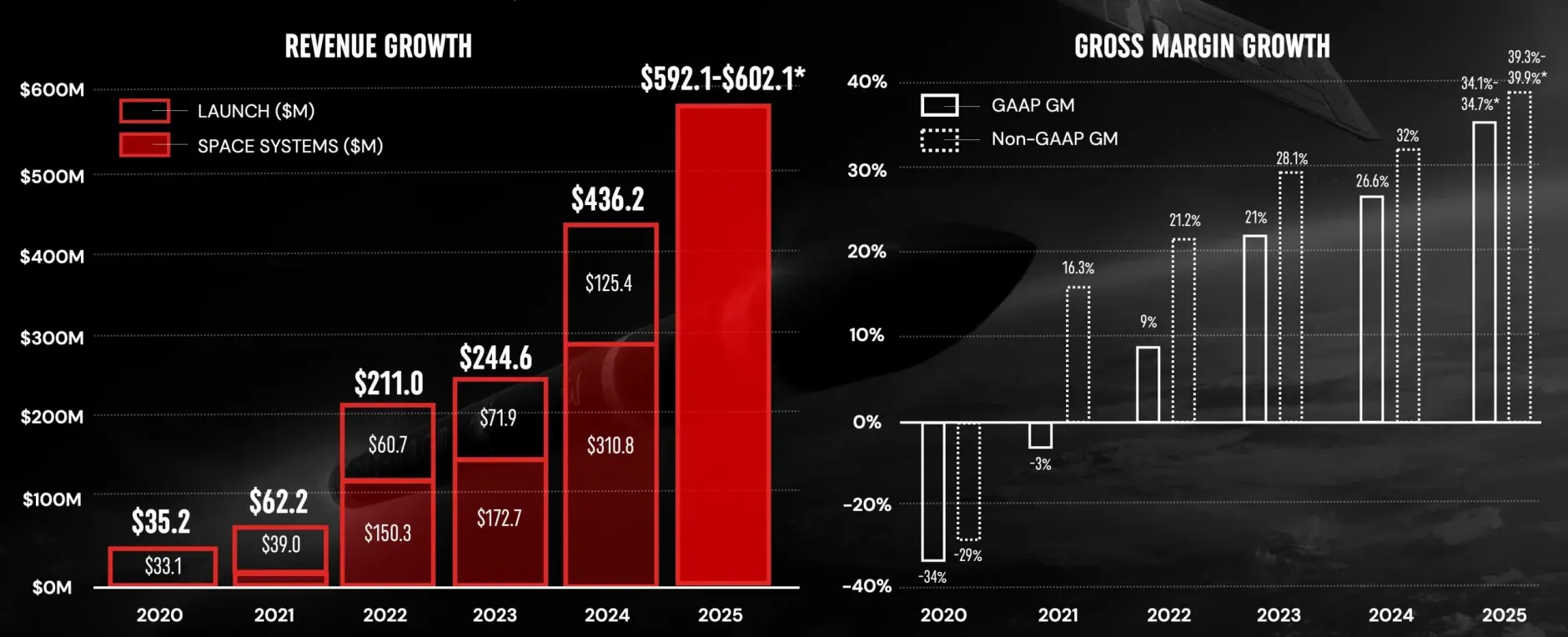

Revenue acceleration: TTM sales hit $555 million (up 52% YoY). Q3 2025 delivered record revenue of $155 million, beating estimates by 7.6%. Q4 guidance of $170-180M implies full-year revenue around $600M. Management's been beating top-line estimates consistently since mid-2024.

Margin expansion: GAAP gross margins expanded to 37% (from negative 34% five years ago). Q4 guidance: 37-39% GAAP, 43-45% non-GAAP. The shift toward higher-margin Space Systems revenue is the real story - that segment grew 74% YoY in Q3.

Path to profitability: Q3 EPS came in at -$0.03 vs. -$0.10 expected - a 7-cent beat. Management says they're approaching peak R&D spending on Neutron, which means operating leverage kicks in through 2026. EBITDA breakeven looks achievable by year-end 2026.

