Meta just beat earnings again, shocking absolutely no one

Zuckerberg's money printer goes brrr for the 45th time - at what point do analysts just stop trying?

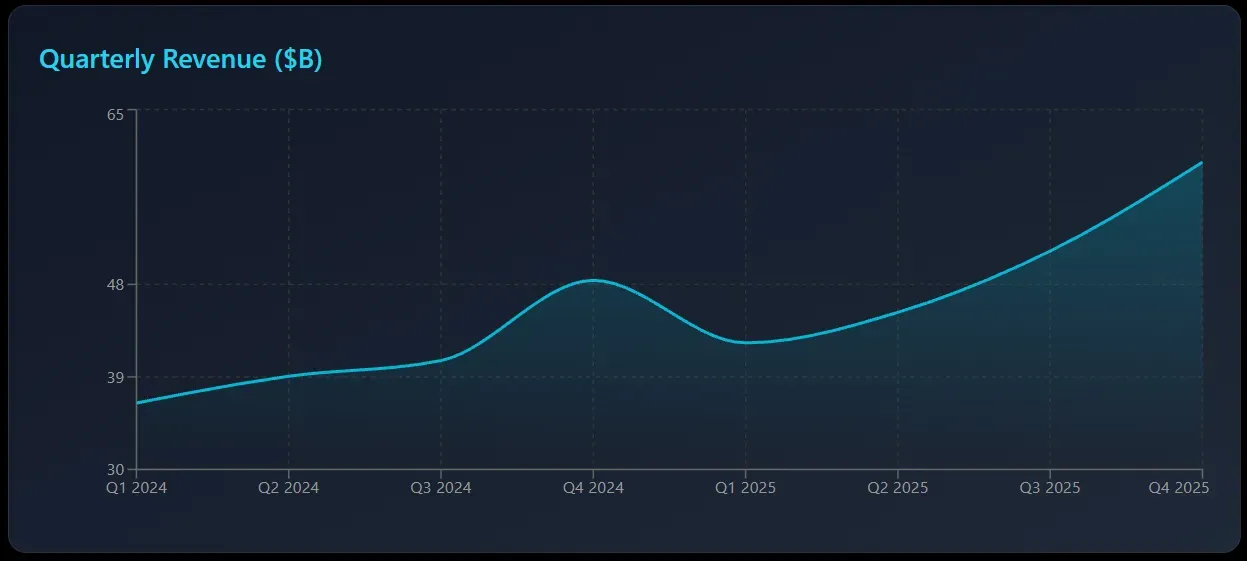

Writing about Meta earnings is starting to feel like reporting that water is wet. Q4 2025 dropped today and - surprise, surprise - they crushed it. Again. The company has now beaten analyst estimates 45 out of 57 quarters. That's a 79% beat rate. At this point, analysts should just add 10% to whatever number they're thinking and call it a day.

The stock popped 10% after hours. Because of course it did.

The numbers that made Wall Street say 'not again'

Metric -- Expected -- Actual

Revenue: $58.4B -- $59.89B (+2.5%)

EPS: $8.19 -- $8.88 (+8.4%)

Q1 2026 Guide: $51.3B -- $53.5-56.5B

Revenue jumped 24% year-over-year to a record $59.89 billion. That's not a typo - nearly $60 billion in a single quarter from showing you ads while you scroll through your aunt's vacation photos.

The advertising machine generated $58.1 billion alone, accounting for 97% of total revenue. Zuckerberg figured out how to monetize your attention span better than anyone in human history.

The part where Zuck goes full 'founder mode'

