2025 Stock Market Forecast: Winners, Losers Under Trump's Policies

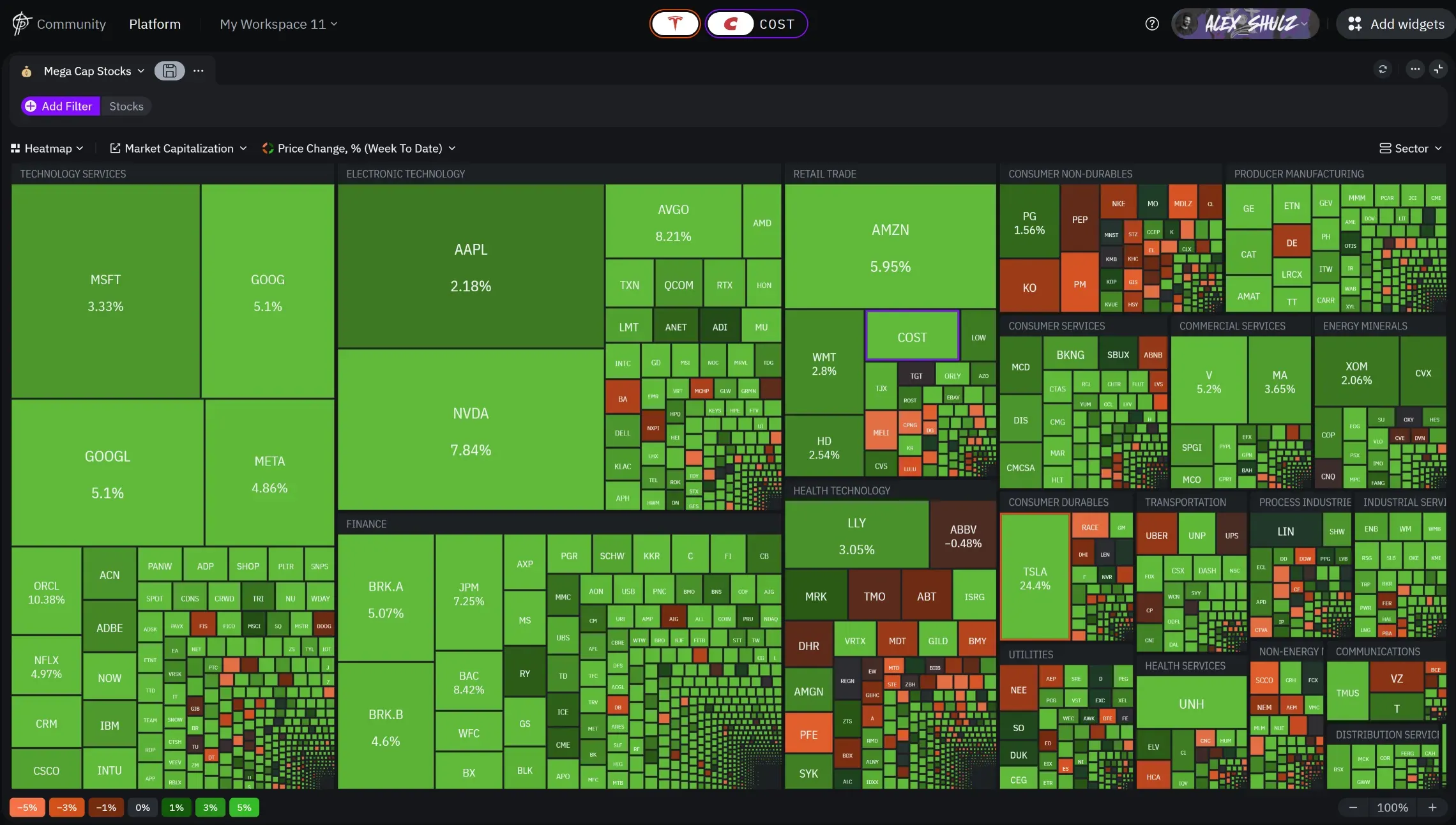

After Trump's 2024 election win, I've been assessing market changes and creating a watchlist

My curated portfolio strategy for navigating Trump's policy impacts

Following Trump's victory in the 2024 election, I've been analyzing potential market shifts and building my watchlist. I'm sharing my thoughts here - perhaps you'll find some interesting ideas for your own research and analysis.

