JPMorgan just dropped earnings and the Street is missing the real story

Record profits, dominant market share, and a 40% surge in equities trading. But Dimon's macro warning and APR cap risk mean patience beats FOMO here

JPMorgan just kicked off bank earnings season and the numbers look solid on the surface.

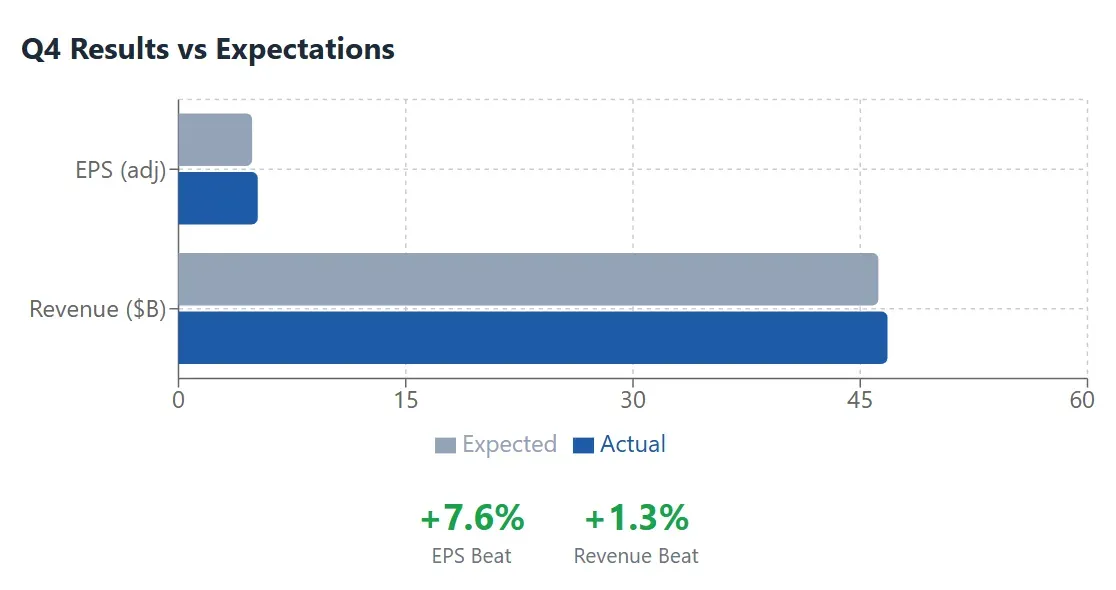

Q4 adjusted EPS came in at $5.23, crushing the $4.86-5.01 consensus by nearly 8%. Revenue hit $46.8 billion versus $46.2 billion expected. Full year 2025 netted $57.5 billion in profit with a 20% ROTCE. These are monster numbers for any company, let alone a bank.

But here's where it gets interesting. The headline miss everyone's talking about? That $2.2 billion reserve build for the Apple Card portfolio they're absorbing from Goldman Sachs. Strip that out, and this was a clean beat across the board. The market's initial reaction was muted - stock barely moved in pre-market -but I think that's actually setting up an opportunity.

What the chart says

The technical picture is constructive but requires patience. JPM hit an all-time high of $337.25 on January 5th and has pulled back about 3.5% since then. The stock is trading inside a well-defined ascending channel that's been in place since the October 2023 lows.

Support Levels

- $321-323 (demand zone, 20 DMA)

- $317 (channel midline)

- $310-312 (200 DMA, major support)

Resistance Levels

- $326-327 (immediate)

- $331 (prior resistance)

- $337.25 (all-time high)

RSI is sitting at 24, which is oversold territory - not something you see often on a stock that just printed record profits. The MACD has crossed bearish in the short term, but the weekly timeframe still shows buy signals. This feels like a consolidation within a larger uptrend rather than the start of something worse.

The fundamental story

Let me break down what actually happened this quarter because the numbers deserve a closer look.