Balance sheet strength: ~$1 billion in cash and liquidity vs. ~$517M in debt. They raised $468.8M through an at-the-market offering in Q3, taking advantage of the stock's strength. This runway is more than sufficient for Neutron development and strategic M&A.

Neutron is the real game-changer coming in 2026

The Electron rocket has been executing flawlessly - 21 successful launches in 2025 with 100% mission success rate, making it the second most frequently launched U.S. vehicle. But Electron can only lift 300kg to LEO. That's fine for small satellites, but the real money is in the medium-lift constellation market.

Enter Neutron. This is Rocket Lab's reusable medium-lift rocket designed to carry 13,000kg to LEO (15,000kg expendable). According to the company, 98% of all payloads launching through 2029 don't need Falcon 9's heavy-lift capacity. Neutron is purpose-built to capture that sweet spot.

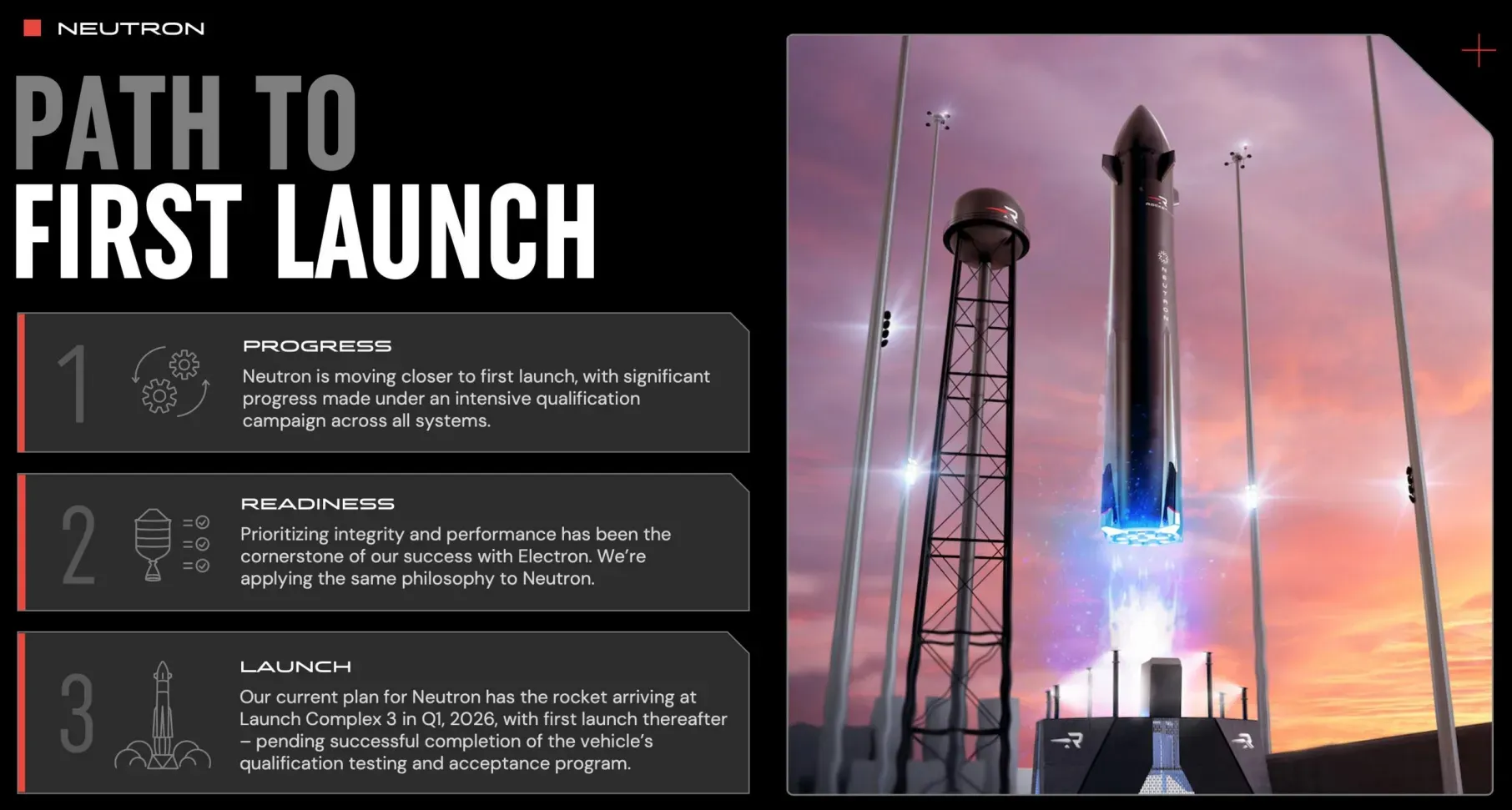

Timeline: First flight vehicle ships to Wallops Island launch site in Q1 2026. Maiden flight expected Q2 2026. Management pushed from late 2025 to ensure they "get it right" - CEO Peter Beck is obsessed with reaching orbit on the first try.

The "hungry hippo" fairing design allows the first stage to be reusable, and they're building a 400-foot landing barge called "Return On Investment" for booster recovery. Three fully-priced Neutron missions already in backlog, with more expected once the rocket proves itself.

The defense angle nobody's talking about

This is where it gets interesting. In December 2025, Rocket Lab won an $816 million contract from the Space Development Agency to build 18 satellites for the Tranche 3 Tracking Layer. This is their largest contract ever - and it's for missile warning satellites critical to U.S. national security.

Total SDA contracts now exceed $1.3 billion. Then in January 2026, Secretary of Defense Pete Hegseth visited RKLB's facilities as part of his "Arsenal of Freedom" tour. That's a significant signal about the Pentagon's view of Rocket Lab as a strategic partner.

I'd compare this positioning to what Palantir achieved in the data/intelligence space or Lockheed Martin in traditional defense -except RKLB is capturing the emerging space domain. With the Pentagon shifting toward resilient space architectures (think: distributed satellite constellations vs. vulnerable monolithic systems), Rocket Lab is perfectly positioned.

The valuation debate

Yes, at $47 billion market cap and 77x TTM sales, RKLB looks expensive by traditional metrics. But context matters:

FY2026 consensus revenue ~$1 billion brings P/S down to ~52x. Still rich, but the growth trajectory justifies a premium. The $770 billion total addressable market by 2030 provides enormous runway. There's no pure public comparable - SpaceX remains private.

Analyst sentiment: 12 Buy ratings, 5 Hold, 0 Sell. Average price target around $68-73 (well below current price), but Needham just raised to $90. The street is playing catch-up with a stock that's moved faster than their models anticipated.

The insider selling context

CEO Peter Beck sold about $141 million in stock during December 2025. Before you panic: virtually all sales were executed under a pre-arranged Rule 10b5-1 trading plan established in June 2025. This is standard procedure for executives to diversify concentrated holdings without risking insider trading accusations.

Beck still directly owns 902,942 shares worth ~$80M+ at current prices. CFO Adam Spice and other executives have also sold, but again mostly through 10b5-1 plans. I'm not reading this as a bearish signal on the business - it's wealth management, not a vote of no-confidence.

What keeps me up at night

Neutron execution risk: A failed maiden flight would be devastating. The entire 2026 narrative depends on reaching orbit successfully. SpaceX learned hard lessons with early Falcon failures—Rocket Lab can't afford the same growing pains with the stock at these levels.

SpaceX competition: Elon's operation has unmatched scale and pricing power. Starship's eventual success could compress the addressable market for medium-lift vehicles. That said, customers are actively seeking alternatives to SpaceX concentration risk.

Valuation compression: High-multiple growth stocks are vulnerable to rate sensitivity and risk-off rotations. A broader market selloff could hit RKLB hard given its 2.18 beta.

Continued losses: Until EBITDA turns positive, there's execution risk around cash burn timing.

Bottom line

Rocket Lab is transitioning from "interesting small-cap space play" to "strategic U.S. defense contractor with a pipeline of major catalysts." The Neutron launch, accelerating profitability, and deepening Pentagon relationships create a setup where the current premium valuation could actually prove cheap in hindsight.

The risk is real - execution matters enormously here. But for investors with appropriate position sizing and a 12-18 month horizon, RKLB offers asymmetric upside if Neutron succeeds and the Space Systems segment continues its trajectory.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.