Alphabet (GOOGL) is crushing it and I'm adding to my position

Why GOOGL's AI comeback has me bullish heading into year-end

Alphabet just hit an all-time high and is now knocking on the door of a $4 trillion market cap. After watching this stock closely for years, I think we're witnessing a genuine inflection point. Google's AI strategy is finally clicking, and the market is starting to price in what I've been anticipating:

Alphabet could emerge as the dominant force in the AI race.

Technical analysis

The chart is telling a compelling story right now. GOOGL gained over 8% on Monday alone, driven by a combination of institutional buying and momentum traders piling in. Here's what I'm seeing:

- Price action: Stock surged 8%+ to record highs with heavy volume confirmation. This isn't a low-volume drift higher - it's conviction buying.

- Market cap: Now at $3.82 trillion, making it the fourth company in history approaching the $4 trillion club after Nvidia, Microsoft, and Apple.

- Relative strength: Best performer among the Mag 7 since November started. When a mega-cap leads its peer group with this kind of momentum, I pay attention.

- Year-to-date performance: Up nearly 70% in a year. If this holds, it would be Alphabet's first time ever as the best annual performer among the Magnificent Seven.

Fundamental analysis

Three major tailwinds are converging:

Cloud business acceleration

Google Cloud has transformed from a laggard to a genuine growth driver. Enterprise AI adoption is pushing workloads to Google's platform, and the integration of Gemini into cloud services is creating sticky enterprise relationships.

Vertical integration advantage

This is the piece most investors are missing. Google is the most vertically integrated hyperscaler in the game. Their custom TPUs and networking infrastructure give them a cost and performance edge that's extremely difficult to replicate. Melius analyst Ben Reitzes nailed it:

Google has the only team really capable of taking chip design fully in-house and pushing custom optical circuit switches. That's a structural moat.

Gemini 3 momentum

The November 18th launch of Gemini 3 was a turning point. Google deployed it directly into Search, the Gemini app, and enterprise cloud stack - all at once. This wasn't a beta rollout or limited preview. It was a statement. The model outperformed OpenAI's ChatGPT 5.1 and Anthropic's Claude Sonnet 4.5 on academic and scientific reasoning benchmarks. When your flagship AI product beats the competition on substance, not just hype, that matters.

Broader market context

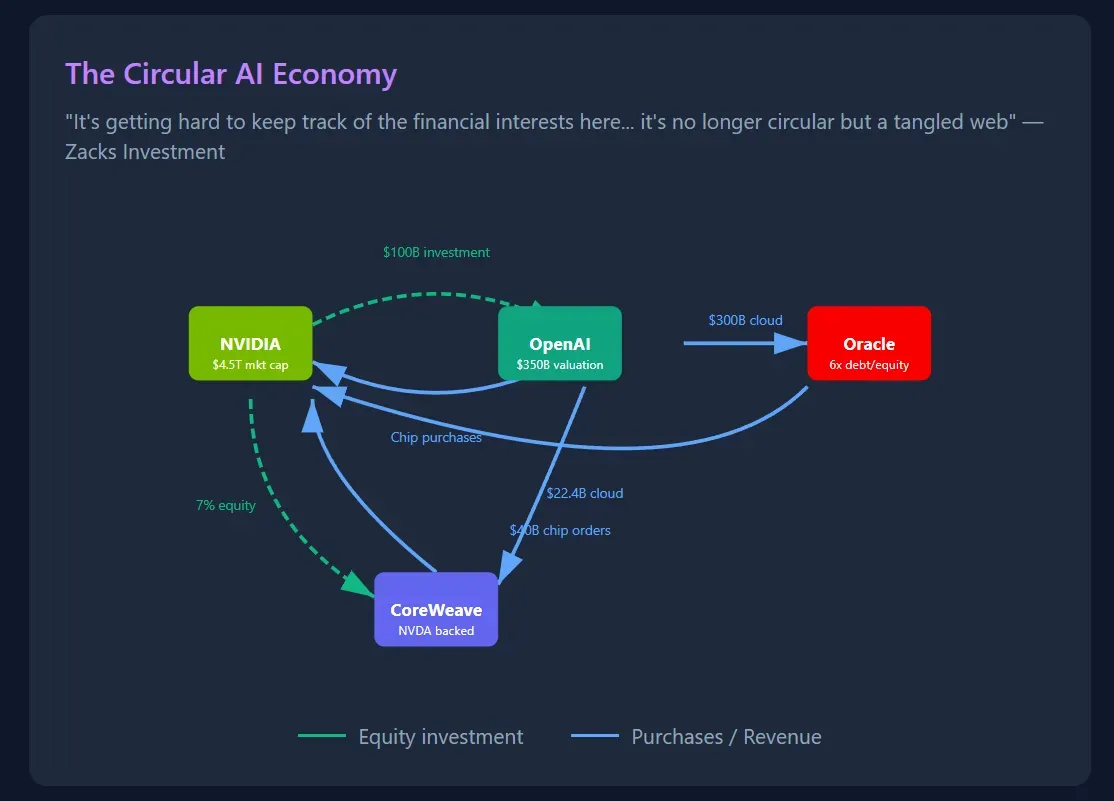

Here's what makes the Alphabet trade interesting right now: the broader AI narrative is getting more complicated. Nvidia posted stellar earnings but the stock couldn't sustain its rally. Investors are increasingly worried about hyperscaler spending sustainability and whether the AI buildout is creating circular industry dynamics.

In that environment, Alphabet stands out. They're not just a customer of the AI infrastructure boom - they're building their own. Every dollar Google spends on TPUs is a dollar they're not spending with Nvidia. That makes them more insulated from the "who's actually making money from AI" question that's haunting other names.

Buffett's Berkshire Hathaway taking a position adds another layer of validation. When the Oracle of Omaha's team sees value in a growth-oriented mega-cap, it signals something about the durability of the business model.

Catalysts and insider activity

Several near-term catalysts could keep the momentum going:

- NATO contract: Google Cloud just landed a multi-million dollar contract with NATO's Communication and Information Agency for sovereign, air-gapped cloud infrastructure. This isn't just revenue - it's a validation of Google's security capabilities at the highest levels.

- Meta TPU deal: Reports suggest Meta is considering Google TPUs for their data centers in a deal potentially worth billions. If Zuckerberg's team starts buying Google silicon, that's a seismic shift in the competitive landscape.

- $4 trillion milestone: Alphabet now has a 25% chance of becoming the most valuable company in the world by year-end. That kind of headline would drive significant passive flows and media attention.

Risk factors

I'm not ignoring the risks. The antitrust overhang remains real. Google's dominance in search and advertising continues to attract regulatory scrutiny. Additionally, if OpenAI stages a comeback with a breakthrough model, some of the Gemini enthusiasm could fade quickly.

Sundar Pichai himself acknowledged the AI investment cycle has "rational and irrational elements," comparing it to the early internet days. There was excess investment then, and there could be excess now. But as Pichai noted, the internet was still "profound." I think AI will be the same.

Final thoughts

Alphabet's AI comeback is real. The vertical integration, Gemini 3's strong reception, and institutional tailwinds create a compelling setup. Yes, the stock has run, but momentum tends to persist in mega-caps with improving fundamentals. I'm adding to my position here and watching for any weakness to add more.

The AI trade might not be a zero-sum game, but if there's going to be a clear winner, I'm betting it's Google.