Nebius (NBIS) just became my favorite AI infrastructure play

Here's why this "neocloud" hyperscaler could be the trade of 2025

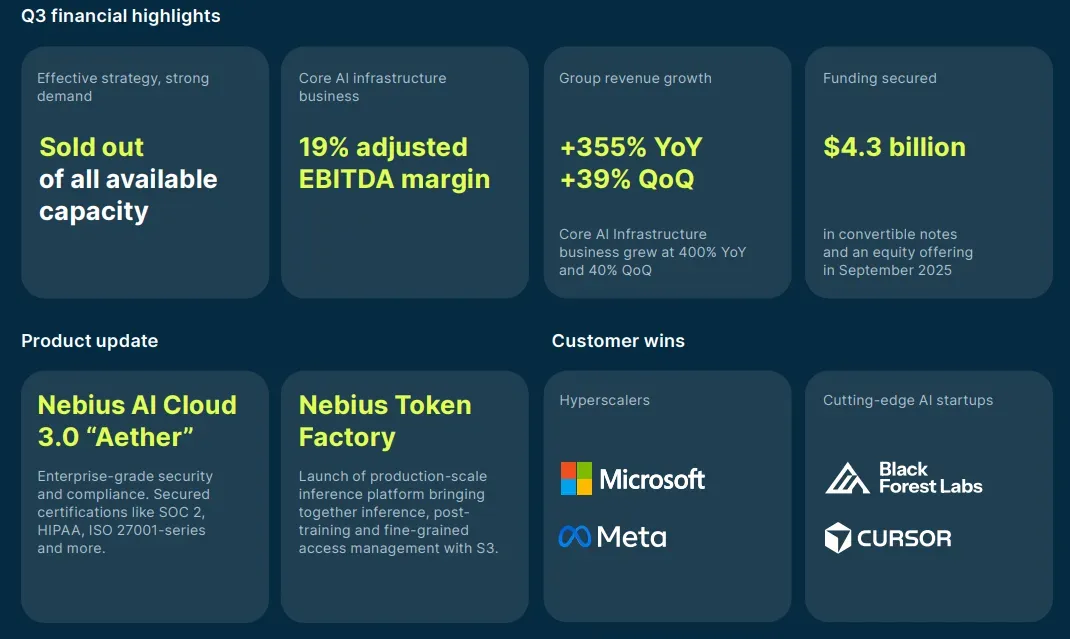

I've been tracking the AI infrastructure space closely, and Nebius Group (NBIS) just flashed a massive buy signal on my screens. After a 355% year-over-year revenue surge and back-to-back multi-billion dollar deals with Microsoft and Meta, this stock pulled back 42% from its highs - creating what I see as a golden entry point.

The stock's been an absolute beast, up 211% year-to-date, but here's what's fascinating: while everyone's obsessing over the usual AI plays, this relatively unknown player is quietly signing contracts that dwarf its entire current business. We're talking about a company that just inked a $3 billion deal with Meta that could generate $600 million annually - more than their entire 2025 revenue guidance.