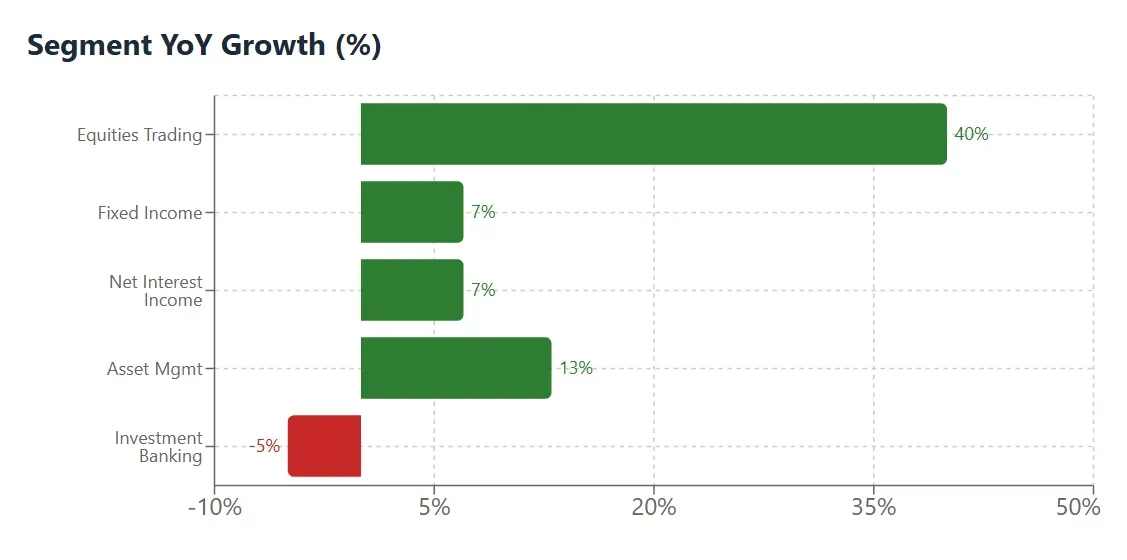

The standout here is equities trading at +40% YoY - that's not a typo. Fixed income was up 7%, and only investment banking disappointed with a 5% decline on weaker M&A and underwriting activity. But here's the thing: JPM still ranked #1 globally in IB with an 8.4% wallet share. This is the dominant franchise flexing.

On the consumer side, they opened 1.7 million net new checking accounts and 10.4 million credit card accounts in 2025. Average loans grew 9% YoY while deposits rose 6%. Asset and Wealth Management AUM hit $4.8 trillion, up 18% YoY. These aren't incremental gains - this is a company taking market share across every business line.

What Dimon is really saying

Jamie Dimon's commentary is worth parsing carefully. He called the economy "resilient" and noted consumers continue to spend while businesses remain healthy. But he also dropped this: "markets seem to underappreciate the potential hazards—including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices."

Translation: the macro backdrop is fine for now, but Dimon sees risks building that the market isn't pricing. He's not predicting doom, but he's telling you to stay alert. When the most powerful banker in America uses words like "vigilant," pay attention.

The 2026 guidance story

- Total Net Interest Income: ~$103B

- NII ex-Markets: ~$95B

- Adjusted Expenses: ~$105B

- Card Net Charge-Off Rate: ~3.4%

- Card Loan Growth: 6-7%

The expense guidance is the one number that raised eyebrows - $105 billion is a meaningful step-up. But Dimon was explicit about why:

"We're not going to try to meet some expense target at the risk of being left behind competitively."

They're investing heavily in technology, AI, payments infrastructure, branch expansion, and the Apple Card integration (which takes 2 years to fully absorb).

This is classic JPMorgan playbook - spend through uncertainty to widen the moat. The company also announced a Coinbase partnership that lets customers buy crypto within JPMorgan's consumer banking ecosystem. From "Bitcoin is a fraud" to building crypto infrastructure -that's quite a pivot.

Catalysts ahead

- Deregulation benefits: The new administration's lighter touch on banking regulation should lower compliance costs and potentially allow more capital returns.

- IB pipeline recovery: M&A activity has been sluggish, but Barnum indicated a strong pipeline. If dealmaking picks up, IB fees could inflect.

- Apple Card synergies: Once integrated, this adds a premium customer base and card spend volume. The reserve build is front-loaded; the earnings benefit comes later.

- Crypto and blockchain expansion: The Coinbase partnership and tokenized money market fund (Kinexus) position JPM as the institutional on-ramp for digital assets.

My trading plan

I'm cautiously bullish here, but the entry matters. The oversold RSI and pullback to the $321-323 demand zone make this an interesting spot to start building a position. I'm not chasing into strength given the regulatory noise around credit cards.

Final notes

JPMorgan is the best-run bank in America, maybe the world. The Q4 results confirm the franchise keeps getting stronger - trading is booming, consumer banking is gaining share, and they're investing aggressively in the next generation of financial infrastructure. The Apple Card noise is a speed bump, not a story-changer.

The risk/reward at these levels isn't asymmetric given the 34% run in 2025 and regulatory uncertainty. But a pullback to the $318-323 zone would change that math considerably. I'm setting alerts and waiting for my pitch.

Wall Street consensus PT is $332, with Barclays most bullish at $391. Even the bears at Citi are at $250 - well below current levels. The Street sees upside, I just want a better entry.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.