Lucid shares skyrocket 13% on Saudi factory deal

I think the robotaxi partnership with Uber could be a game-changer, but massive cash burn keeps me cautious

Lucid shares jumped 13.4% on January 21st after announcing a deepened collaboration with Rockwell Automation to support their expanding manufacturing facility in Saudi Arabia. Rockwell will deploy its FactoryTalk MES software and provide local support to boost production visibility and workforce training. This partnership aligns with Saudi Vision 2030 and represents a major step in scaling Lucid's international production capacity.

But here's what really caught my attention: the options market lit up with heavy call activity ahead of earnings, signaling aggressive bullish bets. This stock has made 53 moves greater than 5% over the past year, so volatility is the name of the game here.

The robotaxi catalyst nobody's talking about enough

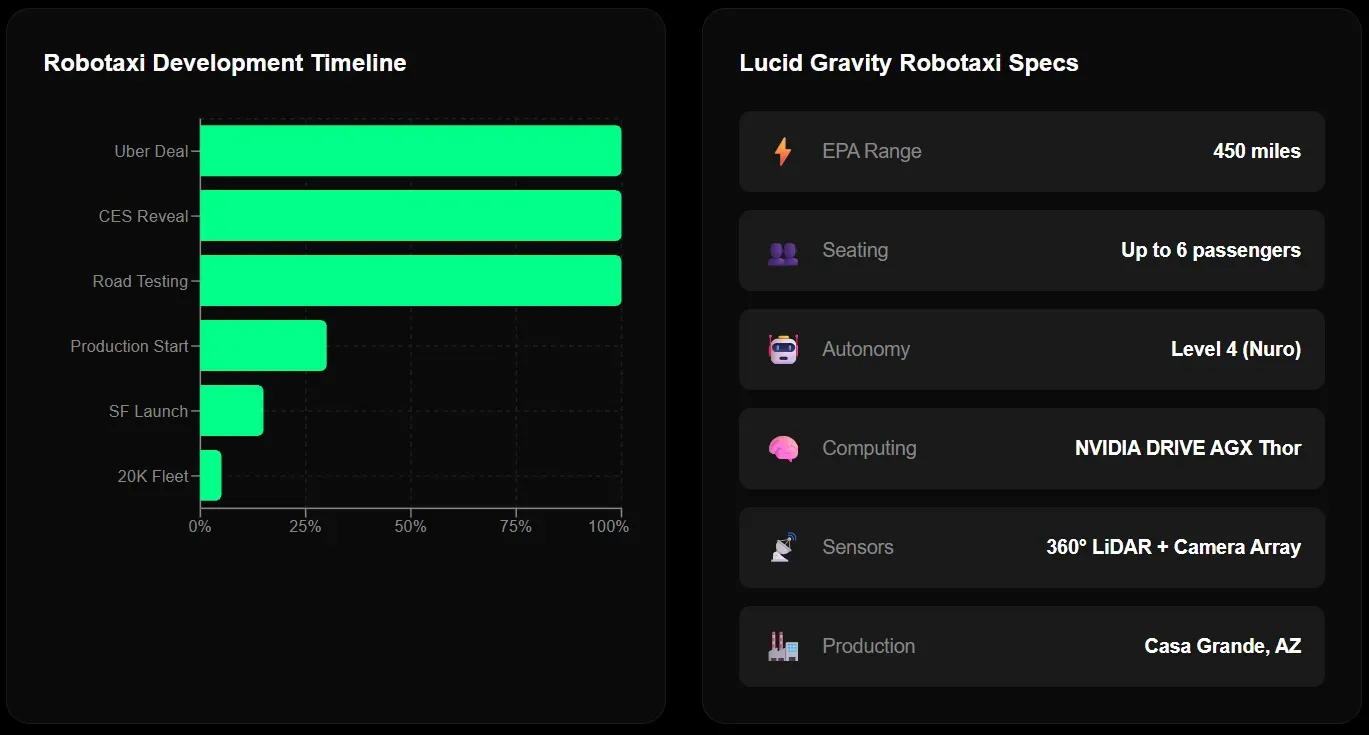

The real story here isn't just the Saudi factory. At CES 2026, Lucid, Nuro, and Uber unveiled their production-intent robotaxi based on the Gravity SUV. Autonomous on-road testing already began in December in the San Francisco Bay Area, with commercial launch expected later this year.