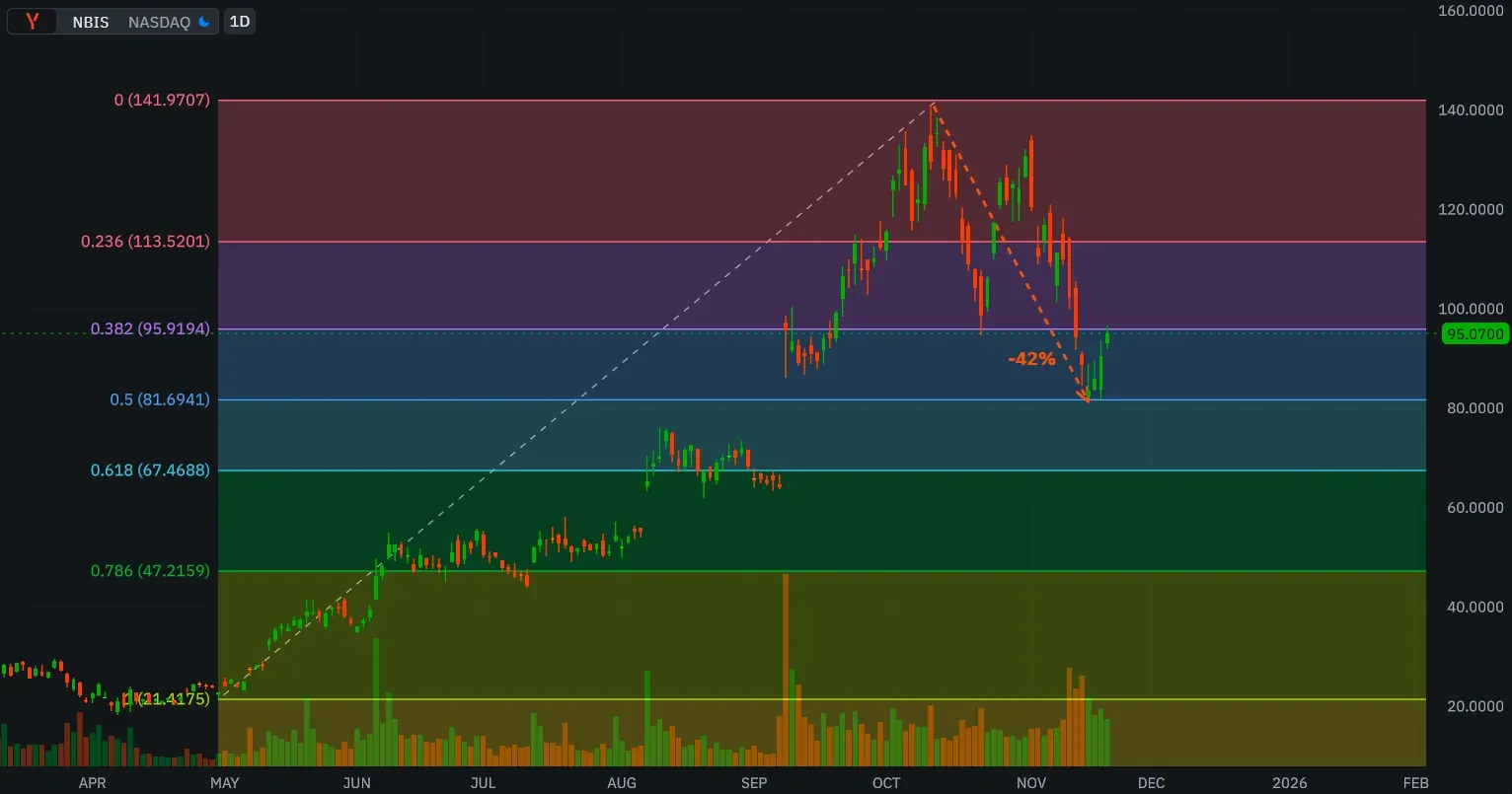

Technical analysis: The pullback I've been waiting for

Looking at the daily chart, NBIS just tagged its 100-day EMA around $95, which has been rock-solid support throughout this uptrend. The RSI dropped from overbought territory above 70 down to the 30-40 range - classic oversold bounce setup.

What's even more interesting is the Bollinger Band action. After riding the upper band through September-October, we've now kissed the lower band. In my experience, when you see this pattern in a strong uptrend, it's usually a gift, not a warning.

My key levels:

- Support: $95 (100-day EMA), then $85 (major psychological level)

- Resistance: $115 (recent highs), then $125 (next target)

- Stop loss: Below $90 breaks the trend

The fundamentals that have me excited

Here's where it gets really interesting. Nebius is selling every single GPU they can get their hands on.

That's not hype - that's supply/demand economics at its finest.

The Q3 numbers back this up:

- Infrastructure segment grew 400% YoY

- Pipeline jumped 70% sequentially to $4 billion

- EBITDA margins hit 19% and climbing

But here's the kicker: they're raising CapEx from $2 billion to $5 billion for 2025. Normally, I'd run from that kind of spending, but when you have pre-committed contracts from Microsoft and Meta backing it? That's just smart growth financing.