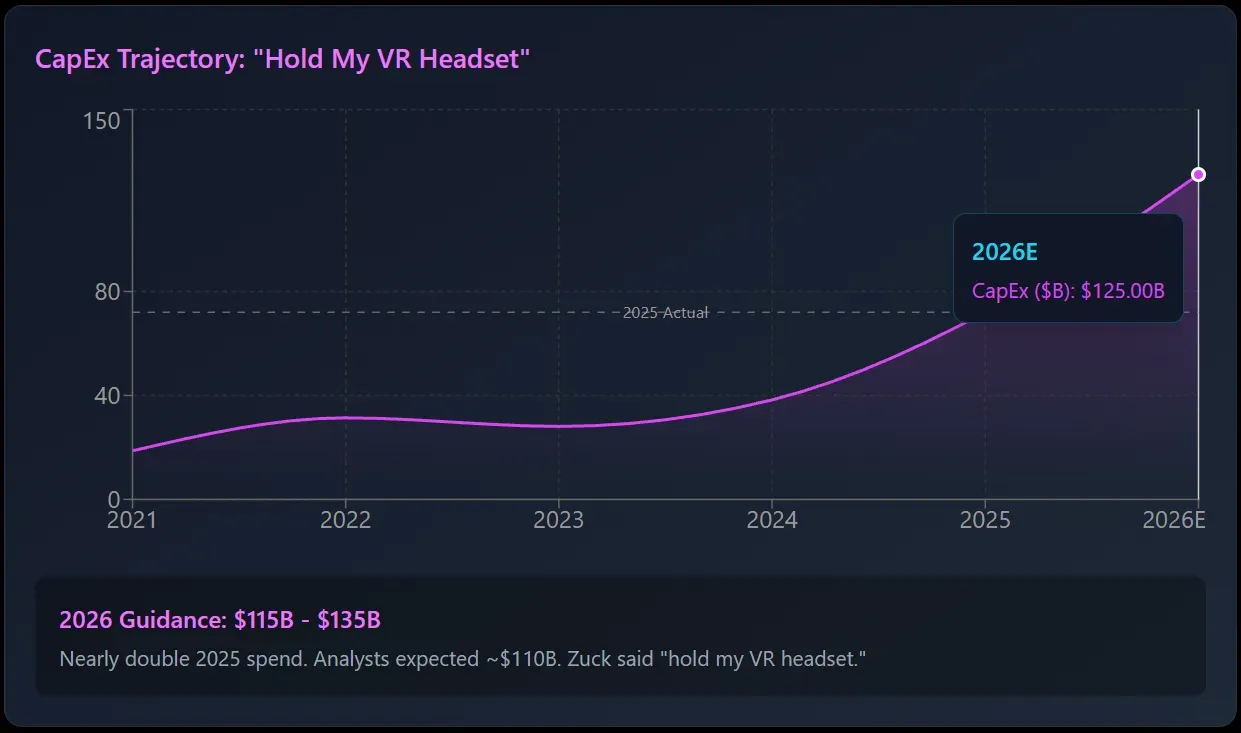

Now here's where it gets spicy. Meta announced 2026 CapEx guidance of $115 to $135 billion. That's nearly double the $72 billion they spent in 2025. Analysts expected around $110 billion. Meta said 'hold my VR headset.'

Where's all that money going? Three guesses, and the first two don't count: AI infrastructure. Zuckerberg is building what he calls 'Meta Compute' - essentially a small country's worth of data centers powered by 6.6 gigawatts of energy. For reference, that's roughly what Doc Brown needed to send Marty McFly back to 1985. Times six.

On the earnings call, Zuck promised a 'major AI acceleration' in 2026 after admitting Meta fell behind Google, OpenAI, and Anthropic on leading AI models last year. He also poached Scale AI's founder Alexandr Wang and invested $14.3 billion in Scale to run Meta's TBD unit – their top-secret project to build frontier models. There's even a new model codenamed 'Avocado' coming in the first half of 2026. Because apparently regular code names are too boring.

Reality Labs: still burning cash like it's going out of style

Let's talk about the elephant in the metaverse. Reality Labs posted another quarter of $6.02 billion in operating losses on just $955 million in revenue. That brings total Reality Labs losses to nearly $80 billion since late 2020. That's 'we could have bought a small European country' money.

Meta also laid off over 1,000 Reality Labs employees this month, shifting resources to AI and wearables like the Ray-Ban smart glasses (which tripled in sales last year – actual bright spot). Zuckerberg says 2026 will be the 'peak' of Reality Labs losses. We've heard that before, but maybe the 14th time's the charm?