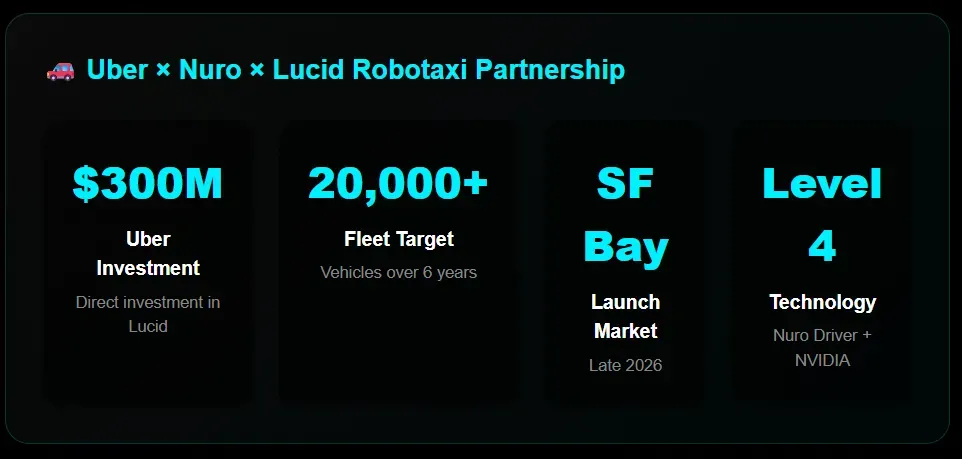

The numbers are significant: Uber plans to deploy 20,000+ Lucid robotaxis over six years across dozens of global markets. Uber invested $300 million directly into Lucid, with multi-hundred-million dollar commitments to both Lucid and Nuro. This isn't just a partnership - it's a strategic bet on Lucid's technology being the backbone of autonomous ride-hailing.

Uber-Nuro-Lucid Partnership Details

Uber Investment: $300 million direct investment in Lucid

Vehicle Target: 20,000+ robotaxis over 6 years

Technology: Nuro Level 4 autonomy + NVIDIA DRIVE AGX Thor

Launch Timeline: SF Bay Area, late 2026

Vehicle Base: Lucid Gravity SUV (450-mile range)