Markets often react emotionally to political changes, but I prefer focusing on fundamental policy impacts. Here's what I'm watching in my portfolio as Trump begins his second term.

🌐 Trade Policies: Navigating New Tariffs

With the confirmed 60% China tariff implementation approaching, I've identified several companies that might need to adapt:

- Import-Dependent Companies:

- Apple (AAPL) - Despite supply chain challenges, their pricing power could help absorb costs.

- Tesla (TSLA) - Their expanding U.S. manufacturing footprint could offset tariff impacts.

- Walmart (WMT) - Their scale gives them unique supplier negotiation advantages.

- International Markets:

- iShares MSCI Emerging Markets ETF (EEM) - Could benefit from capital flows shifting to non-Chinese markets

💵 Corporate Taxes

The upcoming corporate tax reduction to 15% looks particularly interesting for current giants:

- Tech Giants:

- Apple (AAPL) - Their massive overseas cash reserves could see enhanced repatriation benefits.

- Microsoft (MSFT) - Cloud division's high margins would directly benefit from lower taxes.

- Alphabet (GOOGL) - Ad business's high margins make them a prime beneficiary.

- Market Exposure:

- Vanguard S&P 500 ETF (VOO) - Broad exposure to companies benefiting from tax cuts.

🏢 Domestic Champions

Looking at companies well-positioned under the new trade environment:

- U.S.-Focused Leaders:

- Home Depot (HD) - Housing market resilience plus minimal import exposure.

- Procter & Gamble (PG) - Strong domestic manufacturing base and pricing power.

- Broad Market Play:

- Vanguard Total Stock Market ETF (VTI) - Captures full spectrum of domestic opportunity.

🏦 Financial Sector

With deregulation back on the agenda:

- Banking Sector:

- JPMorgan Chase (JPM) - Could benefit from lighter regulatory oversight.

- Bank of America (BAC) - Well-positioned for potential interest rate changes.

- Energy Leaders:

- ExxonMobil (XOM) - Aligned with Trump's domestic energy production push.

- Chevron (CVX) - Could benefit from reduced environmental regulations.

- Sector ETFs:

- Financial Select Sector SPDR Fund (XLF) - Broad exposure to deregulation benefits.

- Energy Select Sector SPDR Fund (XLE) - Captures potential domestic energy boom.

📊 Bond Market

With inflation concerns and growing national debt:

- Short-Term Plays:

- iShares Short Treasury Bond ETF (SHV) - Flexibility in rising rate environment.

- Long-Term Options (may suffer in the case of inflationary policy):

- Vanguard Long-Term Bond ETF (BLV) - Higher yield potential, but watch duration risk.

💲 Dollar Dynamics

- Currency Exposure:

- Invesco DB U.S. Dollar Index Bullish Fund (UUP) - a short-term bet on strengthening the dollar until the promised weakening by Trump begins to take effect.

🪙 Gold and Safe Havens Looking at inflation protection:

- Mining Leaders:

- Barrick Gold Corporation (GOLD) - Strong production profile in stable jurisdictions.

- Newmont Corporation (NEM) - Solid dividend policy adds defensive appeal.

- Gold ETFs:

- SPDR Gold Shares (GLD) - Direct gold price exposure without storage hassle.

- iShares Gold Trust (IAU) - Lower expense ratio alternative.

₿ Crypto Perspective With Trump's surprisingly positive crypto stance:

- Crypto Infrastructure:

- Coinbase Global (COIN) - Could benefit from clearer regulatory environment.

- Marathon Digital (MARA) - U.S.-based mining operations align with domestic focus.

- Bitcoin Access:

- Grayscale Bitcoin Trust (GBTC) - Traditional investment vehicle for crypto exposure.

https://takeprofit.com/financials/01JVZSHA118EMNE10XD46QJJBD

These are just my observations based on current policy directions. Markets are complex, and everyone's investment needs differ. I'll continue updating my analysis as policies take shape and market reactions unfold.

Disclaimer: This represents my personal market observations. Always conduct thorough research and seek professional advice before making investment decisions.