Here's the wild part though: none of this matters to the stock. The core advertising business is so absurdly profitable that Meta can light $80 billion on fire in the metaverse and investors still cheer. Operating margin sits at a healthy 41%. They're buying back $13.4 billion in stock per quarter while sitting on $70 billion in cash. It's the financial equivalent of running a marathon while carrying a refrigerator – impressive and slightly concerning.

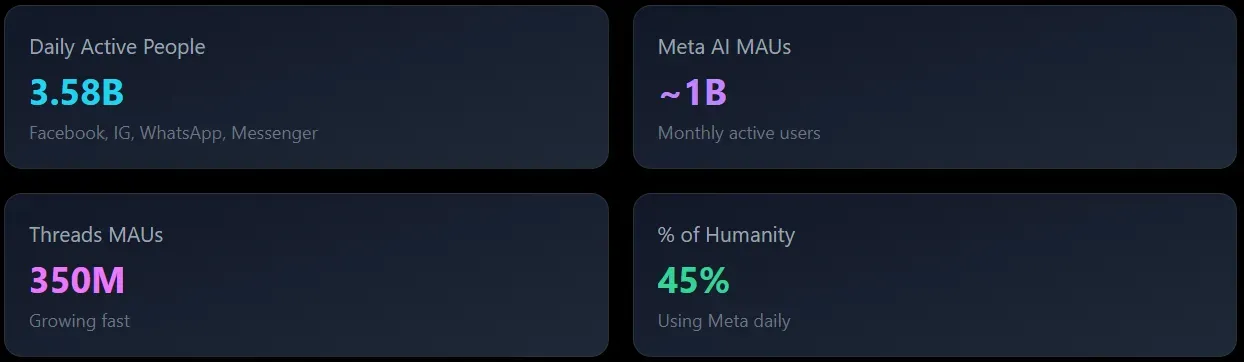

3.58 billion humans and counting

Daily active people across the Family of Apps hit 3.58 billion. That's roughly 45% of everyone on Earth using Facebook, Instagram, WhatsApp, or Messenger every single day. Meta AI now has nearly 1 billion monthly active users. Threads crossed 350 million MAUs. When you have this kind of scale, 'AI-driven ad targeting improvements' means billions in incremental revenue.

Zuckerberg talked about merging LLMs with Meta's recommendation systems:

Soon, you'll open our apps and you'll have an AI that understands you and also happens to be able to show you great content or even generate great personalized content for you.

Translation: the algorithm is about to know you better than you know yourself. Bullish for ad revenue. Slightly terrifying for humanity.

Technical setup

Current Price (pre-earnings): ~$620-650

200-Day MA: $679

Key Resistance: $762 / $796 (prior highs)

Key Support: $599 / $580

Forward P/E: ~21-22x

Avg Analyst Target: $825-835 (27%+ upside)

Here's the thing: META actually trades at its widest P/E discount to Alphabet since 2022. The market is pricing in a 'capital penalty' - assuming all that AI spend won't generate returns. If you believe Zuckerberg can actually monetize AI (and the ad business says he can monetize anything), this is a discount you rarely see on a company printing this much cash.

My take

Bullish. Look, I know the CapEx numbers sound insane. $135 billion is more than most countries' GDPs. The Reality Labs losses are embarrassing. The AI race is heating up with Google's Gemini 3 currently in the lead.

But this is a company that just printed $60 billion in revenue in a single quarter, grew 24% YoY despite everyone saying 'digital ads are dead,' operates at a 41% margin, and has more daily users than any other platform on Earth. They've beaten estimates 45 times. The ad business is a cheat code that funds everything else.

The question isn't whether Meta can afford to spend $135 billion on AI. They clearly can. The question is whether you want to bet against the guy who built a $1.5 trillion company by monetizing human attention. I don't.

Key risks

- EU regulatory headwinds – the 'subscription for no ads' model isn't flying with Brussels, and Europe is 16% of revenue

- AI spend might not generate returns – $135B is a big bet

- FTC appealing antitrust loss – unlikely to succeed but headline risk

- Social media bans for minors gaining momentum globally

The earnings machine keeps printing. Until analysts figure out how to properly model a company that beats 79% of the time, I'm riding with the Zuck.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.