Seating Capacity: Up to 6 passengers with luggage space

The fundamental picture

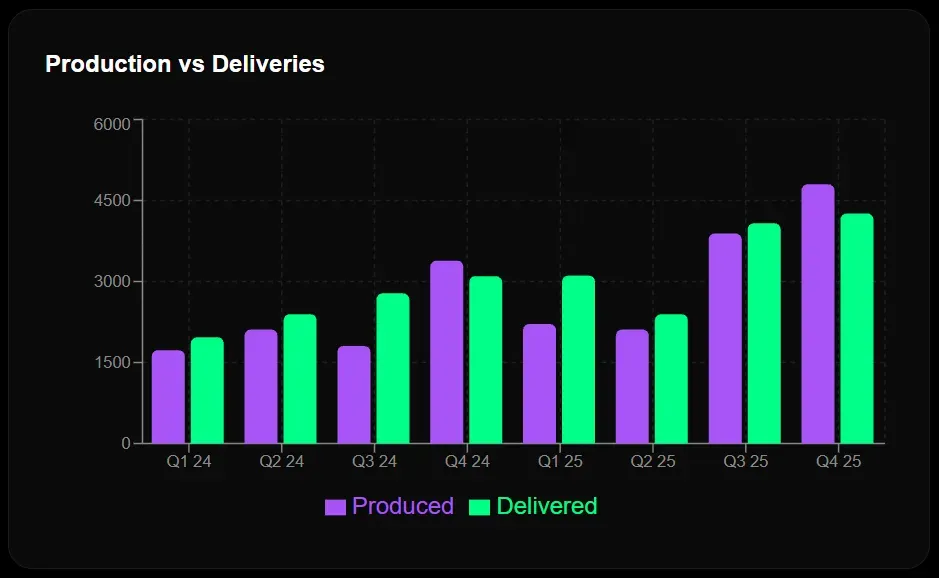

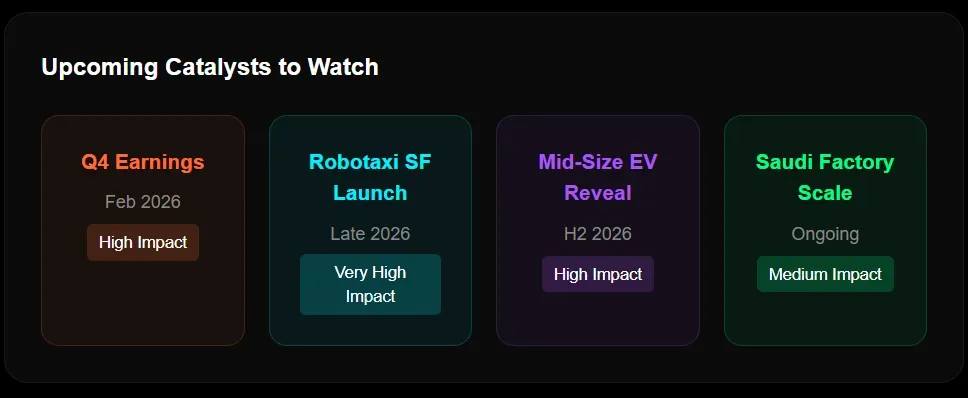

The company doubled production in 2024 and hit a record 1,000 vehicles per week in December. Q3 revenue climbed 68% YoY to $336.6 million with 4,078 deliveries. They've added Tesla Supercharger access for Air models and launched the Gravity SUV which is driving the growth story.

However, the cash burn is brutal - around $950 million per quarter. Q3 net loss was approximately $978 million, meaning Lucid loses money on every vehicle sold. Gross margins remain deeply negative. The company's liquidity extends through H1 2027 with roughly $5.5 billion pro forma, but that runway can disappear fast at this burn rate.

Financial Snapshot

Revenue: $336.6M +68% YoY

Net Loss: ~$978M, ~$240K loss per car sold

Production: 3,891 vehicles, Record production rate

Deliveries: 4,078 vehicles. Strong YoY growth

Liquidity: ~$5.5B, Runway to H1 2027

Gross Margin: Negative. Losing money per vehicle

Losing money per vehicle

Risks I'm watching closely

1. Cash Burn Crisis: At nearly $1 billion per quarter, the math is unforgiving. Even with $5.5B in liquidity, that's roughly 5-6 quarters of runway without additional capital raises.

2. Negative Unit Economics: The company lost over $240,000 for every car sold in Q3. That's not a path to profitability- it's a race against the clock.

3. EV Tax Credit Headwinds: Federal EV incentives are winding down, which could hurt demand just as Lucid is scaling up.

4. Competition: Tesla dominates the EV and robotaxi narrative. BYD is eating market share globally. Lucid is fighting giants with a premium niche strategy.

5. Execution Risk: The robotaxi program with Uber/Nuro is ambitious but unproven. Regulatory hurdles, technical challenges, and deployment delays could derail the timeline.

6. Analyst Sentiment: Consensus is cautious - average target around $9.41 with a Sell/Hold rating. Jim Cramer's "sell, sell, sell" call last month didn't help sentiment.

Hidden opportunities

1. Multi-Trillion Dollar Robotaxi Market: If the Uber partnership succeeds, Lucid becomes a key supplier to one of the most valuable emerging markets in transportation. The 20,000-vehicle commitment is just the beginning.

2. Saudi Arabia Backing: The Public Investment Fund's support provides a strategic lifeline most EV startups don't have. The $2B undrawn term loan facility offers optionality.

3. Technology Leadership: Lucid's 450-mile range on the Gravity and industry-leading efficiency metrics provide genuine differentiation. The NVIDIA partnership for Level 4 autonomy adds credibility.

4. Mid-Size EV Platform: A sub-$50,000 EV targeting Tesla Model Y could dramatically expand Lucid's addressable market in late 2026. This is the volume play they need.

5. Analysts rating: Some analysts see 300% upside potential to $42 by 2030 if execution improves.

Technical picture

The daily chart shows LCID trading at $11.06, deep in the accumulation zone after a brutal decline from the July 2025 high of $34.49. Price is holding the critical Fibonacci 0 level at $9.64 - this is the line in the sand.

Key levels from Fibonacci retracement:

- Support: $9.64 (must hold, or we see $8)

- Resistance 1: $13.27 (0.236 Fib) - first hurdle to clear

- Resistance 2: $15.51 (0.382 Fib) - breakout confirmation

- Target zone: $17.32-$19.13 (0.5-0.618 Fib)

What I'm seeing:

- Price trading 58% below the 100 SMA ($26.36) - still in downtrend territory

- RSI at 54/41 - neutral, room to move either way

- Volume picking up on recent green candles - potential accumulation

- Descending trendline (dashed) still acting as resistance

The setup is forming a potential base near $10. A confirmed break above $13.27 with volume would signal trend reversal. Until then, it's a high-risk bounce play with $9.64 as the stop-loss anchor.

Bottom Line: Lucid is a turnaround story with legitimate catalysts but existential risks. The Uber robotaxi deal could be transformational, but the company needs to survive long enough to see it through. Only suitable for investors comfortable with high volatility and potential total loss. Watch for Q4 earnings and robotaxi testing updates before sizing up.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.