Why the big tech chose them over AWS

This is what sealed it for me. Meta and Microsoft could've gone with Amazon or Google, but they chose Nebius. Why? Because the traditional cloud giants can't dedicate the kind of exclusive capacity these AI workloads need. Nebius is building purpose-built AI infrastructure from the ground up.

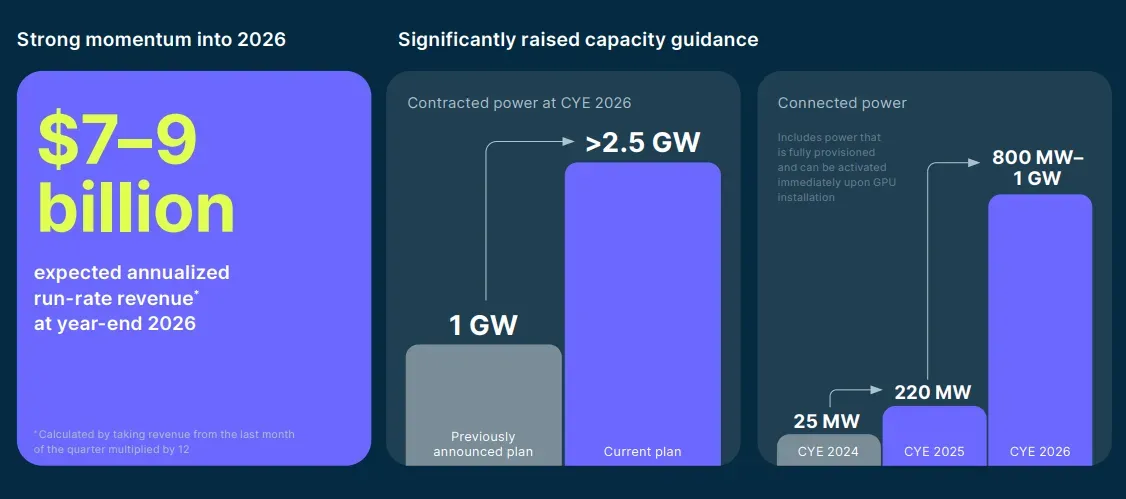

Their 2026 targets are aggressive but believable:

- Contracted power expanding from 1 GW to 2.5 GW

- ARR guidance of $7-9 billion (up from ~$550 million today)

- Over 50% already booked through existing contracts

The risks I'm watching

I'm not blind to the concerns here:

- Nvidia dependency: If GPU supply hiccups, Nebius is toast

- Execution risk: Scaling from $500M to $9B revenue isn't trivial

- Valuation: Trading at 40x forward sales isn't cheap

- Dilution: They're raising capital through ATM offerings

The biggest red flag? They're burning cash like crazy and won't be profitable until they hit scale. But with Meta and Microsoft essentially funding their buildout, I'm willing to take that bet.

My trading plan

I'm going long here with a specific strategy:

- Entry: Scaling in between $95-100

- Target 1: $125 (25% gain)

- Target 2: $145 (45% gain)

- Stop loss: $89 (just below trend support)

- Position size: 3% of portfolio (this is still speculative)

For options traders, I like the March 2025 $110 calls - gives time for the next earnings and capacity updates.

I'm buying the fear

The market's spooked by the CapEx increase and near-term losses, but they're missing the forest for the trees. This company has two of the world's biggest tech giants pre-paying for infrastructure that doesn't even exist yet. The 24% pullback from highs while fundamentals keep improving? That's the definition of a buying opportunity.

Yes, it's risky. Yes, it could crash if AI demand slows. But at current levels, the risk/reward is tilted heavily in our favor. When consensus estimates show the forward P/S ratio compressing from 40x to under 2x by 2028, and you've got Microsoft and Meta essentially guaranteeing your revenue ramp - I'll take that bet all day.

This is exactly the kind of asymmetric opportunity I look for: misunderstood company, temporary selling pressure, massive secular tailwind, and clear catalysts ahead.

Position: Long NBIS at $97, targeting $125+

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.